Laddered bond ETFs diversify maturity dates to reduce interest rate risk and enhance portfolio stability, offering steady income streams through staggered bond expirations. Green bond funds focus on financing environmentally sustainable projects, appealing to investors seeking positive social impact alongside financial returns. Explore the distinct benefits and strategic advantages of laddered bond ETFs and green bond funds to optimize your investment portfolio.

Why it is important

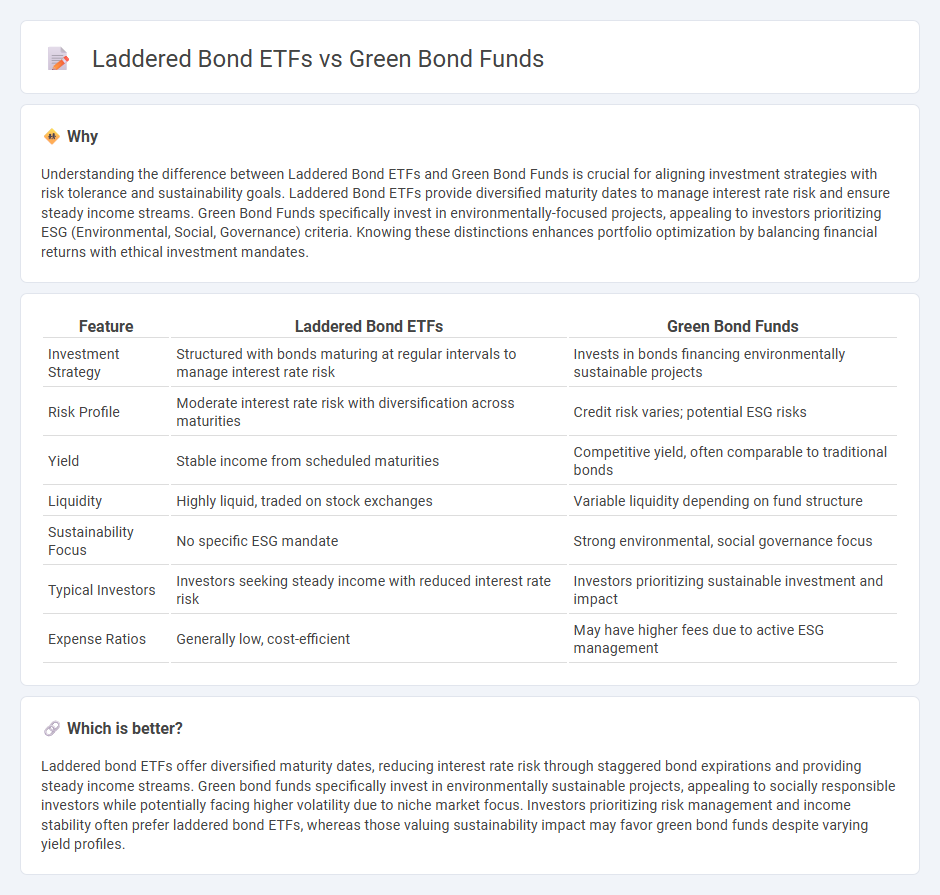

Understanding the difference between Laddered Bond ETFs and Green Bond Funds is crucial for aligning investment strategies with risk tolerance and sustainability goals. Laddered Bond ETFs provide diversified maturity dates to manage interest rate risk and ensure steady income streams. Green Bond Funds specifically invest in environmentally-focused projects, appealing to investors prioritizing ESG (Environmental, Social, Governance) criteria. Knowing these distinctions enhances portfolio optimization by balancing financial returns with ethical investment mandates.

Comparison Table

| Feature | Laddered Bond ETFs | Green Bond Funds |

|---|---|---|

| Investment Strategy | Structured with bonds maturing at regular intervals to manage interest rate risk | Invests in bonds financing environmentally sustainable projects |

| Risk Profile | Moderate interest rate risk with diversification across maturities | Credit risk varies; potential ESG risks |

| Yield | Stable income from scheduled maturities | Competitive yield, often comparable to traditional bonds |

| Liquidity | Highly liquid, traded on stock exchanges | Variable liquidity depending on fund structure |

| Sustainability Focus | No specific ESG mandate | Strong environmental, social governance focus |

| Typical Investors | Investors seeking steady income with reduced interest rate risk | Investors prioritizing sustainable investment and impact |

| Expense Ratios | Generally low, cost-efficient | May have higher fees due to active ESG management |

Which is better?

Laddered bond ETFs offer diversified maturity dates, reducing interest rate risk through staggered bond expirations and providing steady income streams. Green bond funds specifically invest in environmentally sustainable projects, appealing to socially responsible investors while potentially facing higher volatility due to niche market focus. Investors prioritizing risk management and income stability often prefer laddered bond ETFs, whereas those valuing sustainability impact may favor green bond funds despite varying yield profiles.

Connection

Laddered bond ETFs and green bond funds both offer strategic fixed-income investment options that enhance portfolio diversification and risk management. Laddered bond ETFs stagger maturities to mitigate interest rate risks, while green bond funds specifically focus on environmentally sustainable projects, appealing to socially responsible investors. Combining these approaches provides a balanced investment in eco-friendly assets with systematic maturity scheduling.

Key Terms

Environmental Impact

Green Bond Funds invest specifically in environmentally sustainable projects, channeling capital into renewable energy, clean water, and pollution reduction initiatives that directly contribute to climate change mitigation. Laddered bond ETFs diversify maturity dates to reduce interest rate risk but may include a mix of bonds without a specific environmental focus, offering less targeted impact on sustainability goals. Explore the differences further to understand how each investment aligns with your environmental impact priorities.

Maturity Structure

Green Bond Funds concentrate investments in environmentally sustainable projects, often featuring varied maturity structures aligned with green initiatives' timelines. Laddered bond ETFs strategically spread bond maturities over set periods, enhancing liquidity and interest rate risk management by regularly maturing bonds. Explore how each approach impacts portfolio stability and sustainability goals for deeper financial insights.

Yield

Green Bond Funds prioritize investments in environmentally sustainable projects, offering yields often influenced by the growing demand for eco-friendly assets, though sometimes lower than traditional bonds. Laddered bond ETFs provide diversified maturity timelines to manage interest rate risks, typically delivering more stable and predictable yields due to staggered reinvestment. Explore detailed yield comparisons and strategies to optimize fixed-income portfolios by delving deeper into these bond investment options.

Source and External Links

How to Invest in Green Bonds - Green bond funds invest capital in projects with direct environmental benefits, have grown rapidly since 2021, and appeal particularly to long-term investors due to their focus on sustainable outcomes and sensitivity to interest rate changes.

Green Social Sustainable Bond Fund - This actively managed fund builds a diversified fixed income portfolio focused on green, social, and sustainable projects, ensuring full transparency and alignment with EU SFDR Article 9 criteria to avoid greenwashing.

Green Bonds | Robeco Global - Robeco's green bond strategy, managed by an experienced team, targets measurable environmental impact and sustainable development goals, following strict exclusions and classified under EU SFDR Article 9.

dowidth.com

dowidth.com