Trader funding programs offer capital to skilled traders seeking to leverage proprietary funds, focusing on performance-based profit sharing and risk management. Angel investing involves affluent individuals providing early-stage capital to startups in exchange for equity, aiming for high growth potential and long-term returns. Discover the key differences and benefits of each approach to optimize your financial strategy.

Why it is important

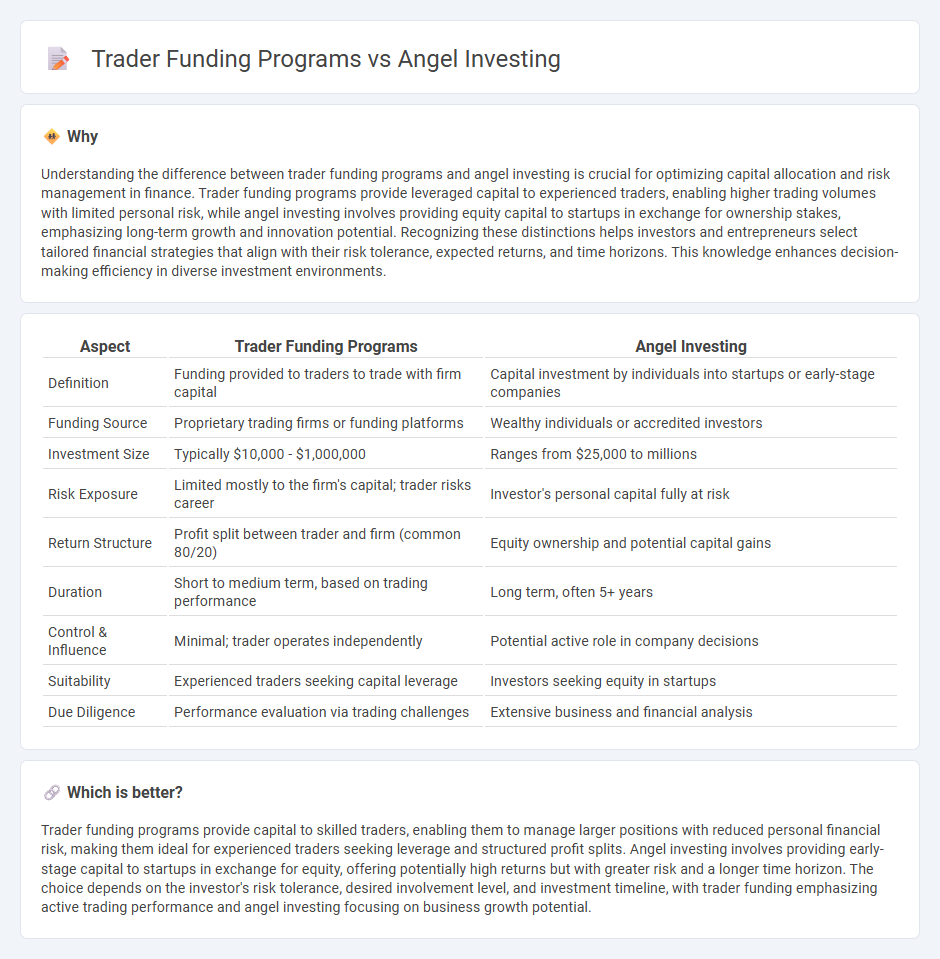

Understanding the difference between trader funding programs and angel investing is crucial for optimizing capital allocation and risk management in finance. Trader funding programs provide leveraged capital to experienced traders, enabling higher trading volumes with limited personal risk, while angel investing involves providing equity capital to startups in exchange for ownership stakes, emphasizing long-term growth and innovation potential. Recognizing these distinctions helps investors and entrepreneurs select tailored financial strategies that align with their risk tolerance, expected returns, and time horizons. This knowledge enhances decision-making efficiency in diverse investment environments.

Comparison Table

| Aspect | Trader Funding Programs | Angel Investing |

|---|---|---|

| Definition | Funding provided to traders to trade with firm capital | Capital investment by individuals into startups or early-stage companies |

| Funding Source | Proprietary trading firms or funding platforms | Wealthy individuals or accredited investors |

| Investment Size | Typically $10,000 - $1,000,000 | Ranges from $25,000 to millions |

| Risk Exposure | Limited mostly to the firm's capital; trader risks career | Investor's personal capital fully at risk |

| Return Structure | Profit split between trader and firm (common 80/20) | Equity ownership and potential capital gains |

| Duration | Short to medium term, based on trading performance | Long term, often 5+ years |

| Control & Influence | Minimal; trader operates independently | Potential active role in company decisions |

| Suitability | Experienced traders seeking capital leverage | Investors seeking equity in startups |

| Due Diligence | Performance evaluation via trading challenges | Extensive business and financial analysis |

Which is better?

Trader funding programs provide capital to skilled traders, enabling them to manage larger positions with reduced personal financial risk, making them ideal for experienced traders seeking leverage and structured profit splits. Angel investing involves providing early-stage capital to startups in exchange for equity, offering potentially high returns but with greater risk and a longer time horizon. The choice depends on the investor's risk tolerance, desired involvement level, and investment timeline, with trader funding emphasizing active trading performance and angel investing focusing on business growth potential.

Connection

Trader funding programs provide capital to skilled traders in exchange for a share of profits, enabling them to access larger positions without risking their own funds. Angel investing often targets startups and early-stage companies, including fintech firms that develop innovative trading platforms and funding solutions. Both approaches fuel financial market growth by injecting capital and supporting talent development within the trading ecosystem.

Key Terms

Angel Investing:

Angel investing involves providing capital to startups or early-stage companies in exchange for equity, often supporting innovative ventures with high growth potential. Traders typically seek funding programs that offer leveraged capital or margin trading accounts, focusing on short-term profits rather than long-term business growth. Discover the benefits and risks of angel investing to determine if it aligns with your financial goals.

Equity

Angel investing provides entrepreneurs with equity capital in exchange for ownership stakes, fostering long-term growth and value creation. Trader funding programs typically offer traders capital with profit-sharing agreements but rarely involve equity participation. Explore the distinctions to determine which funding option aligns best with your financial goals and business model.

Valuation

Angel investing typically involves early-stage companies with valuations based on growth potential, market opportunity, and founder expertise, often resulting in high-risk, high-reward scenarios. Trader funding programs, by contrast, focus on providing capital to experienced traders with proven strategies, where valuation centers on the trader's performance metrics and risk management capabilities rather than company equity. Explore more to understand how valuation impacts your choice between angel investing and trader funding programs.

Source and External Links

Understanding angel financing and investing - J.P. Morgan - Angel investing involves individuals providing early-stage capital to startups in exchange for equity or convertible debt, often helping startups move from initial family and friends funding to professional rounds, while offering mentorship and valuable networks to increase chances of success.

Angel Investors - The Hartford Insurance - Angel investors are wealthy individuals using their own money to fund startups, usually in exchange for equity and expecting significant returns, often around 30%, with a focus on an eventual exit through acquisition or public offering.

Demystifying Angel Investing - Angel Capital Association - Angel investing offers individuals a way to build wealth by investing in startups, sometimes gaining tax advantages, and also supports local economies by funding early-stage companies that create jobs and innovation.

dowidth.com

dowidth.com