Tokenized treasury bills represent a modern form of government debt securities digitized on blockchain, offering enhanced liquidity and transparency compared to traditional instruments. Structured notes combine debt securities with derivatives to provide tailored risk-return profiles linked to underlying assets like stocks or indices. Discover the key differences and investment potentials of tokenized treasury bills versus structured notes to optimize your financial strategy.

Why it is important

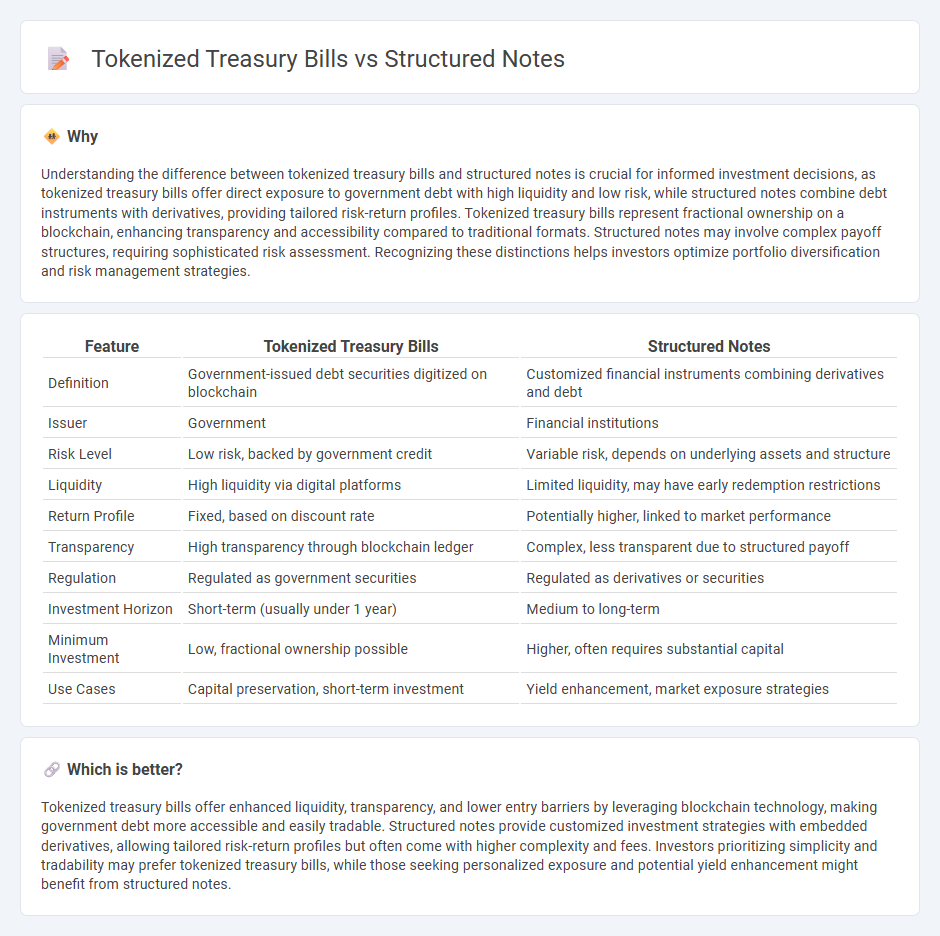

Understanding the difference between tokenized treasury bills and structured notes is crucial for informed investment decisions, as tokenized treasury bills offer direct exposure to government debt with high liquidity and low risk, while structured notes combine debt instruments with derivatives, providing tailored risk-return profiles. Tokenized treasury bills represent fractional ownership on a blockchain, enhancing transparency and accessibility compared to traditional formats. Structured notes may involve complex payoff structures, requiring sophisticated risk assessment. Recognizing these distinctions helps investors optimize portfolio diversification and risk management strategies.

Comparison Table

| Feature | Tokenized Treasury Bills | Structured Notes |

|---|---|---|

| Definition | Government-issued debt securities digitized on blockchain | Customized financial instruments combining derivatives and debt |

| Issuer | Government | Financial institutions |

| Risk Level | Low risk, backed by government credit | Variable risk, depends on underlying assets and structure |

| Liquidity | High liquidity via digital platforms | Limited liquidity, may have early redemption restrictions |

| Return Profile | Fixed, based on discount rate | Potentially higher, linked to market performance |

| Transparency | High transparency through blockchain ledger | Complex, less transparent due to structured payoff |

| Regulation | Regulated as government securities | Regulated as derivatives or securities |

| Investment Horizon | Short-term (usually under 1 year) | Medium to long-term |

| Minimum Investment | Low, fractional ownership possible | Higher, often requires substantial capital |

| Use Cases | Capital preservation, short-term investment | Yield enhancement, market exposure strategies |

Which is better?

Tokenized treasury bills offer enhanced liquidity, transparency, and lower entry barriers by leveraging blockchain technology, making government debt more accessible and easily tradable. Structured notes provide customized investment strategies with embedded derivatives, allowing tailored risk-return profiles but often come with higher complexity and fees. Investors prioritizing simplicity and tradability may prefer tokenized treasury bills, while those seeking personalized exposure and potential yield enhancement might benefit from structured notes.

Connection

Tokenized treasury bills represent government debt instruments converted into blockchain-based digital assets, allowing enhanced liquidity and accessibility, while structured notes are customized financial products combining fixed income and derivatives to achieve targeted risk-return profiles. Both instruments facilitate portfolio diversification and risk management by offering tailored exposure to underlying assets and market conditions. The integration of tokenization technology in structured notes can improve transparency, settlement efficiency, and market reach for these hybrid financial products.

Key Terms

Underlying Asset

Structured notes often have complex underlying assets such as baskets of equities, indices, or derivatives, providing tailored risk-return profiles. Tokenized treasury bills represent digitized ownership of government debt, offering liquidity and transparency while directly reflecting the performance of the underlying sovereign securities. Explore the differences in asset backing and investment implications to understand their distinct advantages.

Liquidity

Structured notes often have lower liquidity compared to tokenized treasury bills due to their complexity and limited secondary market availability. Tokenized treasury bills benefit from blockchain technology, enabling faster settlement, 24/7 trading, and increased transparency, which enhances liquidity for investors. Explore the advantages of tokenized treasury bills to understand their impact on liquidity and investment flexibility.

Credit Risk

Structured notes carry higher credit risk due to their dependence on the issuer's financial stability, often linked to banks or financial institutions. Tokenized treasury bills, backed by government securities, exhibit lower credit risk as they are secured by sovereign credit and benefit from blockchain transparency. Explore the nuances of credit risk management in these investment options to make informed financial decisions.

Source and External Links

What Are Structured Notes and How Do They Work? - Structured notes are hybrid securities combining bonds and derivatives, where the return is linked to the performance of an underlying asset like a stock index, often using a preset formula to determine payouts at maturity.

Understanding Structured Notes With Principal Protection - These are a type of structured product that offer full or partial return of principal at maturity regardless of underlying asset performance, using derivatives to blend safety features with market-linked returns.

Structured Notes 101 - Structured notes, typically issued by banks, provide investors with market-linked growth potential and customizable principal protection, enabling a tailored reward-to-risk trade-off when held to maturity.

dowidth.com

dowidth.com