Trader funding programs provide capital to skilled traders, enabling them to trade with institutional funds and share in the profits, while investment clubs pool resources from multiple investors to collectively make investment decisions and manage portfolios. These programs offer structured risk management and performance-based evaluations, contrasting with the collaborative and often informal nature of investment clubs. Explore the features and benefits of trader funding programs versus investment clubs to determine the best fit for your financial goals.

Why it is important

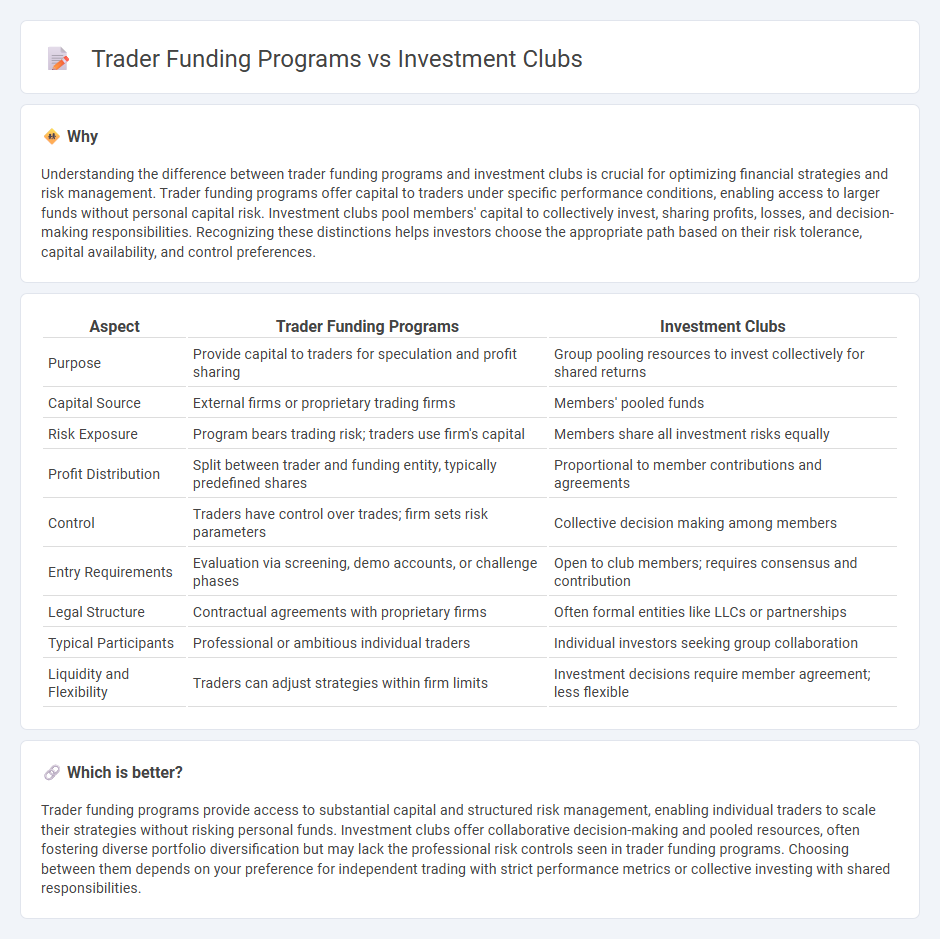

Understanding the difference between trader funding programs and investment clubs is crucial for optimizing financial strategies and risk management. Trader funding programs offer capital to traders under specific performance conditions, enabling access to larger funds without personal capital risk. Investment clubs pool members' capital to collectively invest, sharing profits, losses, and decision-making responsibilities. Recognizing these distinctions helps investors choose the appropriate path based on their risk tolerance, capital availability, and control preferences.

Comparison Table

| Aspect | Trader Funding Programs | Investment Clubs |

|---|---|---|

| Purpose | Provide capital to traders for speculation and profit sharing | Group pooling resources to invest collectively for shared returns |

| Capital Source | External firms or proprietary trading firms | Members' pooled funds |

| Risk Exposure | Program bears trading risk; traders use firm's capital | Members share all investment risks equally |

| Profit Distribution | Split between trader and funding entity, typically predefined shares | Proportional to member contributions and agreements |

| Control | Traders have control over trades; firm sets risk parameters | Collective decision making among members |

| Entry Requirements | Evaluation via screening, demo accounts, or challenge phases | Open to club members; requires consensus and contribution |

| Legal Structure | Contractual agreements with proprietary firms | Often formal entities like LLCs or partnerships |

| Typical Participants | Professional or ambitious individual traders | Individual investors seeking group collaboration |

| Liquidity and Flexibility | Traders can adjust strategies within firm limits | Investment decisions require member agreement; less flexible |

Which is better?

Trader funding programs provide access to substantial capital and structured risk management, enabling individual traders to scale their strategies without risking personal funds. Investment clubs offer collaborative decision-making and pooled resources, often fostering diverse portfolio diversification but may lack the professional risk controls seen in trader funding programs. Choosing between them depends on your preference for independent trading with strict performance metrics or collective investing with shared responsibilities.

Connection

Trader funding programs provide capital to skilled traders who pass evaluation stages, enabling access to larger markets without risking personal funds. Investment clubs pool resources from members to collectively invest in various assets, often benefiting from shared expertise and diversified strategies. Both models rely on collective capital and risk sharing to enhance investment opportunities and increase potential returns in financial markets.

Key Terms

**Investment Clubs:**

Investment clubs pool resources from multiple investors to collectively invest in stocks, real estate, or other assets, sharing both profits and decision-making responsibilities. These clubs often emphasize education, collaboration, and long-term growth, with members actively participating in research and strategy discussions. Discover how investment clubs can enhance your financial knowledge and amplify your investment potential.

Portfolio Diversification

Investment clubs emphasize portfolio diversification by pooling members' resources to invest across various asset classes, spreading risk and enhancing potential returns through collective decision-making. Trader funding programs typically provide capital to individual traders, often concentrating on high-risk, high-reward strategies without extensive diversification, aiming for rapid profit generation. Explore the advantages and trade-offs of each approach to optimize your investment strategy.

Collective Decision-Making

Investment clubs emphasize collective decision-making, allowing members to pool resources and share investment strategies democratically, often leading to diversified portfolios and risk distribution. Trader funding programs, in contrast, typically allocate capital to individual traders based on performance metrics, prioritizing personal accountability and rapid profit generation over group consensus. Explore how these models impact investment outcomes and risk management in detail.

Source and External Links

Investment club - An investment club is a group of individuals who pool money and meet periodically to invest jointly or discuss investing strategies together.

Investment Clubs: How To Join One Or Start Your Own - Investment clubs are groups where members pool money to invest or share investment ideas, often meeting monthly and having elected officers to manage contributions and decisions.

Investment Clubs and the SEC - Investment clubs generally pool money to invest collectively with members making joint decisions, and while the SEC usually does not regulate them, unique clubs may need to consider registration requirements.

dowidth.com

dowidth.com