Nonfungible tokens (NFTs) fractionalization enables investors to own a portion of unique digital assets, enhancing liquidity and accessibility in the digital art and collectibles market. Mutual funds pool capital from multiple investors to acquire diversified portfolios of stocks or bonds, offering professional management and risk mitigation. Explore the distinctions and benefits of NFT fractionalization compared to traditional mutual funds to optimize your investment strategy.

Why it is important

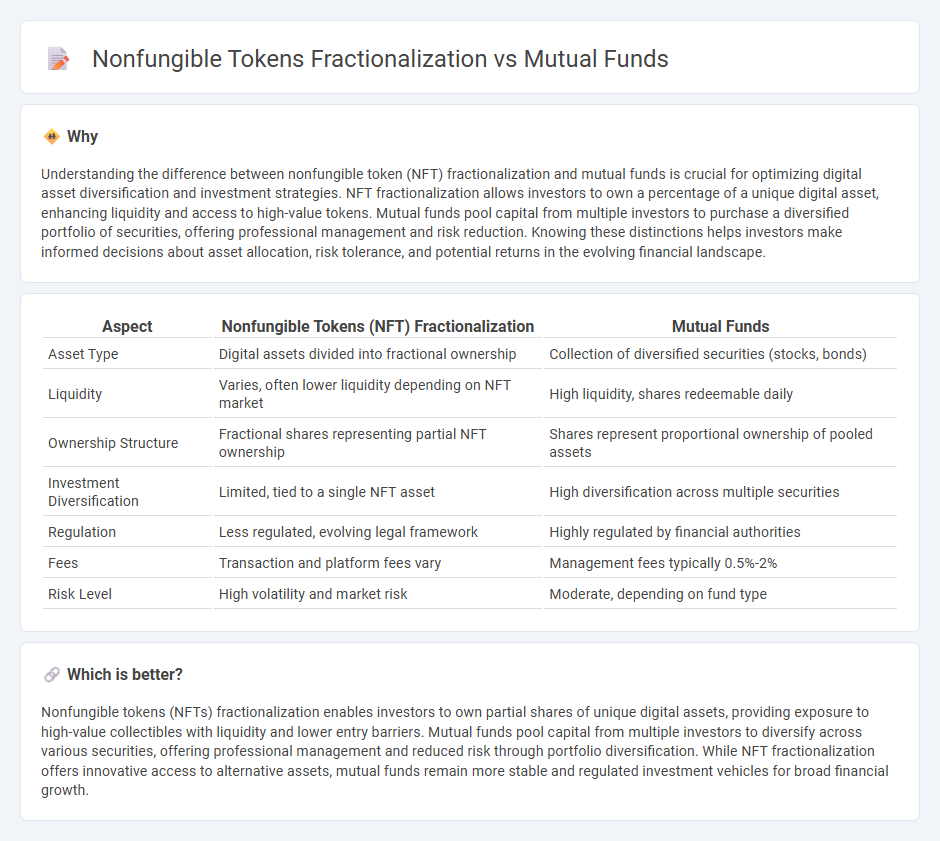

Understanding the difference between nonfungible token (NFT) fractionalization and mutual funds is crucial for optimizing digital asset diversification and investment strategies. NFT fractionalization allows investors to own a percentage of a unique digital asset, enhancing liquidity and access to high-value tokens. Mutual funds pool capital from multiple investors to purchase a diversified portfolio of securities, offering professional management and risk reduction. Knowing these distinctions helps investors make informed decisions about asset allocation, risk tolerance, and potential returns in the evolving financial landscape.

Comparison Table

| Aspect | Nonfungible Tokens (NFT) Fractionalization | Mutual Funds |

|---|---|---|

| Asset Type | Digital assets divided into fractional ownership | Collection of diversified securities (stocks, bonds) |

| Liquidity | Varies, often lower liquidity depending on NFT market | High liquidity, shares redeemable daily |

| Ownership Structure | Fractional shares representing partial NFT ownership | Shares represent proportional ownership of pooled assets |

| Investment Diversification | Limited, tied to a single NFT asset | High diversification across multiple securities |

| Regulation | Less regulated, evolving legal framework | Highly regulated by financial authorities |

| Fees | Transaction and platform fees vary | Management fees typically 0.5%-2% |

| Risk Level | High volatility and market risk | Moderate, depending on fund type |

Which is better?

Nonfungible tokens (NFTs) fractionalization enables investors to own partial shares of unique digital assets, providing exposure to high-value collectibles with liquidity and lower entry barriers. Mutual funds pool capital from multiple investors to diversify across various securities, offering professional management and reduced risk through portfolio diversification. While NFT fractionalization offers innovative access to alternative assets, mutual funds remain more stable and regulated investment vehicles for broad financial growth.

Connection

Nonfungible token (NFT) fractionalization enables the division of unique digital assets into smaller, tradable shares, similar to how mutual funds pool capital from multiple investors to diversify holdings. Both mechanisms enhance liquidity by allowing investors to access fractions of high-value assets or portfolios without full ownership. This connection highlights the convergence of digital asset innovation and traditional financial instruments in expanding investment opportunities.

Key Terms

Asset Pooling

Mutual funds aggregate investor capital to purchase a diversified portfolio of assets managed by professionals, providing liquidity and risk mitigation through asset pooling. Nonfungible tokens (NFTs) fractionalization partitions a unique digital asset into smaller fractions, enabling multiple investors to own portions of a single NFT while leveraging blockchain transparency and security. Explore the advantages and mechanisms of asset pooling in both mutual funds and NFT fractionalization to understand their impact on investment accessibility and portfolio management.

Ownership Structure

Mutual funds pool investors' money to purchase a diversified portfolio of securities, offering fractional ownership in a collective investment vehicle managed by professionals. Nonfungible token (NFT) fractionalization allows multiple investors to own a percentage of a single unique digital asset through blockchain-based token shares, providing direct and transparent ownership proofs. Explore the nuances of these ownership structures to understand their implications for investment flexibility and asset control.

Liquidity

Mutual funds provide high liquidity by allowing investors to buy and sell shares at the end of each trading day, backed by professionally managed diversified portfolios. Nonfungible tokens (NFTs) fractionalization introduces liquidity to traditionally illiquid digital assets by enabling partial ownership and trading on secondary markets, although liquidity varies based on platform and demand. Explore further to understand how liquidity dynamics influence investment decisions in these asset classes.

Source and External Links

Mutual Funds - Investor.gov - Mutual funds are SEC-registered open-end investment companies that pool money from many investors to invest in diversified portfolios of stocks, bonds, and other securities, managed by professional advisers, offering features like diversification, liquidity, and low minimum investments.

Mutual Fund - Wikipedia - Mutual funds pool investor money to purchase securities and are classified by investment type and management style; they provide diversification, professional management, liquidity, and economies of scale with various fees and regulatory requirements.

Understanding Mutual Funds - Charles Schwab - Mutual funds let investors pool money to buy diversified stocks and bonds, managed by professionals, and offer benefits such as diversification, low costs, convenience, and exposure to different investment strategies.

dowidth.com

dowidth.com