Risk parity portfolios allocate assets based on risk contribution, aiming for balanced volatility across investments to enhance diversification and reduce drawdowns. Constant Proportion Portfolio Insurance (CPPI) dynamically adjusts exposure to risky assets to protect a predefined floor value while allowing participation in market upside. Explore deeper insights into these strategies for optimized risk management and portfolio growth.

Why it is important

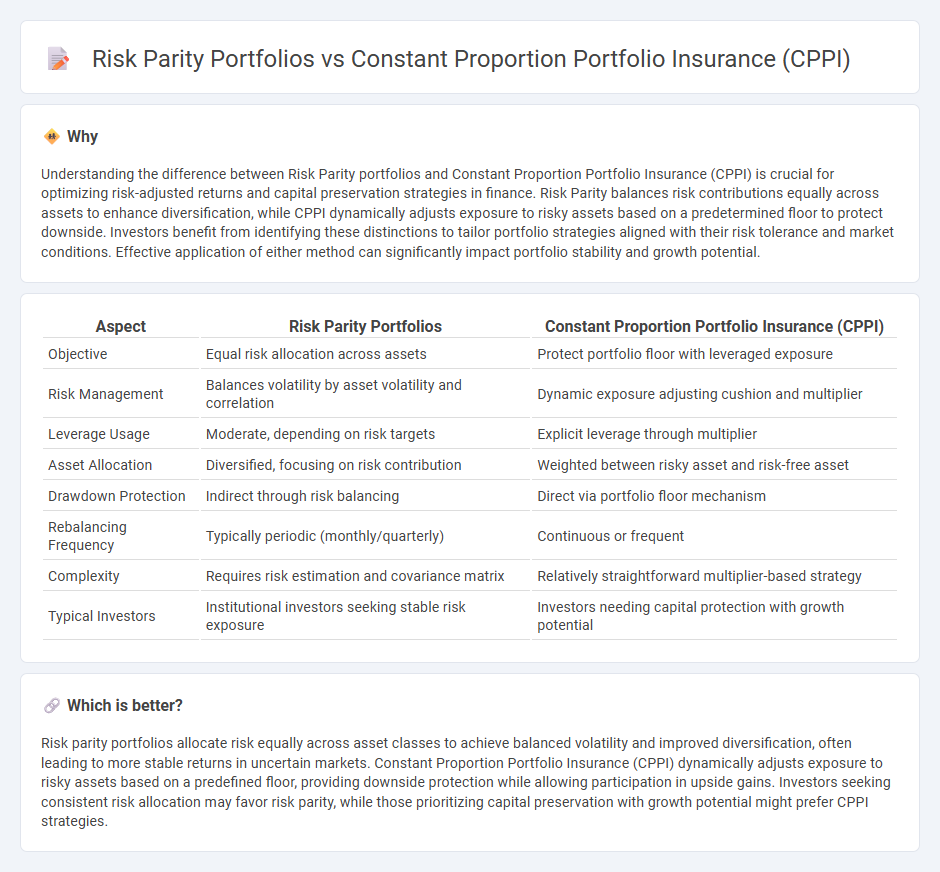

Understanding the difference between Risk Parity portfolios and Constant Proportion Portfolio Insurance (CPPI) is crucial for optimizing risk-adjusted returns and capital preservation strategies in finance. Risk Parity balances risk contributions equally across assets to enhance diversification, while CPPI dynamically adjusts exposure to risky assets based on a predetermined floor to protect downside. Investors benefit from identifying these distinctions to tailor portfolio strategies aligned with their risk tolerance and market conditions. Effective application of either method can significantly impact portfolio stability and growth potential.

