Altcoins staking involves holding and locking cryptocurrencies to support blockchain network operations, earning rewards in return. Synthetic asset minting creates tokenized representations of real-world assets, enabling exposure to diverse markets without owning the underlying asset. Explore the differences and benefits of altcoin staking versus synthetic asset minting to optimize your decentralized finance strategy.

Why it is important

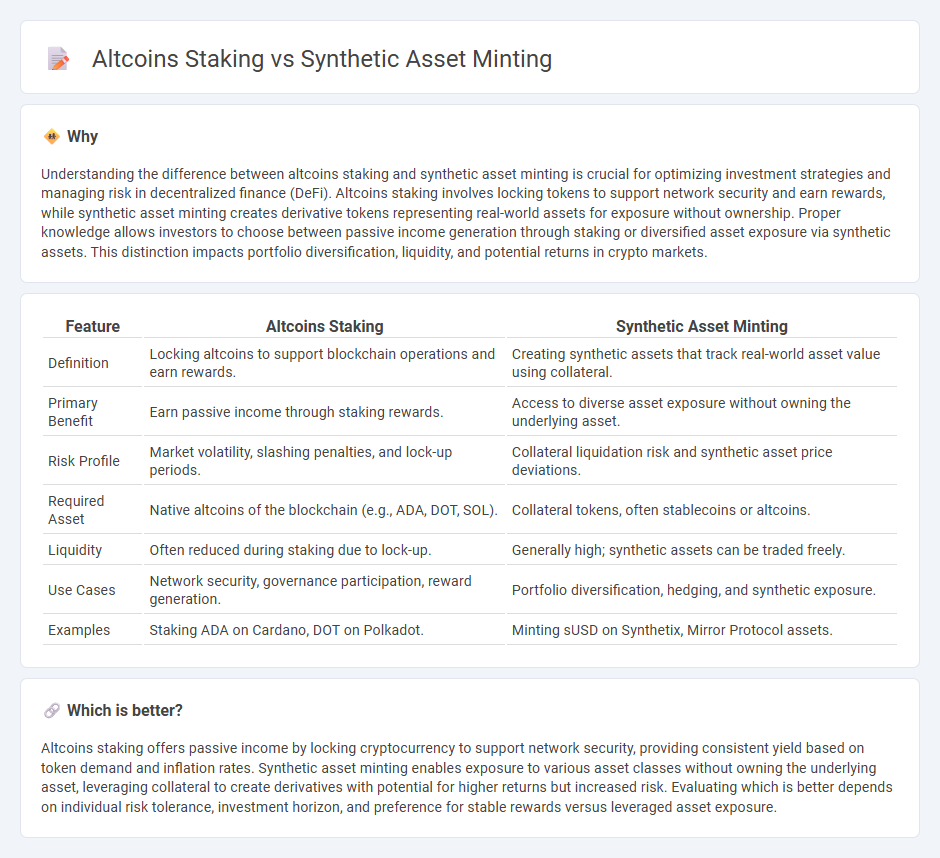

Understanding the difference between altcoins staking and synthetic asset minting is crucial for optimizing investment strategies and managing risk in decentralized finance (DeFi). Altcoins staking involves locking tokens to support network security and earn rewards, while synthetic asset minting creates derivative tokens representing real-world assets for exposure without ownership. Proper knowledge allows investors to choose between passive income generation through staking or diversified asset exposure via synthetic assets. This distinction impacts portfolio diversification, liquidity, and potential returns in crypto markets.

Comparison Table

| Feature | Altcoins Staking | Synthetic Asset Minting |

|---|---|---|

| Definition | Locking altcoins to support blockchain operations and earn rewards. | Creating synthetic assets that track real-world asset value using collateral. |

| Primary Benefit | Earn passive income through staking rewards. | Access to diverse asset exposure without owning the underlying asset. |

| Risk Profile | Market volatility, slashing penalties, and lock-up periods. | Collateral liquidation risk and synthetic asset price deviations. |

| Required Asset | Native altcoins of the blockchain (e.g., ADA, DOT, SOL). | Collateral tokens, often stablecoins or altcoins. |

| Liquidity | Often reduced during staking due to lock-up. | Generally high; synthetic assets can be traded freely. |

| Use Cases | Network security, governance participation, reward generation. | Portfolio diversification, hedging, and synthetic exposure. |

| Examples | Staking ADA on Cardano, DOT on Polkadot. | Minting sUSD on Synthetix, Mirror Protocol assets. |

Which is better?

Altcoins staking offers passive income by locking cryptocurrency to support network security, providing consistent yield based on token demand and inflation rates. Synthetic asset minting enables exposure to various asset classes without owning the underlying asset, leveraging collateral to create derivatives with potential for higher returns but increased risk. Evaluating which is better depends on individual risk tolerance, investment horizon, and preference for stable rewards versus leveraged asset exposure.

Connection

Altcoins staking provides liquidity and security to blockchain networks, enabling synthetic asset minting by locking collateral in decentralized finance (DeFi) protocols. Synthetic asset minting leverages staked altcoins as collateral to create tokenized derivatives that track the value of real-world assets, expanding market access without direct ownership. This interconnection enhances capital efficiency and unlocks new yield opportunities within the crypto economy.

Key Terms

Collateralization

Synthetic asset minting relies on over-collateralization to back issued tokens, ensuring stability and reducing liquidation risks by locking assets as collateral. Altcoins staking generally involves locking native tokens to secure the network without necessarily providing direct collateral for asset issuance. Explore the differences in collateral management and risk profiles to deepen understanding of these DeFi mechanisms.

Yield

Synthetic asset minting generates yield by allowing users to create tokenized derivatives that mirror real-world assets, offering exposure without direct ownership. Altcoins staking provides yield through network participation, where users lock tokens to support blockchain security and receive rewards proportionate to their stake. Explore the nuances of yield optimization between synthetic assets and altcoin staking to enhance your investment strategy.

Liquidity

Synthetic asset minting generates liquidity by enabling users to create tokenized derivatives representing various assets without holding the underlying commodity, thus expanding market access and capital efficiency. Altcoins staking secures blockchain networks by locking tokens, which may reduce immediate liquidity but offers rewards that incentivize long-term holding and network participation. Explore the detailed impacts of synthetic asset minting and altcoin staking on market liquidity and investment strategies to make informed decisions.

Source and External Links

What is Synthetic Minting in DeFi Development? - Nadcab Labs - Synthetic asset minting in DeFi is the process of creating new synthetic assets via smart contracts on a blockchain, enabling users to gain exposure to underlying assets without holding them directly, managed by programmable automated contracts for issuance, trading, and settlement.

Synthetics - THORChain Docs - Synthetic assets are minted by swapping a base asset like RUNE into a synthetic counterpart 1:1 via pool liquidity, with synthetic units providing 100% collateralization to back the minted synths and isolate their liquidity from other liquidity providers.

What are synthetic assets? - Bitstamp - Synthetic assets are tokenized representations of other assets created on blockchains, minted either through centralized issuance, smart contract custodianship, or overcollateralized models like Synthetix that require users to stake collateral to issue synthetic tokens.

dowidth.com

dowidth.com