Perpetual futures offer continuous contract trading with no expiration, enabling leveraged exposure to assets such as cryptocurrencies and commodities. Exchange-traded funds (ETFs) provide diversified portfolio access through shares traded on stock exchanges, representing underlying assets like stocks, bonds, or commodities. Explore the differences and benefits of perpetual futures versus ETFs to optimize your investment strategy.

Why it is important

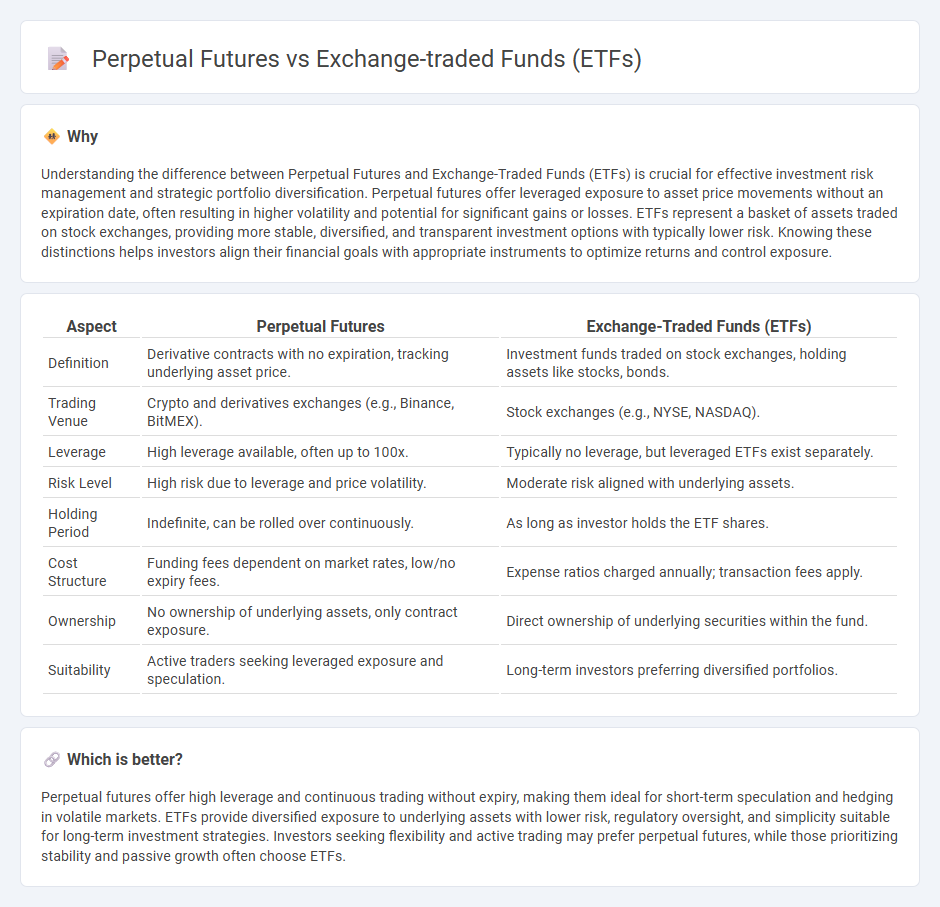

Understanding the difference between Perpetual Futures and Exchange-Traded Funds (ETFs) is crucial for effective investment risk management and strategic portfolio diversification. Perpetual futures offer leveraged exposure to asset price movements without an expiration date, often resulting in higher volatility and potential for significant gains or losses. ETFs represent a basket of assets traded on stock exchanges, providing more stable, diversified, and transparent investment options with typically lower risk. Knowing these distinctions helps investors align their financial goals with appropriate instruments to optimize returns and control exposure.

Comparison Table

| Aspect | Perpetual Futures | Exchange-Traded Funds (ETFs) |

|---|---|---|

| Definition | Derivative contracts with no expiration, tracking underlying asset price. | Investment funds traded on stock exchanges, holding assets like stocks, bonds. |

| Trading Venue | Crypto and derivatives exchanges (e.g., Binance, BitMEX). | Stock exchanges (e.g., NYSE, NASDAQ). |

| Leverage | High leverage available, often up to 100x. | Typically no leverage, but leveraged ETFs exist separately. |

| Risk Level | High risk due to leverage and price volatility. | Moderate risk aligned with underlying assets. |

| Holding Period | Indefinite, can be rolled over continuously. | As long as investor holds the ETF shares. |

| Cost Structure | Funding fees dependent on market rates, low/no expiry fees. | Expense ratios charged annually; transaction fees apply. |

| Ownership | No ownership of underlying assets, only contract exposure. | Direct ownership of underlying securities within the fund. |

| Suitability | Active traders seeking leveraged exposure and speculation. | Long-term investors preferring diversified portfolios. |

Which is better?

Perpetual futures offer high leverage and continuous trading without expiry, making them ideal for short-term speculation and hedging in volatile markets. ETFs provide diversified exposure to underlying assets with lower risk, regulatory oversight, and simplicity suitable for long-term investment strategies. Investors seeking flexibility and active trading may prefer perpetual futures, while those prioritizing stability and passive growth often choose ETFs.

Connection

Perpetual futures and exchange-traded funds (ETFs) are connected through their roles in enabling leveraged exposure to underlying assets in financial markets. Perpetual futures, which have no expiration date, allow traders to speculate or hedge on asset prices continuously, while ETFs provide investors with diversification and liquidity by pooling assets and trading them like stocks. Together, these instruments enhance market efficiency by offering varied strategies for risk management, arbitrage, and portfolio allocation.

Key Terms

Liquidity

Exchange-traded funds (ETFs) typically offer high liquidity through shares traded on established stock exchanges, ensuring transparent pricing and ease of entry and exit for investors. Perpetual futures provide continuous trading opportunities with high leverage, often resulting in even greater liquidity on specialized cryptocurrency or derivatives platforms. Explore the nuances of liquidity in ETFs and perpetual futures to optimize your trading strategy.

Leverage

Exchange-traded funds (ETFs) offer investors leveraged exposure through products like leveraged ETFs, which use financial derivatives to amplify returns by a fixed multiple, typically 2x or 3x, while limiting risk through regulated trading on stock exchanges. Perpetual futures provide more flexible and often higher leverage, sometimes exceeding 100x, enabling traders to amplify positions with lower upfront capital but also increasing the risk of liquidation and price volatility. Explore the intricacies of leverage in ETFs and perpetual futures to optimize your trading strategy and risk management.

Expiry/Settlement

Exchange-traded funds (ETFs) offer continuous market trading without expiration, providing investors with long-term exposure to asset classes through a buy-and-hold approach. Perpetual futures, unlike traditional futures, have no fixed expiry, allowing traders to maintain positions indefinitely while settlement occurs via periodic funding rates to keep contract prices aligned with spot markets. Explore the key differences in risk management and trading strategies between ETFs and perpetual futures to optimize your investment portfolio.

Source and External Links

Exchange-Traded Fund (ETF) - An ETF is an exchange-traded investment product that pools money from many investors to invest in a portfolio of securities and is traded on national exchanges like a stock, offering potential tax efficiency compared to mutual funds.

What is an ETF (Exchange-Traded Fund)? - ETFs combine the flexibility of stocks and diversification of mutual funds, allowing investors to buy and sell shares on exchanges during market hours, generally tracking an index with lower costs and greater tax efficiency.

Exchange-Traded Funds and Products - ETFs are pooled investments holding assets like stocks and bonds, traded on exchanges, with shares issued and redeemed by authorized participants in large blocks, and can be either passively indexed or actively managed funds.

dowidth.com

dowidth.com