Liability Driven Investing (LDI) focuses on structuring investment portfolios to match future liabilities, aiming to minimize funding gaps and interest rate risks. Asset-Liability Management (ALM) encompasses a broader risk management strategy that optimizes both assets and liabilities to ensure overall financial stability and liquidity. Explore deeper insights to understand how these approaches optimize financial outcomes.

Why it is important

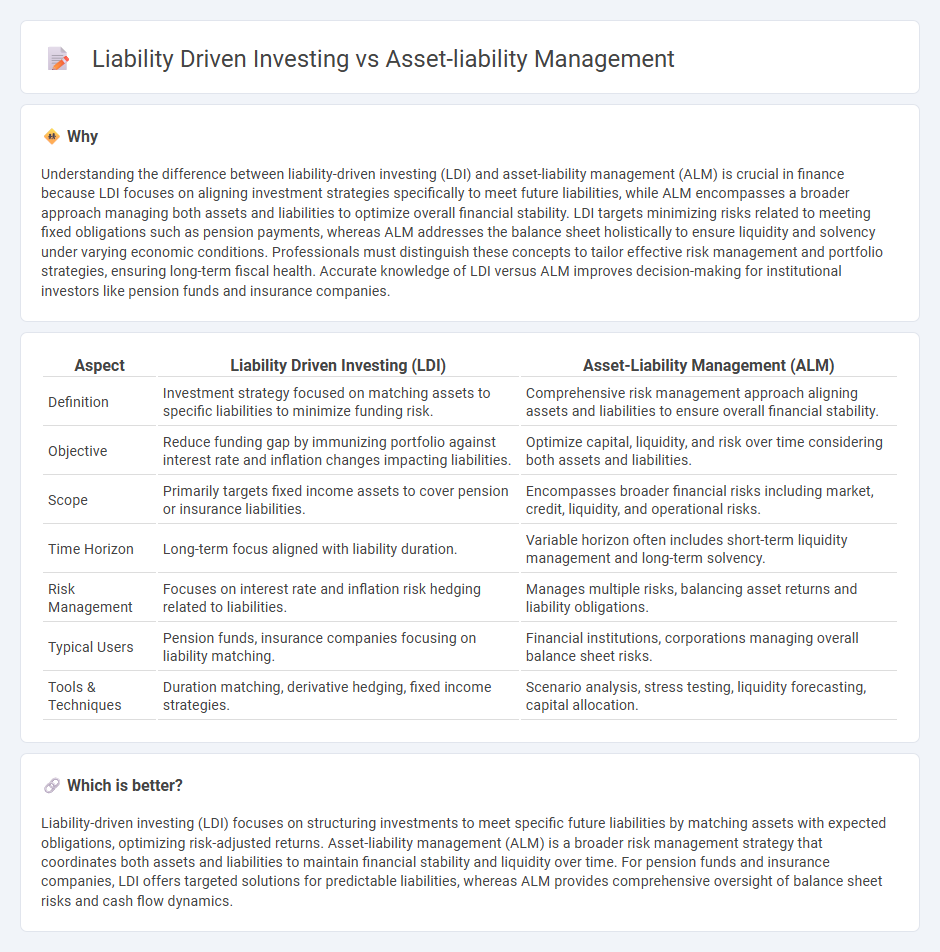

Understanding the difference between liability-driven investing (LDI) and asset-liability management (ALM) is crucial in finance because LDI focuses on aligning investment strategies specifically to meet future liabilities, while ALM encompasses a broader approach managing both assets and liabilities to optimize overall financial stability. LDI targets minimizing risks related to meeting fixed obligations such as pension payments, whereas ALM addresses the balance sheet holistically to ensure liquidity and solvency under varying economic conditions. Professionals must distinguish these concepts to tailor effective risk management and portfolio strategies, ensuring long-term fiscal health. Accurate knowledge of LDI versus ALM improves decision-making for institutional investors like pension funds and insurance companies.

