AI-driven portfolio management leverages advanced algorithms and machine learning to analyze vast datasets, optimize asset allocation, and enhance risk-adjusted returns. ESG investing focuses on companies demonstrating strong environmental, social, and governance practices, aiming to achieve sustainable financial performance alongside positive societal impact. Explore how these innovative investment strategies shape the future of finance.

Why it is important

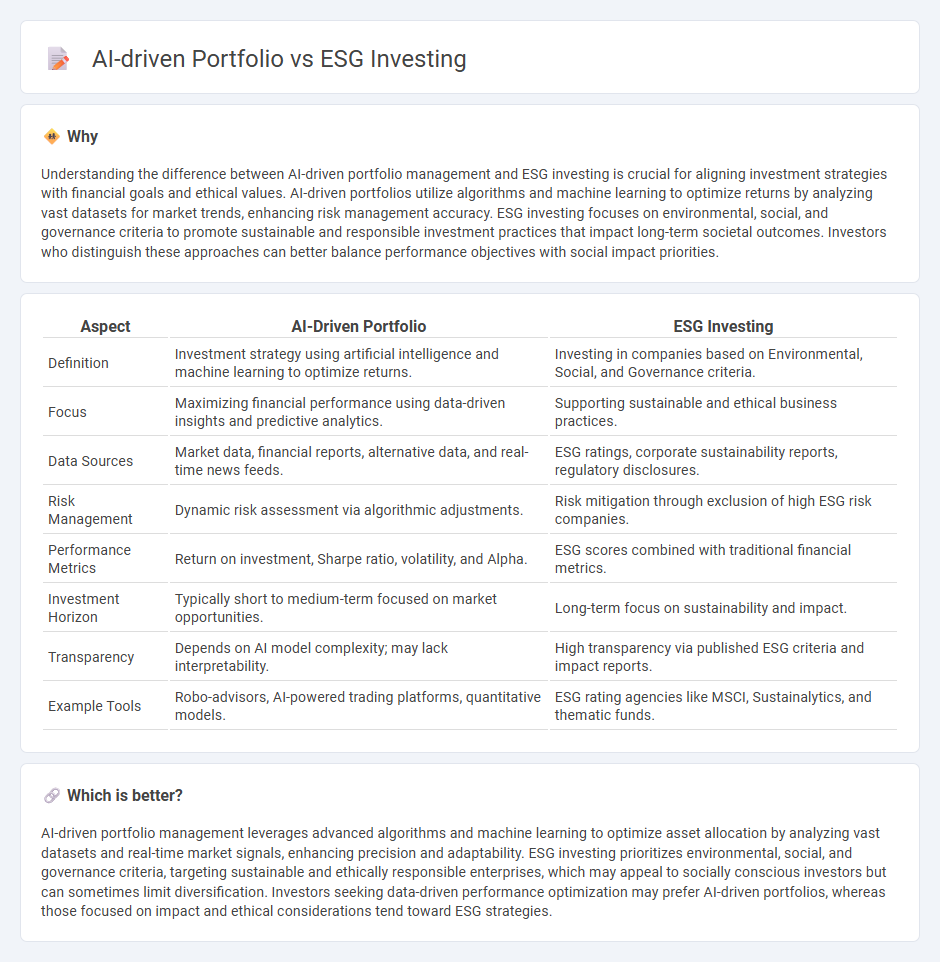

Understanding the difference between AI-driven portfolio management and ESG investing is crucial for aligning investment strategies with financial goals and ethical values. AI-driven portfolios utilize algorithms and machine learning to optimize returns by analyzing vast datasets for market trends, enhancing risk management accuracy. ESG investing focuses on environmental, social, and governance criteria to promote sustainable and responsible investment practices that impact long-term societal outcomes. Investors who distinguish these approaches can better balance performance objectives with social impact priorities.

