Green bond laddering diversifies investment maturity dates, reducing interest rate risk while funding environmentally sustainable projects. Thematic bonds focus on specific sectors such as renewable energy or clean technology, aligning investments with targeted social or environmental goals. Explore the benefits and strategies of each approach to optimize your sustainable finance portfolio.

Why it is important

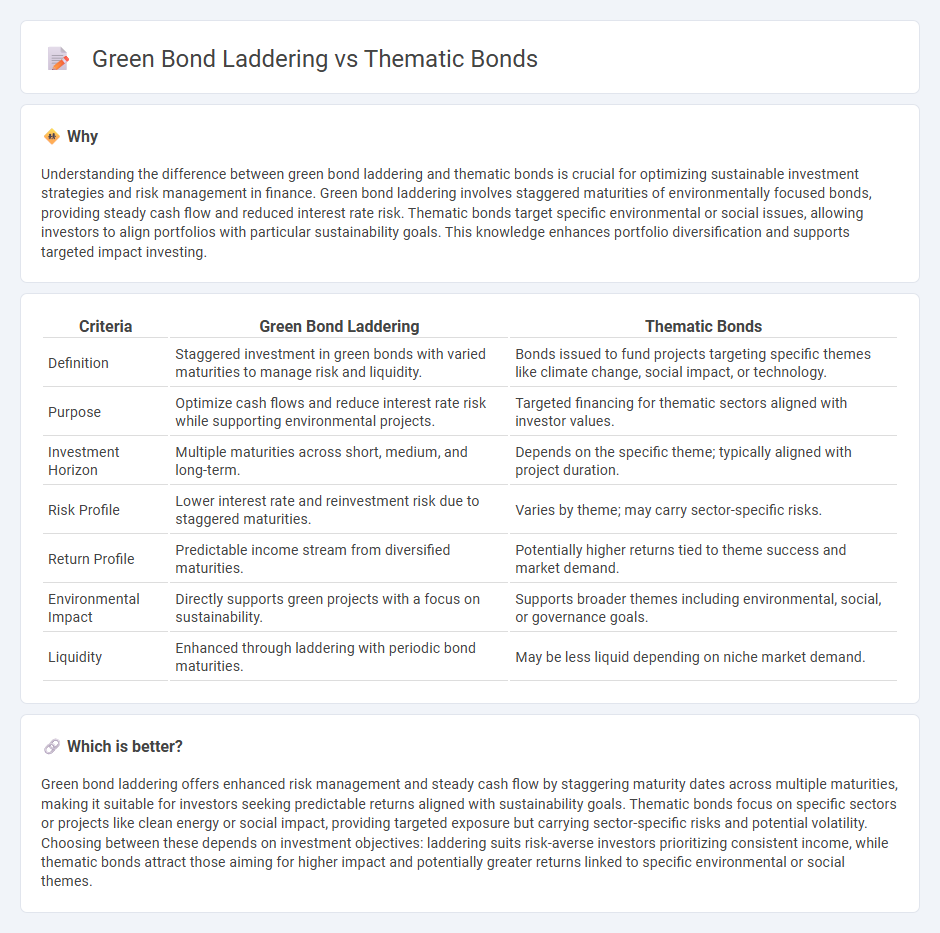

Understanding the difference between green bond laddering and thematic bonds is crucial for optimizing sustainable investment strategies and risk management in finance. Green bond laddering involves staggered maturities of environmentally focused bonds, providing steady cash flow and reduced interest rate risk. Thematic bonds target specific environmental or social issues, allowing investors to align portfolios with particular sustainability goals. This knowledge enhances portfolio diversification and supports targeted impact investing.

Comparison Table

| Criteria | Green Bond Laddering | Thematic Bonds |

|---|---|---|

| Definition | Staggered investment in green bonds with varied maturities to manage risk and liquidity. | Bonds issued to fund projects targeting specific themes like climate change, social impact, or technology. |

| Purpose | Optimize cash flows and reduce interest rate risk while supporting environmental projects. | Targeted financing for thematic sectors aligned with investor values. |

| Investment Horizon | Multiple maturities across short, medium, and long-term. | Depends on the specific theme; typically aligned with project duration. |

| Risk Profile | Lower interest rate and reinvestment risk due to staggered maturities. | Varies by theme; may carry sector-specific risks. |

| Return Profile | Predictable income stream from diversified maturities. | Potentially higher returns tied to theme success and market demand. |

| Environmental Impact | Directly supports green projects with a focus on sustainability. | Supports broader themes including environmental, social, or governance goals. |

| Liquidity | Enhanced through laddering with periodic bond maturities. | May be less liquid depending on niche market demand. |

Which is better?

Green bond laddering offers enhanced risk management and steady cash flow by staggering maturity dates across multiple maturities, making it suitable for investors seeking predictable returns aligned with sustainability goals. Thematic bonds focus on specific sectors or projects like clean energy or social impact, providing targeted exposure but carrying sector-specific risks and potential volatility. Choosing between these depends on investment objectives: laddering suits risk-averse investors prioritizing consistent income, while thematic bonds attract those aiming for higher impact and potentially greater returns linked to specific environmental or social themes.

Connection

Green bond laddering and thematic bonds are interconnected as both focus on targeted investment in sustainable and environmentally friendly projects, enhancing portfolio diversification and risk management. Green bond laddering involves staggering the maturity dates of green bonds to optimize cash flow and returns while maintaining exposure to eco-friendly initiatives. Thematic bonds, including green bonds, allow investors to align their portfolios with specific environmental themes, reinforcing the strategic allocation in sustainable finance.

Key Terms

Use of Proceeds

Thematic bonds target specific environmental or social projects, with Use of Proceeds strictly allocated to initiatives like renewable energy or affordable housing, ensuring measurable impact aligned with sustainability goals. Green bond laddering involves staggering the issuance dates of green bonds to optimize cash flow and risk management, while maintaining strict Use of Proceeds criteria focused on environmental projects. Explore how these strategies improve investment sustainability and portfolio diversification in detail.

Diversification

Thematic bonds offer targeted investment opportunities in specific sectors like renewable energy or social impact, enabling investors to align portfolios with sustainable development goals. Green bond laddering, on the other hand, strategically staggers maturities of environmentally focused bonds to optimize risk management and ensure steady cash flow. Explore how combining these strategies can enhance diversification and sustainability in your investment portfolio.

Impact Reporting

Thematic bonds emphasize targeted environmental or social outcomes, often spotlighted through detailed impact reporting that measures specific project achievements. Green bond laddering involves structuring bond maturities to align ongoing funding with progressive sustainability goals, enhancing transparency and accountability via phased impact disclosures. Explore the nuances of impact reporting methods in thematic bonds and green bond laddering to optimize your sustainable investment strategy.

Source and External Links

Thematic Bonds - IDB Invest - Thematic bonds are debt instruments used to finance projects aligned with Sustainable Development Goals, classified as green, social, or sustainability bonds based on the use of proceeds or linked to sustainability performance, supporting long-term financing and diversified capital sources.

The Name is Bonds. Thematic Bonds. What's next for the ... - Dentons - Thematic bonds, including green, social, sustainability, and sustainability-linked bonds, fund ESG-related activities, with growing use by sovereign issuers to support energy transition and social projects while offering cost-effective financing.

Thematic Bonds Can Help Increase Investment in Responsible ... - Thematic bonds facilitate financing for high-capital projects like critical minerals mining by linking funding to sustainability commitments, improving transparency and attracting ESG-focused investors through performance-based incentives.

dowidth.com

dowidth.com