Decentralized finance (DeFi) leverages blockchain technology to offer financial services without traditional intermediaries, enabling transparent, automated, and borderless transactions. Peer-to-peer (P2P) lending connects borrowers and lenders directly through online platforms, facilitating personal loans with reduced reliance on banks and lower interest rates. Explore the key differences and benefits of DeFi and P2P lending to understand their impact on the future of finance.

Why it is important

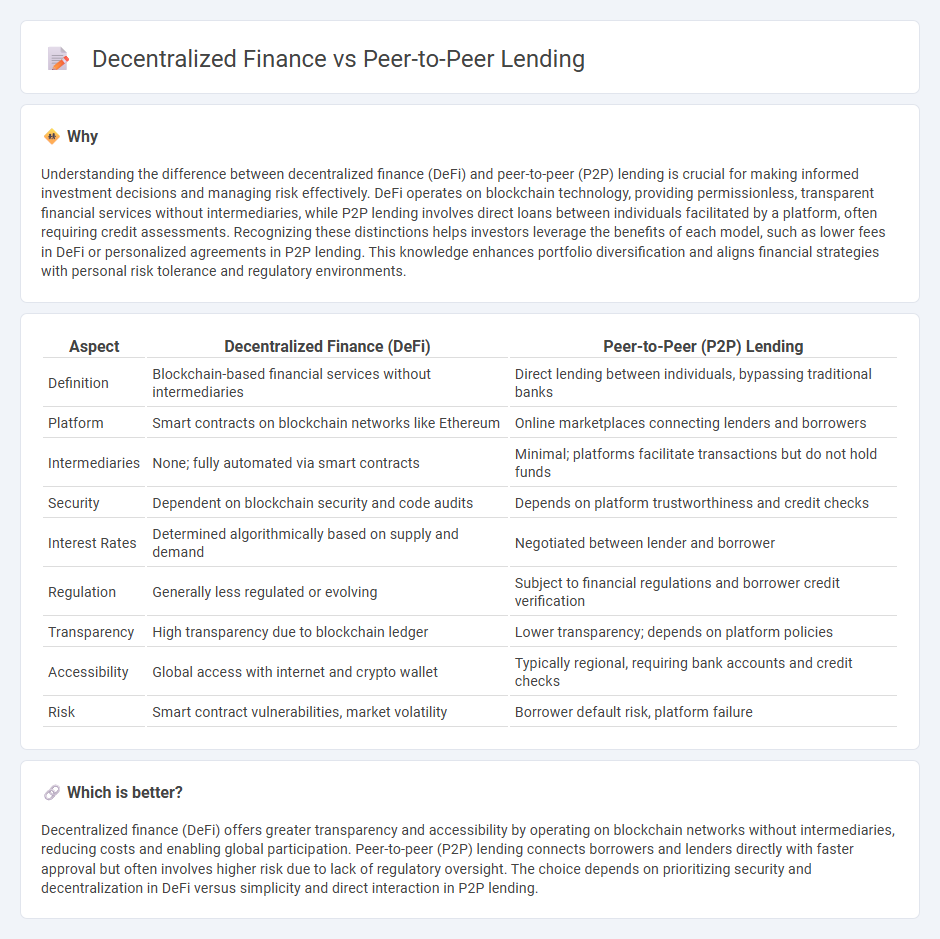

Understanding the difference between decentralized finance (DeFi) and peer-to-peer (P2P) lending is crucial for making informed investment decisions and managing risk effectively. DeFi operates on blockchain technology, providing permissionless, transparent financial services without intermediaries, while P2P lending involves direct loans between individuals facilitated by a platform, often requiring credit assessments. Recognizing these distinctions helps investors leverage the benefits of each model, such as lower fees in DeFi or personalized agreements in P2P lending. This knowledge enhances portfolio diversification and aligns financial strategies with personal risk tolerance and regulatory environments.