Comparison Table

| Aspect | AI-Driven Portfolio | ESG Investing |

|---|---|---|

| Definition | Investment strategy using artificial intelligence and machine learning to optimize returns. | Investing in companies based on Environmental, Social, and Governance criteria. |

| Focus | Maximizing financial performance using data-driven insights and predictive analytics. | Supporting sustainable and ethical business practices. |

| Data Sources | Market data, financial reports, alternative data, and real-time news feeds. | ESG ratings, corporate sustainability reports, regulatory disclosures. |

| Risk Management | Dynamic risk assessment via algorithmic adjustments. | Risk mitigation through exclusion of high ESG risk companies. |

| Performance Metrics | Return on investment, Sharpe ratio, volatility, and Alpha. | ESG scores combined with traditional financial metrics. |

| Investment Horizon | Typically short to medium-term focused on market opportunities. | Long-term focus on sustainability and impact. |

| Transparency | Depends on AI model complexity; may lack interpretability. | High transparency via published ESG criteria and impact reports. |

| Example Tools | Robo-advisors, AI-powered trading platforms, quantitative models. | ESG rating agencies like MSCI, Sustainalytics, and thematic funds. |

Which is better?

AI-driven portfolio management leverages advanced algorithms and machine learning to optimize asset allocation by analyzing vast datasets and real-time market signals, enhancing precision and adaptability. ESG investing prioritizes environmental, social, and governance criteria, targeting sustainable and ethically responsible enterprises, which may appeal to socially conscious investors but can sometimes limit diversification. Investors seeking data-driven performance optimization may prefer AI-driven portfolios, whereas those focused on impact and ethical considerations tend toward ESG strategies.

Connection

AI-driven portfolio management enhances ESG investing by analyzing vast datasets to identify companies with strong environmental, social, and governance practices, optimizing investment decisions for sustainability and financial performance. Machine learning algorithms assess ESG scores, carbon footprints, and social impact metrics, enabling investors to align portfolios with ethical standards and regulatory requirements. This integration improves risk assessment, drives responsible investment strategies, and promotes transparency in the sustainable finance sector.

Key Terms

**ESG Investing:**

ESG investing integrates environmental, social, and governance criteria into financial analysis, prioritizing sustainable and ethical business practices to mitigate risks and identify long-term opportunities. This strategy has gained traction among investors seeking to align portfolios with values such as climate action, social responsibility, and corporate transparency, often resulting in resilient performance amid regulatory and market shifts. Explore further to understand how ESG metrics enhance investment decisions and support sustainable growth.

Sustainability

ESG investing prioritizes environmental, social, and governance criteria to create portfolios aligned with sustainable, ethical practices, supporting long-term positive societal impact. AI-driven portfolios leverage advanced algorithms and machine learning to optimize asset allocation and risk management, potentially integrating ESG data for enhanced sustainability outcomes. Explore how combining ESG principles with AI technology can revolutionize sustainable investment strategies.

Social Responsibility

ESG investing prioritizes environmental, social, and governance criteria to support companies with strong social responsibility and sustainable practices, influencing long-term ethical impact and risk management. AI-driven portfolios leverage machine learning algorithms to analyze vast datasets, optimizing investment decisions based on financial performance while increasingly integrating social responsibility metrics for enhanced ethical alignment. Discover how blending ESG criteria with AI technology is reshaping socially responsible investing strategies.

Source and External Links

Embracing Sustainable Investment Practices with ESG Investing - ESG investing is an investment strategy that considers a business's environmental, social, and governance risks, growing rapidly due to concerns about climate change and social justice, with ESG assets now estimated at $4 trillion globally.

What is ESG Investing? - ESG investing, also known as sustainable or socially responsible investing, incorporates environmental, social, and governance factors into investment decisions to promote sustainability and human wellbeing, rooted historically in ethical investing traditions, and formalized in 2006 by the UN Principles for Responsible Investments.

What is ESG investing? - Deutsche Bank Wealth Management - ESG investing integrates environmental, social, and governance considerations alongside financial criteria, seeking to support long-term societal goals, with $35.3 trillion in assets globally aligned with ESG principles as of 2020.

dowidth.com

dowidth.com