Synthetic assets replicate the performance of actual securities without owning the underlying assets, offering customizable exposure to various financial instruments such as stocks, bonds, and derivatives. These instruments enhance liquidity and risk management by enabling investors to gain targeted market positions with lower capital outlay and increased flexibility. Explore in-depth insights on the advantages and risks of synthetic assets compared to traditional securities.

Why it is important

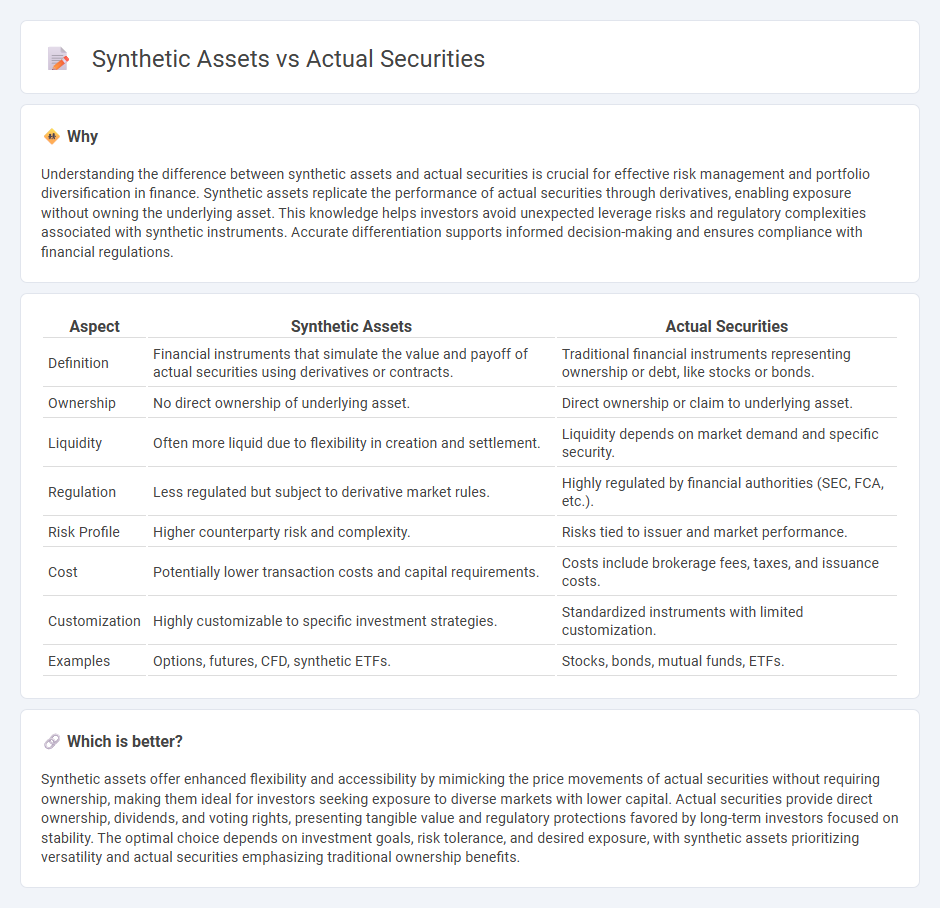

Understanding the difference between synthetic assets and actual securities is crucial for effective risk management and portfolio diversification in finance. Synthetic assets replicate the performance of actual securities through derivatives, enabling exposure without owning the underlying asset. This knowledge helps investors avoid unexpected leverage risks and regulatory complexities associated with synthetic instruments. Accurate differentiation supports informed decision-making and ensures compliance with financial regulations.

Comparison Table

| Aspect | Synthetic Assets | Actual Securities |

|---|---|---|

| Definition | Financial instruments that simulate the value and payoff of actual securities using derivatives or contracts. | Traditional financial instruments representing ownership or debt, like stocks or bonds. |

| Ownership | No direct ownership of underlying asset. | Direct ownership or claim to underlying asset. |

| Liquidity | Often more liquid due to flexibility in creation and settlement. | Liquidity depends on market demand and specific security. |

| Regulation | Less regulated but subject to derivative market rules. | Highly regulated by financial authorities (SEC, FCA, etc.). |

| Risk Profile | Higher counterparty risk and complexity. | Risks tied to issuer and market performance. |

| Cost | Potentially lower transaction costs and capital requirements. | Costs include brokerage fees, taxes, and issuance costs. |

| Customization | Highly customizable to specific investment strategies. | Standardized instruments with limited customization. |

| Examples | Options, futures, CFD, synthetic ETFs. | Stocks, bonds, mutual funds, ETFs. |

Which is better?

Synthetic assets offer enhanced flexibility and accessibility by mimicking the price movements of actual securities without requiring ownership, making them ideal for investors seeking exposure to diverse markets with lower capital. Actual securities provide direct ownership, dividends, and voting rights, presenting tangible value and regulatory protections favored by long-term investors focused on stability. The optimal choice depends on investment goals, risk tolerance, and desired exposure, with synthetic assets prioritizing versatility and actual securities emphasizing traditional ownership benefits.

Connection

Synthetic assets replicate the economic benefits of actual securities through derivatives, enabling investors to gain exposure without owning the underlying asset directly. These financial instruments use options, futures, or swaps to mimic price movements and dividend payouts of traditional securities. By bridging actual securities with synthetic counterparts, markets enhance liquidity and provide versatile risk management strategies.

Key Terms

Underlying Asset

Actual securities represent ownership or debt claims directly tied to tangible underlying assets such as stocks, bonds, or commodities, providing investors with explicit rights and claims on these assets. Synthetic assets, created through derivatives like options, swaps, or futures, replicate the economic exposure of the underlying assets without granting ownership, enabling tailored risk and return profiles. Explore the distinctions further to understand how underlying asset exposure influences investment strategies and risk management.

Derivative

Actual securities represent ownership or debt in real assets such as stocks or bonds, providing direct claims and inherent value based on the underlying entity. Synthetic assets are engineered through derivatives like options, futures, or swaps, allowing investors to mimic the performance of actual securities without holding the underlying asset itself. Explore the nuances of derivatives and their impact on investment strategies to deepen your understanding.

Replication

Actual securities represent direct ownership of financial instruments such as stocks or bonds, providing holders with inherent rights including dividends and voting privileges. Synthetic assets replicate the payoffs of these securities through derivatives like options or swaps, enabling exposure without owning the underlying asset. Explore how replication strategies balance risk and return to optimize portfolio construction and trading.

Source and External Links

Security (finance) - Wikipedia - Actual securities are tradable financial assets, which can be physical (certificated securities) or electronic (book-entry form), and include bearer and registered securities that confer rights such as payment or voting.

SEC.gov | Home - Securities are regulated by the Securities and Exchange Commission (SEC), which oversees trading, brokers, dealers, and investment advisors to protect investors and ensure fair, efficient markets.

Cash and Marketable Securities | EBSCO Research Starters - Marketable securities are short-term financial instruments that can be quickly converted to cash and are considered liquid assets on a company's balance sheet, distinct from physical goods or inventory stock.

dowidth.com

dowidth.com