Comparison Table

| Aspect | Liability Driven Investing (LDI) | Asset-Liability Management (ALM) |

|---|---|---|

| Definition | Investment strategy focused on matching assets to specific liabilities to minimize funding risk. | Comprehensive risk management approach aligning assets and liabilities to ensure overall financial stability. |

| Objective | Reduce funding gap by immunizing portfolio against interest rate and inflation changes impacting liabilities. | Optimize capital, liquidity, and risk over time considering both assets and liabilities. |

| Scope | Primarily targets fixed income assets to cover pension or insurance liabilities. | Encompasses broader financial risks including market, credit, liquidity, and operational risks. |

| Time Horizon | Long-term focus aligned with liability duration. | Variable horizon often includes short-term liquidity management and long-term solvency. |

| Risk Management | Focuses on interest rate and inflation risk hedging related to liabilities. | Manages multiple risks, balancing asset returns and liability obligations. |

| Typical Users | Pension funds, insurance companies focusing on liability matching. | Financial institutions, corporations managing overall balance sheet risks. |

| Tools & Techniques | Duration matching, derivative hedging, fixed income strategies. | Scenario analysis, stress testing, liquidity forecasting, capital allocation. |

Which is better?

Liability-driven investing (LDI) focuses on structuring investments to meet specific future liabilities by matching assets with expected obligations, optimizing risk-adjusted returns. Asset-liability management (ALM) is a broader risk management strategy that coordinates both assets and liabilities to maintain financial stability and liquidity over time. For pension funds and insurance companies, LDI offers targeted solutions for predictable liabilities, whereas ALM provides comprehensive oversight of balance sheet risks and cash flow dynamics.

Connection

Liability Driven Investing (LDI) focuses on structuring investment strategies to match the timing and value of liabilities, ensuring that assets sufficiently cover future obligations. Asset-Liability Management (ALM) encompasses a broader risk management framework that aligns asset allocations with liability profiles to optimize financial stability and minimize exposure to interest rate and inflation risks. Both approaches integrate to enhance portfolio resilience by synchronizing cash flows and mitigating funding mismatches in pension funds, insurance companies, and financial institutions.

Key Terms

Asset-Liability Management:

Asset-Liability Management (ALM) involves strategically balancing assets and liabilities to minimize financial risks such as interest rate fluctuations and liquidity shortfalls, primarily used by banks and insurance companies. ALM frameworks optimize cash flow matching and duration alignment to maintain solvency and achieve long-term financial stability. Explore more detailed strategies and risk mitigation techniques in Asset-Liability Management to enhance financial decision-making.

Duration Gap

Asset-liability management (ALM) strategically balances assets and liabilities to control the duration gap, minimizing the risk from interest rate fluctuations by matching asset durations with liability durations. Liability-driven investing (LDI) specifically targets reducing the duration gap by constructing a portfolio that closely replicates the timing and amount of liabilities, ensuring stable funding for obligations. Discover how these approaches optimize financial stability through effective duration gap management.

Liquidity Risk

Asset-liability management (ALM) focuses on balancing assets and liabilities to optimize liquidity risk by ensuring sufficient cash flows to meet obligations. Liability driven investing (LDI) prioritizes structuring investment portfolios that specifically align with liability profiles, minimizing liquidity shortfalls during liability payments. Discover more about how these strategies address liquidity risk to enhance financial stability.

Source and External Links

Asset and Liability Management (ALM) - ALM is a practice used by financial institutions to mitigate financial risks from mismatches of assets and liabilities by strategically managing balance sheet risk, liquidity, and profitability over the long term.

Asset Liability Management (ALM) - CalPERS - ALM is an integrated review process balancing future pension liabilities with investment returns to ensure a sound and sustainable fund through risk analysis of demographic and economic trends.

Asset Liability Management - Financial Services by Oracle - ALM solutions help financial institutions measure and manage interest rate and liquidity risk, profitability, and balance sheet risk exposure by modeling future risk and returns accurately.

dowidth.com

dowidth.com