Private credit involves non-bank lending by institutional investors to companies, offering tailored financing solutions with higher yields and lower regulatory oversight. Peer-to-peer lending connects individual borrowers directly with investors through online platforms, emphasizing accessibility and smaller loan sizes but carrying higher default risks. Explore the nuances and benefits of private credit and peer-to-peer lending to determine which suits your investment strategy best.

Why it is important

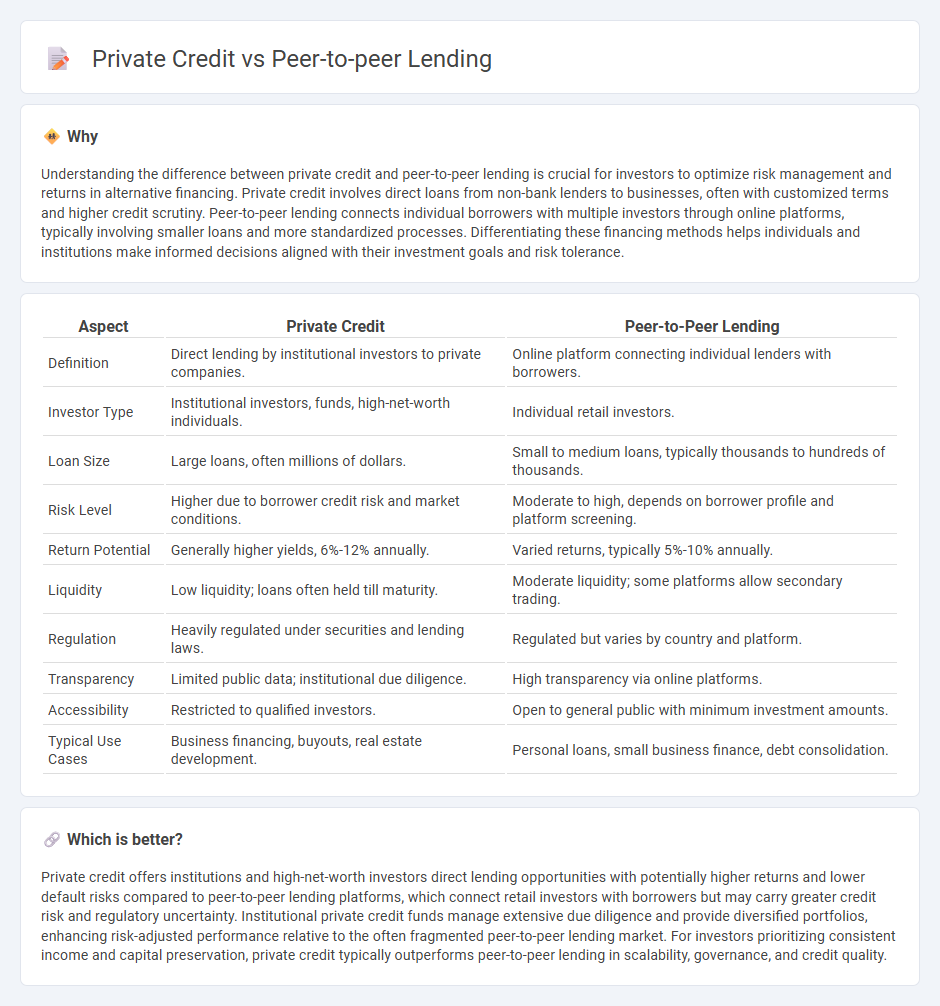

Understanding the difference between private credit and peer-to-peer lending is crucial for investors to optimize risk management and returns in alternative financing. Private credit involves direct loans from non-bank lenders to businesses, often with customized terms and higher credit scrutiny. Peer-to-peer lending connects individual borrowers with multiple investors through online platforms, typically involving smaller loans and more standardized processes. Differentiating these financing methods helps individuals and institutions make informed decisions aligned with their investment goals and risk tolerance.

