Tokenized treasury bills represent digital versions of government debt securities, providing investors with secure, blockchain-based access to fixed-income assets. Stablecoins are cryptocurrencies designed to maintain a stable value by pegging to fiat currencies or asset baskets, facilitating seamless digital transactions. Explore the distinctions and benefits of these innovative financial instruments to enhance your investment strategy.

Why it is important

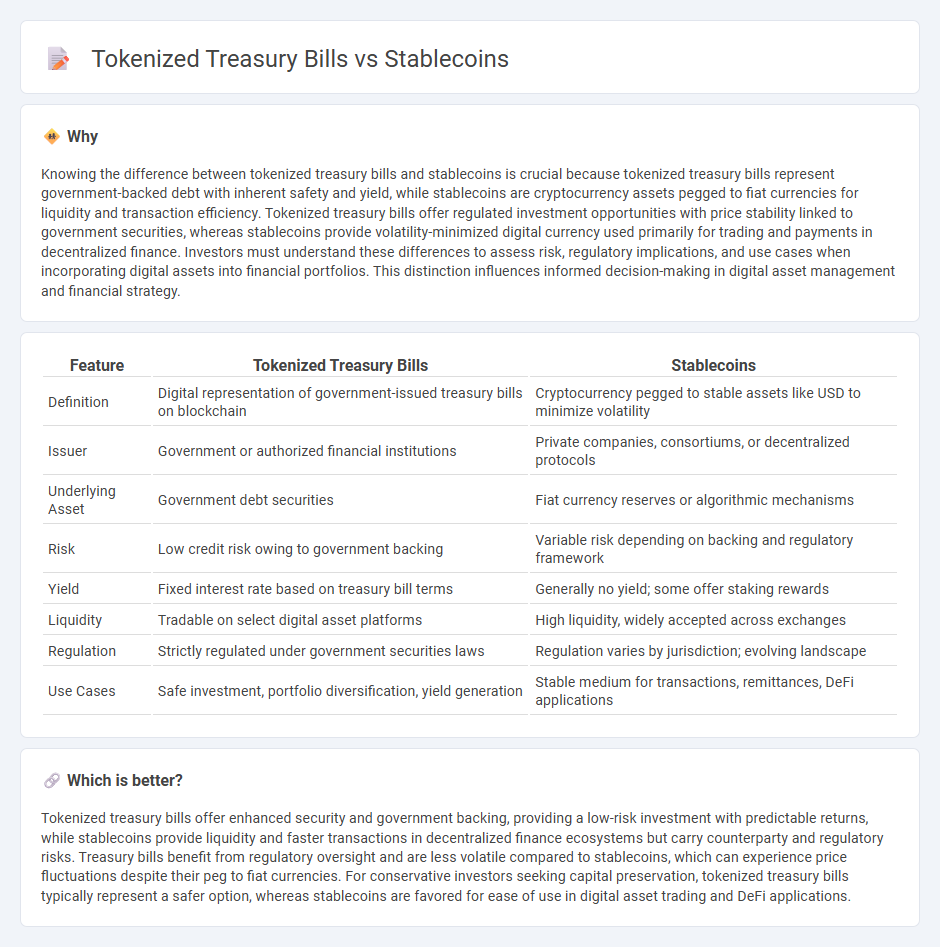

Knowing the difference between tokenized treasury bills and stablecoins is crucial because tokenized treasury bills represent government-backed debt with inherent safety and yield, while stablecoins are cryptocurrency assets pegged to fiat currencies for liquidity and transaction efficiency. Tokenized treasury bills offer regulated investment opportunities with price stability linked to government securities, whereas stablecoins provide volatility-minimized digital currency used primarily for trading and payments in decentralized finance. Investors must understand these differences to assess risk, regulatory implications, and use cases when incorporating digital assets into financial portfolios. This distinction influences informed decision-making in digital asset management and financial strategy.

Comparison Table

| Feature | Tokenized Treasury Bills | Stablecoins |

|---|---|---|

| Definition | Digital representation of government-issued treasury bills on blockchain | Cryptocurrency pegged to stable assets like USD to minimize volatility |

| Issuer | Government or authorized financial institutions | Private companies, consortiums, or decentralized protocols |

| Underlying Asset | Government debt securities | Fiat currency reserves or algorithmic mechanisms |

| Risk | Low credit risk owing to government backing | Variable risk depending on backing and regulatory framework |

| Yield | Fixed interest rate based on treasury bill terms | Generally no yield; some offer staking rewards |

| Liquidity | Tradable on select digital asset platforms | High liquidity, widely accepted across exchanges |

| Regulation | Strictly regulated under government securities laws | Regulation varies by jurisdiction; evolving landscape |

| Use Cases | Safe investment, portfolio diversification, yield generation | Stable medium for transactions, remittances, DeFi applications |

Which is better?

Tokenized treasury bills offer enhanced security and government backing, providing a low-risk investment with predictable returns, while stablecoins provide liquidity and faster transactions in decentralized finance ecosystems but carry counterparty and regulatory risks. Treasury bills benefit from regulatory oversight and are less volatile compared to stablecoins, which can experience price fluctuations despite their peg to fiat currencies. For conservative investors seeking capital preservation, tokenized treasury bills typically represent a safer option, whereas stablecoins are favored for ease of use in digital asset trading and DeFi applications.

Connection

Tokenized treasury bills represent traditional government debt in a digital asset form, allowing for increased liquidity and fractional ownership on blockchain platforms. Stablecoins, pegged to stable assets like fiat currencies or government securities, often use tokenized treasury bills as reserves to maintain their price stability and trustworthiness. This connection enhances the integration of traditional finance with decentralized finance (DeFi), providing secure, transparent, and efficient financial instruments.

Key Terms

Collateralization

Stablecoins are typically collateralized by reserves such as fiat currencies, cryptocurrencies, or commodities to maintain price stability, while tokenized treasury bills represent ownership of government debt instruments backed by the full faith and credit of the issuing government. Collateralization in stablecoins can vary from fully backed (e.g., USDC) to algorithmic models without direct asset backing, whereas tokenized treasury bills rely solely on the underlying government security as collateral. Explore how these fundamental differences impact risk, liquidity, and regulatory oversight to better understand their roles in digital finance.

Yield

Stablecoins offer predictable returns by maintaining a fixed value, often backed by fiat reserves, resulting in low yield but high stability. Tokenized treasury bills provide exposure to government debt with yields reflecting current interest rates, typically offering higher returns than stablecoins while retaining liquidity. Explore the nuanced differences between these digital assets and maximize your portfolio's yield potential.

Price Stability

Stablecoins maintain price stability by pegging their value to fiat currencies like the US dollar, using mechanisms such as collateralization or algorithmic supply adjustments. Tokenized treasury bills derive stability from the underlying government debt instruments, offering low volatility driven by sovereign creditworthiness and short maturities. Explore the nuances of these digital assets to understand their unique approaches to price stability.

Source and External Links

What is a stablecoin? - Coinbase - Stablecoins are cryptocurrencies pegged to stable assets like fiat currencies or gold to maintain a stable price, providing an alternative to volatile cryptocurrencies for everyday transactions and blockchain financial services.

Stablecoin - Wikipedia - Stablecoins are cryptocurrencies pegged to reference assets such as fiat money or commodities, aiming to maintain stable value, but in practice face challenges with reserve adequacy and price stability.

What are stablecoins, and how are they regulated? | Brookings - Stablecoins are digital tokens pegged to assets like the U.S. dollar, operating on blockchain networks with varying issuance models, where some rely on trust in centralized issuers and others employ decentralized governance.

dowidth.com

dowidth.com