Copy trading platforms enable investors to automatically replicate the trades of experienced traders, streamlining portfolio management and minimizing the need for active decision-making. Social trading networks foster a collaborative environment where users share strategies, insights, and market analyses, enhancing collective knowledge and community-driven investment decisions. Explore the features and benefits of these innovative financial tools to elevate your trading experience.

Why it is important

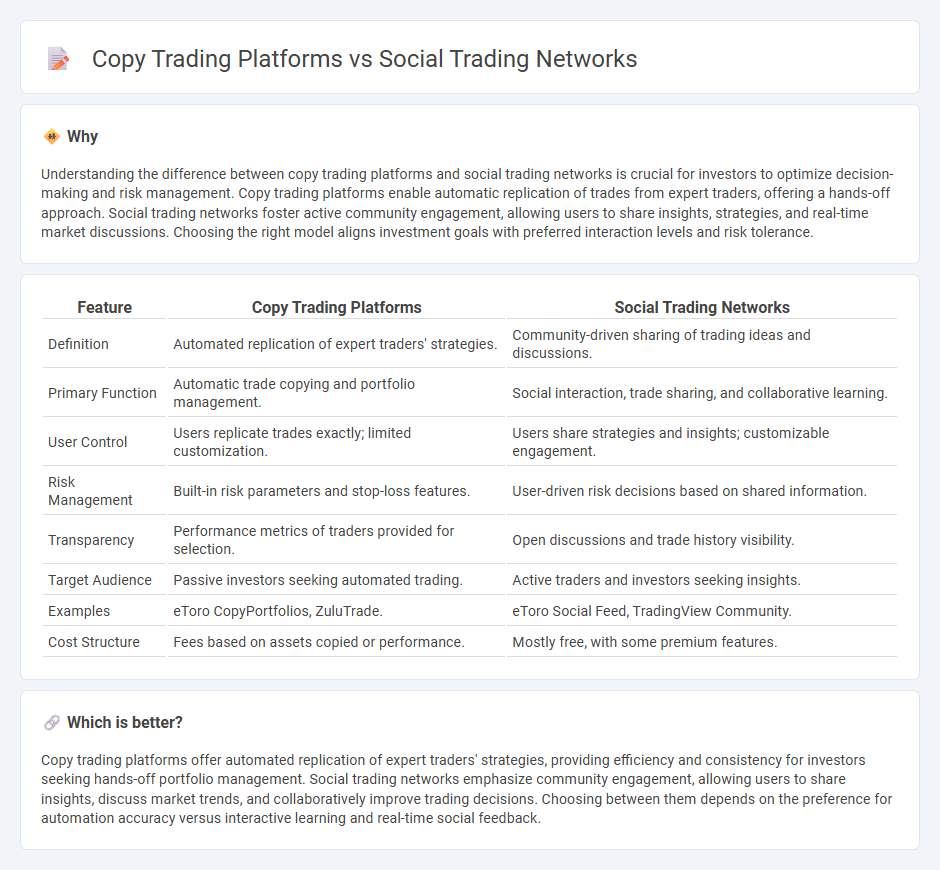

Understanding the difference between copy trading platforms and social trading networks is crucial for investors to optimize decision-making and risk management. Copy trading platforms enable automatic replication of trades from expert traders, offering a hands-off approach. Social trading networks foster active community engagement, allowing users to share insights, strategies, and real-time market discussions. Choosing the right model aligns investment goals with preferred interaction levels and risk tolerance.

Comparison Table

| Feature | Copy Trading Platforms | Social Trading Networks |

|---|---|---|

| Definition | Automated replication of expert traders' strategies. | Community-driven sharing of trading ideas and discussions. |

| Primary Function | Automatic trade copying and portfolio management. | Social interaction, trade sharing, and collaborative learning. |

| User Control | Users replicate trades exactly; limited customization. | Users share strategies and insights; customizable engagement. |

| Risk Management | Built-in risk parameters and stop-loss features. | User-driven risk decisions based on shared information. |

| Transparency | Performance metrics of traders provided for selection. | Open discussions and trade history visibility. |

| Target Audience | Passive investors seeking automated trading. | Active traders and investors seeking insights. |

| Examples | eToro CopyPortfolios, ZuluTrade. | eToro Social Feed, TradingView Community. |

| Cost Structure | Fees based on assets copied or performance. | Mostly free, with some premium features. |

Which is better?

Copy trading platforms offer automated replication of expert traders' strategies, providing efficiency and consistency for investors seeking hands-off portfolio management. Social trading networks emphasize community engagement, allowing users to share insights, discuss market trends, and collaboratively improve trading decisions. Choosing between them depends on the preference for automation accuracy versus interactive learning and real-time social feedback.

Connection

Copy trading platforms enable investors to replicate the trades of experienced traders automatically within social trading networks, fostering a collaborative investment environment. Social trading networks provide the infrastructure for sharing trading strategies, performance data, and market insights, enhancing transparency and trust among participants. This integration leverages collective intelligence to optimize portfolio management and risk diversification in financial markets.

Key Terms

Trade Replication

Trade replication in social trading networks enables users to mirror strategies of experienced traders in real time, fostering community-driven investment decisions. Copy trading platforms offer automated trade replication with advanced algorithmic precision and customizable risk management, appealing to investors seeking hands-off portfolio growth. Explore the key differences in trade replication features to optimize your trading strategy.

Social Feed/Community Interaction

Social trading networks emphasize real-time social feed updates and active community interaction, fostering collaboration and shared insights among traders. Copy trading platforms primarily focus on automated strategy replication with limited direct user engagement or discussion features. Explore the nuances of social engagement versus automation to enhance your trading experience.

Performance Transparency

Social trading networks emphasize community interaction and shared market insights, offering users real-time performance feedback and peer reviews to enhance decision-making. Copy trading platforms provide direct replication of top traders' strategies with detailed performance metrics, enabling users to evaluate risk-adjusted returns and historical outcomes transparently. Explore our comprehensive analysis to understand which approach best aligns with your investment goals and transparency needs.

Source and External Links

Social Trading Networks: Your Guide to Smart Investing 2024 - Social trading networks are online platforms connecting investors worldwide to share strategies and automatically copy successful traders' positions in real time, featuring copy trading, portfolio transparency, risk management tools, and social feeds for market insights, with leading platforms like eToro offering commission-free trading and communities spanning over 30 million traders in 140+ countries.

Social trading - Wikipedia - Social trading allows investors to observe and replicate the trades of peers and experts, including modes like copy trading (single trades) and mirror trading (automatic execution of all trades), thus shortening the learning curve and integrating social indicators into investment decisions.

Best Social Trading Forex Brokers for 2025 - FX-List - Social trading was introduced in forex markets circa 2006 to connect expert traders with novices via platforms that enable copying trades and sharing trading signals, fostering symbiotic knowledge exchange and accelerating profitability for less experienced traders.

dowidth.com

dowidth.com