Carbon credits represent permits allowing companies to emit a specific amount of greenhouse gases, facilitating direct investment in environmental projects to offset emissions. Emissions trading, also known as cap-and-trade, establishes a market-driven system where companies buy and sell emission allowances under a capped total limit, incentivizing reductions. Explore how these financial mechanisms drive corporate accountability and environmental sustainability in the fight against climate change.

Why it is important

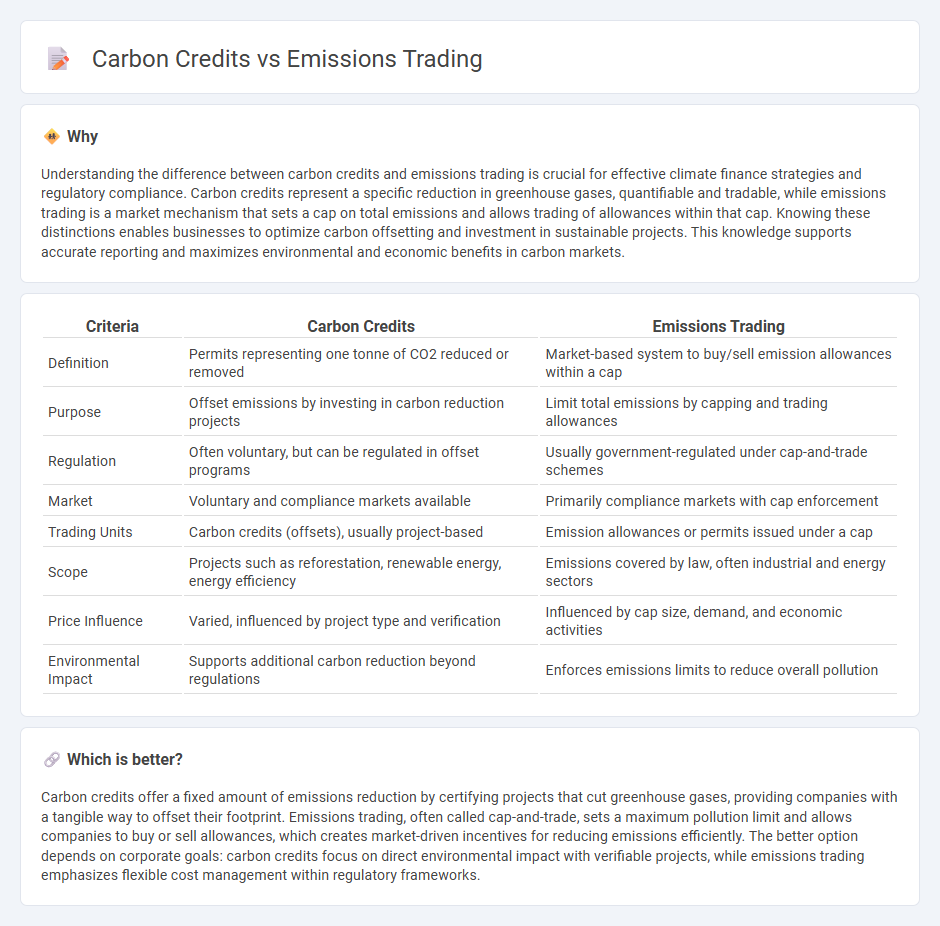

Understanding the difference between carbon credits and emissions trading is crucial for effective climate finance strategies and regulatory compliance. Carbon credits represent a specific reduction in greenhouse gases, quantifiable and tradable, while emissions trading is a market mechanism that sets a cap on total emissions and allows trading of allowances within that cap. Knowing these distinctions enables businesses to optimize carbon offsetting and investment in sustainable projects. This knowledge supports accurate reporting and maximizes environmental and economic benefits in carbon markets.