Comparison Table

| Aspect | Risk Parity Portfolios | Constant Proportion Portfolio Insurance (CPPI) |

|---|---|---|

| Objective | Equal risk allocation across assets | Protect portfolio floor with leveraged exposure |

| Risk Management | Balances volatility by asset volatility and correlation | Dynamic exposure adjusting cushion and multiplier |

| Leverage Usage | Moderate, depending on risk targets | Explicit leverage through multiplier |

| Asset Allocation | Diversified, focusing on risk contribution | Weighted between risky asset and risk-free asset |

| Drawdown Protection | Indirect through risk balancing | Direct via portfolio floor mechanism |

| Rebalancing Frequency | Typically periodic (monthly/quarterly) | Continuous or frequent |

| Complexity | Requires risk estimation and covariance matrix | Relatively straightforward multiplier-based strategy |

| Typical Investors | Institutional investors seeking stable risk exposure | Investors needing capital protection with growth potential |

Which is better?

Risk parity portfolios allocate risk equally across asset classes to achieve balanced volatility and improved diversification, often leading to more stable returns in uncertain markets. Constant Proportion Portfolio Insurance (CPPI) dynamically adjusts exposure to risky assets based on a predefined floor, providing downside protection while allowing participation in upside gains. Investors seeking consistent risk allocation may favor risk parity, while those prioritizing capital preservation with growth potential might prefer CPPI strategies.

Connection

Risk parity portfolios balance asset allocation by equalizing risk contributions, enhancing diversification and reducing volatility. Constant Proportion Portfolio Insurance (CPPI) dynamically adjusts exposure between risky assets and safer bonds to maintain a predefined floor value, utilizing risk budgeting principles similar to risk parity. Both strategies integrate risk management and adaptive allocation to optimize portfolio performance under varying market conditions.

Key Terms

Cushion (CPPI)

Constant Proportion Portfolio Insurance (CPPI) manages the cushion, defined as the difference between portfolio value and a predetermined floor, by dynamically adjusting exposure to risky assets proportional to this cushion, aiming to protect the portfolio from downside risk while capturing upside potential. In contrast, Risk Parity portfolios allocate risk equally across asset classes without an explicit cushion, focusing on balancing volatility rather than providing downside protection. Explore the mechanics and risk management differences between CPPI's cushion-based strategy and risk parity to optimize your portfolio protection approach.

Leverage (Risk parity)

Constant Proportion Portfolio Insurance (CPPI) utilizes a dynamic leveraging strategy to maintain a predefined exposure to risky assets by adjusting the cushion--the difference between portfolio value and a floor--leading to variable leverage levels that increase with market gains. Risk parity portfolios, in contrast, employ leverage to equalize risk contributions across asset classes, ensuring that each allocation, regardless of volatility, contributes uniformly to portfolio risk, often resulting in significant borrowing to amplify low-volatility asset exposure. Explore further how leverage mechanics and risk management principles differ fundamentally between CPPI and risk parity frameworks.

Risk budgeting

Constant Proportion Portfolio Insurance (CPPI) uses a dynamic strategy that allocates assets based on a predefined floor value, ensuring downside protection by maintaining a multiplier-driven exposure to risky assets. Risk parity portfolios allocate risk equally across asset classes, emphasizing balanced risk contribution rather than capital allocation, often using volatility as a measure for risk budgeting. Explore the nuances of risk budgeting in CPPI and risk parity portfolios to optimize asset allocation and enhance portfolio resilience.

Source and External Links

Constant proportion portfolio insurance - CPPI is a trading strategy that maintains exposure to risky assets for upside potential while guaranteeing capital protection through dynamic allocation between treasury bonds and leveraged risky assets, acting somewhat like a call option without using options contracts.

A Constant Proportion Portfolio Insurance Style Trading Strategy - CPPI dynamically allocates funds between risky and safe assets based on the portfolio value exceeding a set floor, using a multiplier to adjust the exposure and continuously rebalancing to protect the portfolio downside while capturing upside gains.

Constant proportion portfolio insurance: Explained - CPPI limits potential losses and enables participation in gains by adjusting risky asset exposure relative to a predefined floor value multiplied by an aggression factor (multiplier), requiring active rebalancing and sufficient risk-free assets for downside protection.

dowidth.com

dowidth.com