Tokenized treasuries represent digital assets backed by government securities, offering transparent, secure, and easily tradable financial instruments. Crypto-backed bonds leverage blockchain technology to provide decentralized, collateralized debt securities, enhancing accessibility and liquidity for investors. Explore the key differences and benefits of these innovative financing options to make informed investment decisions.

Why it is important

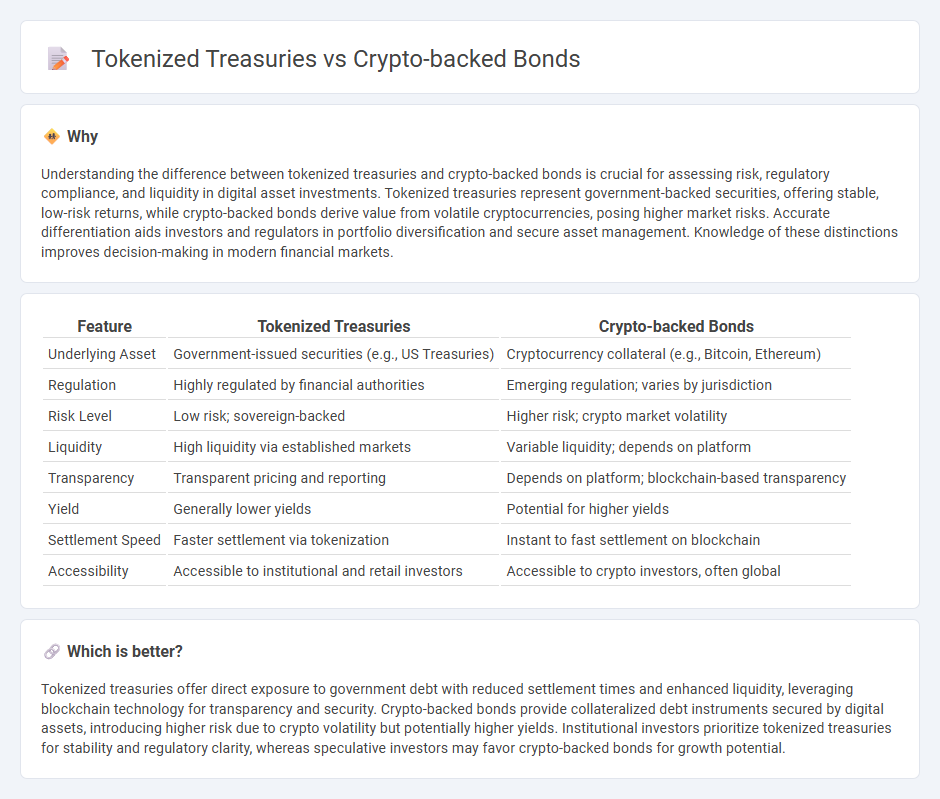

Understanding the difference between tokenized treasuries and crypto-backed bonds is crucial for assessing risk, regulatory compliance, and liquidity in digital asset investments. Tokenized treasuries represent government-backed securities, offering stable, low-risk returns, while crypto-backed bonds derive value from volatile cryptocurrencies, posing higher market risks. Accurate differentiation aids investors and regulators in portfolio diversification and secure asset management. Knowledge of these distinctions improves decision-making in modern financial markets.

Comparison Table

| Feature | Tokenized Treasuries | Crypto-backed Bonds |

|---|---|---|

| Underlying Asset | Government-issued securities (e.g., US Treasuries) | Cryptocurrency collateral (e.g., Bitcoin, Ethereum) |

| Regulation | Highly regulated by financial authorities | Emerging regulation; varies by jurisdiction |

| Risk Level | Low risk; sovereign-backed | Higher risk; crypto market volatility |

| Liquidity | High liquidity via established markets | Variable liquidity; depends on platform |

| Transparency | Transparent pricing and reporting | Depends on platform; blockchain-based transparency |

| Yield | Generally lower yields | Potential for higher yields |

| Settlement Speed | Faster settlement via tokenization | Instant to fast settlement on blockchain |

| Accessibility | Accessible to institutional and retail investors | Accessible to crypto investors, often global |

Which is better?

Tokenized treasuries offer direct exposure to government debt with reduced settlement times and enhanced liquidity, leveraging blockchain technology for transparency and security. Crypto-backed bonds provide collateralized debt instruments secured by digital assets, introducing higher risk due to crypto volatility but potentially higher yields. Institutional investors prioritize tokenized treasuries for stability and regulatory clarity, whereas speculative investors may favor crypto-backed bonds for growth potential.

Connection

Tokenized treasuries transform traditional government debt into blockchain-based digital assets, enhancing liquidity and accessibility for investors. Crypto-backed bonds utilize cryptocurrencies as collateral, integrating decentralized finance with conventional bond structures. This connection bridges traditional finance and blockchain technology, fostering innovative investment opportunities and efficient asset management.

Key Terms

Collateralization

Crypto-backed bonds rely on digital assets as collateral, ensuring liquidity and risk mitigation through over-collateralization techniques. Tokenized treasuries represent fractional ownership of traditional government bonds, offering direct exposure to sovereign credit risk with asset-backed security. Explore deeper insights into the evolving dynamics of collateralization in digital finance.

On-chain Settlement

Crypto-backed bonds use blockchain technology to enable secure, transparent on-chain settlement, reducing counterparty risk and settlement times significantly compared to traditional methods. Tokenized treasuries represent government debt issued as digital assets, allowing instant, programmable settlements with improved liquidity and real-time ownership tracking. Explore how on-chain settlement is transforming fixed income markets by enhancing efficiency and accessibility.

Yield

Crypto-backed bonds offer higher yield potential due to their exposure to blockchain asset volatility and decentralized finance mechanisms, often surpassing traditional fixed-income returns. Tokenized treasuries provide more stable, government-backed yield with enhanced liquidity and fractional ownership, making them attractive for risk-averse investors. Explore how yield dynamics differ within these digital finance instruments to optimize your investment portfolio.

Source and External Links

Smart bond (finance) - Wikipedia - Crypto-backed bonds, also known as smart or blockchain bonds, are automated bond contracts using blockchain technology to enable secure, transparent, and decentralized issuance and settlement processes, reducing intermediaries and costs compared to traditional bonds.

Tokenized Bonds: The Future of Fixed-Income Investments - Tokenized bonds are digital versions of standard bonds represented as blockchain tokens, which allow fractional ownership, automated interest payments via smart contracts, enhanced liquidity, and easier compliance with securities laws through KYC/AML checks.

What are bonds, and how do they work in crypto? - Cointelegraph - Crypto bonds work through decentralized networks and smart contracts that automate payments and principal repayment, offering potentially higher returns but also higher risk compared to traditional bonds while eliminating intermediaries for more transparent investment tracking.

dowidth.com

dowidth.com