Convexity hedging involves managing risks associated with the curvature in the price-yield relationship of bonds, providing protection against large interest rate movements. Delta hedging focuses on neutralizing the price sensitivity of options to small changes in the underlying asset's price, ensuring minimal exposure to directional risk. Explore the differences and strategies behind convexity and delta hedging to enhance your risk management approach.

Why it is important

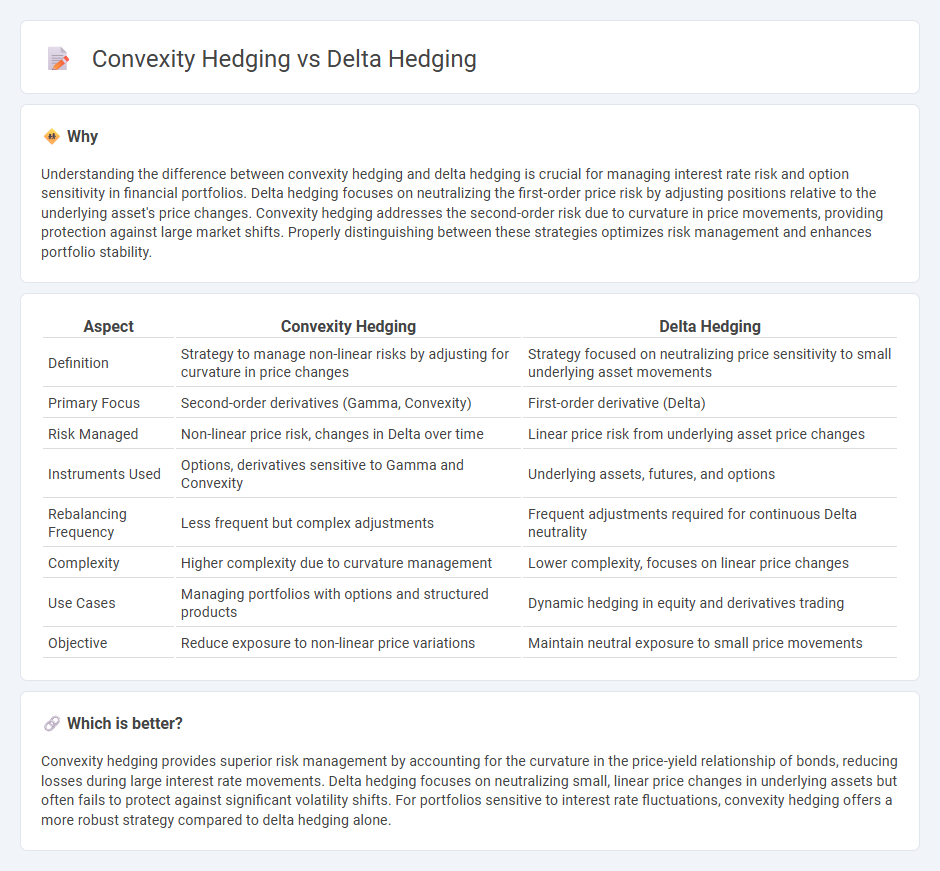

Understanding the difference between convexity hedging and delta hedging is crucial for managing interest rate risk and option sensitivity in financial portfolios. Delta hedging focuses on neutralizing the first-order price risk by adjusting positions relative to the underlying asset's price changes. Convexity hedging addresses the second-order risk due to curvature in price movements, providing protection against large market shifts. Properly distinguishing between these strategies optimizes risk management and enhances portfolio stability.

Comparison Table

| Aspect | Convexity Hedging | Delta Hedging |

|---|---|---|

| Definition | Strategy to manage non-linear risks by adjusting for curvature in price changes | Strategy focused on neutralizing price sensitivity to small underlying asset movements |

| Primary Focus | Second-order derivatives (Gamma, Convexity) | First-order derivative (Delta) |

| Risk Managed | Non-linear price risk, changes in Delta over time | Linear price risk from underlying asset price changes |

| Instruments Used | Options, derivatives sensitive to Gamma and Convexity | Underlying assets, futures, and options |

| Rebalancing Frequency | Less frequent but complex adjustments | Frequent adjustments required for continuous Delta neutrality |

| Complexity | Higher complexity due to curvature management | Lower complexity, focuses on linear price changes |

| Use Cases | Managing portfolios with options and structured products | Dynamic hedging in equity and derivatives trading |

| Objective | Reduce exposure to non-linear price variations | Maintain neutral exposure to small price movements |

Which is better?

Convexity hedging provides superior risk management by accounting for the curvature in the price-yield relationship of bonds, reducing losses during large interest rate movements. Delta hedging focuses on neutralizing small, linear price changes in underlying assets but often fails to protect against significant volatility shifts. For portfolios sensitive to interest rate fluctuations, convexity hedging offers a more robust strategy compared to delta hedging alone.

Connection

Convexity hedging and delta hedging both aim to manage the risks associated with options and fixed-income portfolios by addressing different aspects of price sensitivity. Delta hedging focuses on neutralizing the first-order price changes relative to the underlying asset, while convexity hedging targets the second-order effects or curvature, which become significant in volatile markets. Combining these strategies enhances risk management by minimizing exposure to both linear and nonlinear price fluctuations, optimizing portfolio performance.

Key Terms

Delta

Delta hedging involves adjusting a portfolio to maintain a neutral delta, minimizing risk from small price movements in the underlying asset by balancing positive and negative delta positions. Convexity hedging focuses on managing the curvature (gamma) risk, which becomes important when asset prices experience larger moves, but delta hedging remains the primary tool for day-to-day risk control. Explore more strategies and practical applications to master risk management in financial trading.

Gamma

Delta hedging involves adjusting a portfolio to maintain a neutral exposure to small price movements in the underlying asset, focusing primarily on the first-order derivative, Delta. Convexity hedging, on the other hand, targets the Gamma of the portfolio, which measures the rate of change of Delta and accounts for larger, non-linear price movements in the underlying asset. Understanding the distinctions between Delta and Gamma exposures is crucial for effective risk management; explore more to optimize your hedging strategy.

Convexity

Convexity hedging specifically targets the curvature risk in bond portfolios, addressing the non-linear relationship between bond prices and interest rates, unlike delta hedging which mitigates linear price changes in options portfolios. By adjusting positions to manage convexity, investors can reduce the impact of interest rate volatility and improve portfolio stability in response to large rate movements. Learn more about how convexity hedging enhances fixed income risk management strategies.

Source and External Links

Delta Hedging Explained (Visual Guide w/ Examples) - Delta hedging is a derivatives trading strategy used to balance positive and negative delta so their net effect is zero, reducing directional risk by offsetting positions, such as buying shares to counteract negative delta from options.

Delta Hedging - Overview, How It Works, Pros and Cons - Delta hedging reduces directional risk of an asset's price movements by offsetting the option's delta with opposite positions in the underlying stock or ETFs, aiming for a delta-neutral portfolio that requires frequent rebalancing.

Delta neutral - Delta hedging is the process of maintaining a delta-neutral portfolio, where positive and negative delta components offset each other to make the portfolio's value insensitive to small changes in the underlying asset's price.

dowidth.com

dowidth.com