Laddered bond ETFs offer a structured, staggered maturity approach that manages interest rate risk effectively while providing predictable cash flow, unlike short-term bond funds which actively manage duration and credit risk within a shorter maturity spectrum. Laddered bond ETFs typically feature fixed maturities, enabling investors to plan reinvestments and reduce volatility, whereas short-term bond funds provide liquidity and potential for higher income through active management. Explore the differences in risk, return, and suitability to determine the best fit for your investment portfolio.

Why it is important

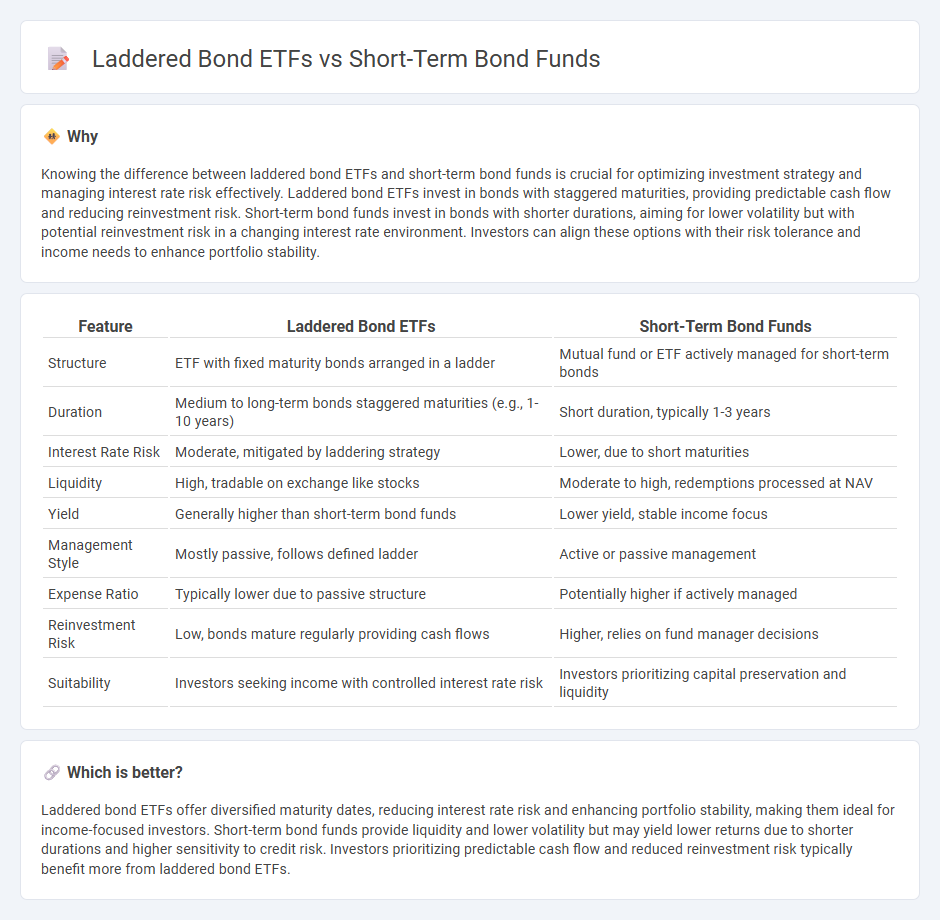

Knowing the difference between laddered bond ETFs and short-term bond funds is crucial for optimizing investment strategy and managing interest rate risk effectively. Laddered bond ETFs invest in bonds with staggered maturities, providing predictable cash flow and reducing reinvestment risk. Short-term bond funds invest in bonds with shorter durations, aiming for lower volatility but with potential reinvestment risk in a changing interest rate environment. Investors can align these options with their risk tolerance and income needs to enhance portfolio stability.

Comparison Table

| Feature | Laddered Bond ETFs | Short-Term Bond Funds |

|---|---|---|

| Structure | ETF with fixed maturity bonds arranged in a ladder | Mutual fund or ETF actively managed for short-term bonds |

| Duration | Medium to long-term bonds staggered maturities (e.g., 1-10 years) | Short duration, typically 1-3 years |

| Interest Rate Risk | Moderate, mitigated by laddering strategy | Lower, due to short maturities |

| Liquidity | High, tradable on exchange like stocks | Moderate to high, redemptions processed at NAV |

| Yield | Generally higher than short-term bond funds | Lower yield, stable income focus |

| Management Style | Mostly passive, follows defined ladder | Active or passive management |

| Expense Ratio | Typically lower due to passive structure | Potentially higher if actively managed |

| Reinvestment Risk | Low, bonds mature regularly providing cash flows | Higher, relies on fund manager decisions |

| Suitability | Investors seeking income with controlled interest rate risk | Investors prioritizing capital preservation and liquidity |

Which is better?

Laddered bond ETFs offer diversified maturity dates, reducing interest rate risk and enhancing portfolio stability, making them ideal for income-focused investors. Short-term bond funds provide liquidity and lower volatility but may yield lower returns due to shorter durations and higher sensitivity to credit risk. Investors prioritizing predictable cash flow and reduced reinvestment risk typically benefit more from laddered bond ETFs.

Connection

Laddered bond ETFs and short-term bond funds both focus on managing interest rate risk by investing in bonds with staggered maturities, enhancing portfolio stability and liquidity. Laddered bond ETFs diversify across multiple maturities within a single fund, while short-term bond funds invest primarily in bonds with shorter durations, typically under three years. Together, they offer investors strategies to balance yield and risk in a low-interest-rate environment.

Key Terms

Duration

Short-term bond funds typically maintain a low average duration, commonly between 1 to 3 years, providing reduced interest rate risk and more stable returns in volatile markets. Laddered bond ETFs diversify across multiple maturities, often spanning 1 to 10 years, balancing higher yields with controlled duration exposure to mitigate interest rate fluctuations. Explore detailed duration profiles and performance comparisons to determine the best strategy for your fixed-income portfolio.

Yield

Short-term bond funds typically offer higher yield stability by investing in bonds with maturities under three years, reducing interest rate risk compared to laddered bond ETFs, which spread investments across varying maturities for smoothing returns. Laddered bond ETFs optimize yield by maintaining a rolling portfolio of bonds, taking advantage of rising rates over time without locking in low yields. Explore the detailed performance metrics and risk profiles to determine the optimal strategy for your income-focused portfolio.

Liquidity

Short-term bond funds offer daily liquidity with the ability to redeem shares at net asset value, making them ideal for investors needing quick access to cash. Laddered bond ETFs, while liquid on exchanges during trading hours, can be subject to bid-ask spreads and market fluctuations, impacting immediate sale value. Explore the nuances of liquidity and risk management in bond investments to make more informed decisions.

Source and External Links

Fidelity short duration bond funds - Short-term bond funds invest primarily in corporate and investment-grade U.S. fixed-income securities with durations of one to three and a half years, offering less sensitivity to interest rate volatility and higher income potential than cash investments.

Best Short-Term Bond Funds in July 2025 - Bankrate - These funds invest in bonds with maturities under five years to reduce interest rate risk, providing a yield higher than savings accounts and suitable for goals within three to five years, with expense ratios being a key factor to consider.

The Best Short-Term Bond Funds | Morningstar - Top-rated short-term bond funds and ETFs invest in high-quality corporate, securitized, and government bonds with short durations (around 1.5 to 2 years), balancing credit risk for conservative income and total return objectives.

dowidth.com

dowidth.com