Comparison Table

| Aspect | Decentralized Finance (DeFi) | Peer-to-Peer (P2P) Lending |

|---|---|---|

| Definition | Blockchain-based financial services without intermediaries | Direct lending between individuals, bypassing traditional banks |

| Platform | Smart contracts on blockchain networks like Ethereum | Online marketplaces connecting lenders and borrowers |

| Intermediaries | None; fully automated via smart contracts | Minimal; platforms facilitate transactions but do not hold funds |

| Security | Dependent on blockchain security and code audits | Depends on platform trustworthiness and credit checks |

| Interest Rates | Determined algorithmically based on supply and demand | Negotiated between lender and borrower |

| Regulation | Generally less regulated or evolving | Subject to financial regulations and borrower credit verification |

| Transparency | High transparency due to blockchain ledger | Lower transparency; depends on platform policies |

| Accessibility | Global access with internet and crypto wallet | Typically regional, requiring bank accounts and credit checks |

| Risk | Smart contract vulnerabilities, market volatility | Borrower default risk, platform failure |

Which is better?

Decentralized finance (DeFi) offers greater transparency and accessibility by operating on blockchain networks without intermediaries, reducing costs and enabling global participation. Peer-to-peer (P2P) lending connects borrowers and lenders directly with faster approval but often involves higher risk due to lack of regulatory oversight. The choice depends on prioritizing security and decentralization in DeFi versus simplicity and direct interaction in P2P lending.

Connection

Decentralized finance (DeFi) leverages blockchain technology to enable peer-to-peer lending platforms without traditional intermediaries, increasing transparency and reducing costs. Smart contracts automate loan agreements and repayments, ensuring trust and security between borrowers and lenders. This integration fosters greater financial inclusion by providing direct access to credit for underserved populations globally.

Key Terms

Intermediary

Peer-to-peer lending platforms reduce reliance on traditional financial intermediaries by directly connecting borrowers with lenders, streamlining the loan process and cutting costs. Decentralized finance (DeFi) eliminates intermediaries altogether through blockchain technology and smart contracts, enabling trustless and automated lending without centralized control. Explore the evolving roles of intermediaries in P2P lending and DeFi to understand their impact on financial accessibility and security.

Smart Contracts

Peer-to-peer lending platforms facilitate direct borrowing and lending between individuals, often relying on centralized intermediaries to manage transactions, whereas decentralized finance (DeFi) leverages blockchain technology and smart contracts to automate and enforce loan agreements without intermediaries. Smart contracts in DeFi enable transparent, immutable, and self-executing conditions that reduce risks of default and increase efficiency in financial services. Explore how smart contracts are revolutionizing lending by enhancing security and accessibility in modern finance.

Liquidity

Peer-to-peer lending platforms offer liquidity through direct borrower-to-lender connections, enabling faster loan disbursement but often with limited secondary market options. Decentralized finance (DeFi) protocols leverage blockchain technology to provide enhanced liquidity via automated market makers and tokenized assets, allowing users to trade or pool funds freely. Explore the nuances of liquidity management in P2P lending and DeFi to maximize your investment strategy.

Source and External Links

What is Peer-to-Peer Lending & How P2P Loans Work - Peer-to-peer lending allows individuals to borrow from and lend money to others via specialized online platforms without involving banks, offering flexible terms and potentially lower eligibility requirements for borrowers and investment opportunities for lenders.

Peer-to-peer lending - Wikipedia - Peer-to-peer lending operates online to connect borrowers and investors directly, often without prior relationships, with platforms managing credit checks, transaction processing, and servicing, while loans can be unsecured and traded as securities.

PEER-TO-PEER LENDING - North American Securities Administrators Association - P2P lending involves borrowers posting loan requests online and investors funding these loans, with the platforms facilitating transactions and note issuance, but investors should be aware of regulatory and business risks associated with the still-developing P2P market.

dowidth.com

dowidth.com