Comparison Table

| Criteria | Carbon Credits | Emissions Trading |

|---|---|---|

| Definition | Permits representing one tonne of CO2 reduced or removed | Market-based system to buy/sell emission allowances within a cap |

| Purpose | Offset emissions by investing in carbon reduction projects | Limit total emissions by capping and trading allowances |

| Regulation | Often voluntary, but can be regulated in offset programs | Usually government-regulated under cap-and-trade schemes |

| Market | Voluntary and compliance markets available | Primarily compliance markets with cap enforcement |

| Trading Units | Carbon credits (offsets), usually project-based | Emission allowances or permits issued under a cap |

| Scope | Projects such as reforestation, renewable energy, energy efficiency | Emissions covered by law, often industrial and energy sectors |

| Price Influence | Varied, influenced by project type and verification | Influenced by cap size, demand, and economic activities |

| Environmental Impact | Supports additional carbon reduction beyond regulations | Enforces emissions limits to reduce overall pollution |

Which is better?

Carbon credits offer a fixed amount of emissions reduction by certifying projects that cut greenhouse gases, providing companies with a tangible way to offset their footprint. Emissions trading, often called cap-and-trade, sets a maximum pollution limit and allows companies to buy or sell allowances, which creates market-driven incentives for reducing emissions efficiently. The better option depends on corporate goals: carbon credits focus on direct environmental impact with verifiable projects, while emissions trading emphasizes flexible cost management within regulatory frameworks.

Connection

Carbon credits represent permits that allow organizations to emit a specified amount of greenhouse gases, enabling participation in emissions trading systems designed to reduce overall carbon emissions. Emissions trading, also known as cap-and-trade, sets a cap on total emissions and allows entities to buy or sell carbon credits based on their actual emissions levels. This market-driven approach incentivizes companies to lower emissions cost-effectively while complying with environmental regulations.

Key Terms

Cap-and-Trade

Cap-and-trade is a market-based emissions trading system where a government sets a limit (cap) on total greenhouse gas emissions and issues allowances or carbon credits equal to that cap. Companies must hold enough credits to cover their emissions, and can buy or sell these credits, incentivizing emission reductions where they are most cost-effective. Explore how cap-and-trade mechanisms drive carbon markets and support climate goals by learning more about their implementation and impact.

Allowances

Emissions trading systems (ETS) primarily use allowances as tradable permits that cap the total greenhouse gas emissions from regulated entities, enabling companies to buy or sell emissions rights within a set limit. Carbon credits represent a reduction in emissions, often generated from projects like reforestation or renewable energy, and can be used to offset emissions outside regulated caps. Explore the nuances of allowances and how they drive compliance markets by learning more about their role in global climate strategies.

Offset Credits

Emissions trading schemes allow companies to buy and sell allowances for greenhouse gas emissions, creating a market-driven cap on total emissions, while carbon credits, specifically Offset Credits, represent measurable reductions in emissions from projects outside the capped sectors. Offset Credits enable organizations to compensate for their emissions by investing in renewable energy, reforestation, or methane capture initiatives, supporting sustainable development and carbon neutrality. Explore how Offset Credits can enhance your emissions management strategy and contribute to global climate goals.

Source and External Links

Emissions trading - Wikipedia - Emissions trading, also called cap and trade, is a market-oriented system where a government sets a cap on pollutant emissions and issues tradable permits, allowing companies to buy and sell allowances to meet pollution limits efficiently while driving overall emissions reductions.

How do emissions trading systems work? - LSE - Emissions trading systems set a cap on greenhouse gas emissions and create permits for each unit; firms must hold permits equal to their emissions and can trade them, incentivizing reductions and supporting climate targets like those in the Paris Agreement.

What Is Emissions Trading? | US EPA - Emissions trading programs impose a pollution cap and issue tradable allowances, providing sources flexibility in compliance while reducing emissions effectively, exemplified by the U.S. Acid Rain Program and other regional schemes lowering pollutants and protecting health and environment.

dowidth.com

dowidth.com