Comparison Table

| Aspect | Private Credit | Peer-to-Peer Lending |

|---|---|---|

| Definition | Direct lending by institutional investors to private companies. | Online platform connecting individual lenders with borrowers. |

| Investor Type | Institutional investors, funds, high-net-worth individuals. | Individual retail investors. |

| Loan Size | Large loans, often millions of dollars. | Small to medium loans, typically thousands to hundreds of thousands. |

| Risk Level | Higher due to borrower credit risk and market conditions. | Moderate to high, depends on borrower profile and platform screening. |

| Return Potential | Generally higher yields, 6%-12% annually. | Varied returns, typically 5%-10% annually. |

| Liquidity | Low liquidity; loans often held till maturity. | Moderate liquidity; some platforms allow secondary trading. |

| Regulation | Heavily regulated under securities and lending laws. | Regulated but varies by country and platform. |

| Transparency | Limited public data; institutional due diligence. | High transparency via online platforms. |

| Accessibility | Restricted to qualified investors. | Open to general public with minimum investment amounts. |

| Typical Use Cases | Business financing, buyouts, real estate development. | Personal loans, small business finance, debt consolidation. |

Which is better?

Private credit offers institutions and high-net-worth investors direct lending opportunities with potentially higher returns and lower default risks compared to peer-to-peer lending platforms, which connect retail investors with borrowers but may carry greater credit risk and regulatory uncertainty. Institutional private credit funds manage extensive due diligence and provide diversified portfolios, enhancing risk-adjusted performance relative to the often fragmented peer-to-peer lending market. For investors prioritizing consistent income and capital preservation, private credit typically outperforms peer-to-peer lending in scalability, governance, and credit quality.

Connection

Private credit and peer-to-peer lending are connected through their function as alternative financing options outside traditional banking systems, providing direct lending solutions to individuals and businesses. Both methods leverage technology to connect borrowers with private investors, enabling faster access to capital while offering diversified investment opportunities. Growth in private credit markets and peer-to-peer platforms reflects increasing demand for flexible lending models driven by tighter bank regulations and evolving investor preferences.

Key Terms

**Peer-to-Peer Lending:**

Peer-to-peer lending connects individual borrowers directly with investors through online platforms, offering an alternative to traditional banks with typically lower interest rates and faster approval processes. It allows investors to diversify portfolios by funding personal, business, or debt consolidation loans with varying risk levels and returns. Explore our detailed analysis to understand how peer-to-peer lending can enhance your investment strategy and financial options.

Online Platform

Peer-to-peer lending platforms connect individual borrowers with investors through fully digital interfaces, offering streamlined access to personal and small business loans without traditional financial intermediaries. In contrast, private credit managed via online platforms typically involves institutional investors providing bespoke debt solutions to mid-sized companies, emphasizing flexibility and customized risk management. Explore how leading online platforms transform lending landscapes by bridging borrowers and investors efficiently.

Individual Lenders

Individual lenders in peer-to-peer lending platforms connect directly with borrowers, offering a streamlined process and potentially higher returns by bypassing traditional financial intermediaries. Private credit, managed through funds or direct lending institutions, involves less direct interaction, focusing on more structured, larger-scale investments with varied risk profiles. To understand how each option suits your investment goals and risk tolerance, explore detailed comparisons of peer-to-peer lending and private credit opportunities.

Source and External Links

What is Peer-to-Peer Lending & How P2P Loans Work - Peer-to-peer (P2P) lending enables individuals to borrow money directly from individual investors via specialized websites, bypassing banks, often with lower eligibility requirements and flexible repayment terms.

Peer-to-peer lending - Wikipedia - Peer-to-peer lending is an online method where individuals or businesses are matched with lenders through an intermediary platform that handles credit checks, payment processing, and loan servicing, offering both secured and unsecured loans outside traditional financial institutions.

Peer to peer lending: what you need to know - Peer-to-peer lending websites act as marketplaces connecting lenders to borrowers, allowing lenders to earn interest, though it carries more risk than a savings account and offers an alternative to traditional bank loans.

dowidth.com

dowidth.com