Tax loss harvesting involves strategically selling investments at a loss to offset capital gains and reduce taxable income, enhancing overall portfolio efficiency. Roth conversions allow individuals to transfer funds from traditional retirement accounts to Roth IRAs, paying taxes now to benefit from tax-free withdrawals later. Explore the differences between these strategies to optimize your tax planning and retirement goals.

Why it is important

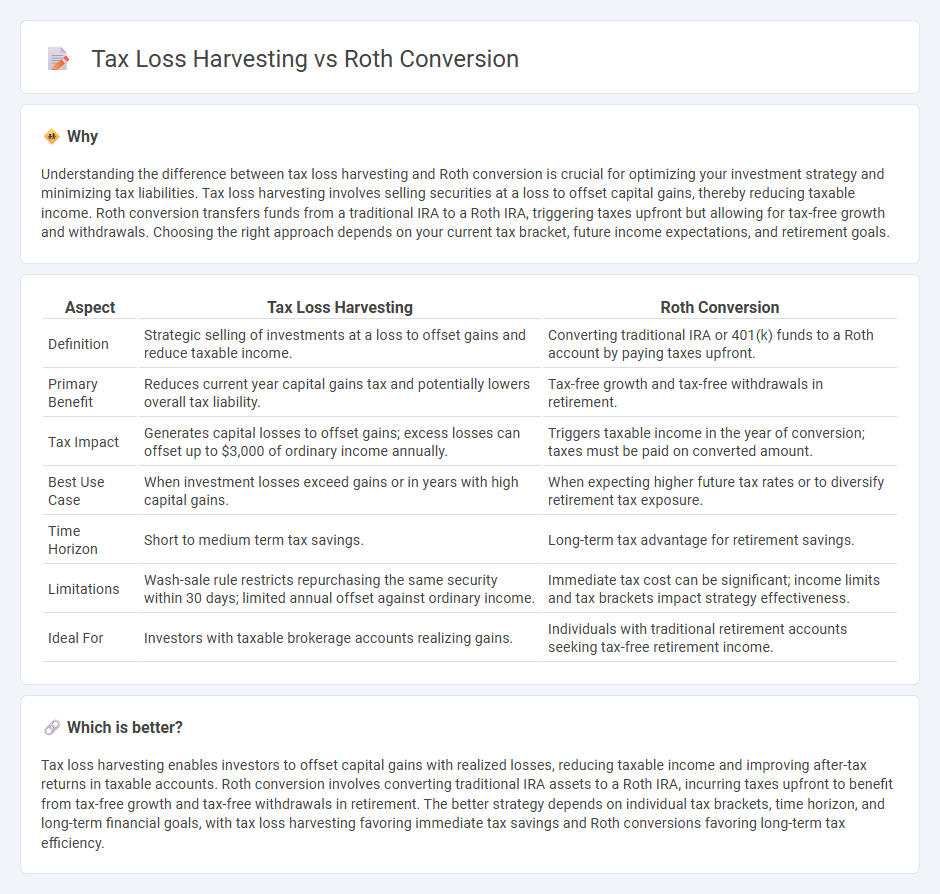

Understanding the difference between tax loss harvesting and Roth conversion is crucial for optimizing your investment strategy and minimizing tax liabilities. Tax loss harvesting involves selling securities at a loss to offset capital gains, thereby reducing taxable income. Roth conversion transfers funds from a traditional IRA to a Roth IRA, triggering taxes upfront but allowing for tax-free growth and withdrawals. Choosing the right approach depends on your current tax bracket, future income expectations, and retirement goals.

Comparison Table

| Aspect | Tax Loss Harvesting | Roth Conversion |

|---|---|---|

| Definition | Strategic selling of investments at a loss to offset gains and reduce taxable income. | Converting traditional IRA or 401(k) funds to a Roth account by paying taxes upfront. |

| Primary Benefit | Reduces current year capital gains tax and potentially lowers overall tax liability. | Tax-free growth and tax-free withdrawals in retirement. |

| Tax Impact | Generates capital losses to offset gains; excess losses can offset up to $3,000 of ordinary income annually. | Triggers taxable income in the year of conversion; taxes must be paid on converted amount. |

| Best Use Case | When investment losses exceed gains or in years with high capital gains. | When expecting higher future tax rates or to diversify retirement tax exposure. |

| Time Horizon | Short to medium term tax savings. | Long-term tax advantage for retirement savings. |

| Limitations | Wash-sale rule restricts repurchasing the same security within 30 days; limited annual offset against ordinary income. | Immediate tax cost can be significant; income limits and tax brackets impact strategy effectiveness. |

| Ideal For | Investors with taxable brokerage accounts realizing gains. | Individuals with traditional retirement accounts seeking tax-free retirement income. |

Which is better?

Tax loss harvesting enables investors to offset capital gains with realized losses, reducing taxable income and improving after-tax returns in taxable accounts. Roth conversion involves converting traditional IRA assets to a Roth IRA, incurring taxes upfront to benefit from tax-free growth and tax-free withdrawals in retirement. The better strategy depends on individual tax brackets, time horizon, and long-term financial goals, with tax loss harvesting favoring immediate tax savings and Roth conversions favoring long-term tax efficiency.

Connection

Tax loss harvesting allows investors to offset capital gains by strategically selling securities at a loss, reducing taxable income. This strategy can enhance the effectiveness of a Roth conversion by minimizing the tax impact when transferring funds from a traditional IRA to a Roth IRA. Coordinating these techniques enables investors to optimize tax efficiency and maximize long-term retirement savings.

Key Terms

Taxable Income

Roth conversion reduces taxable income in retirement by shifting funds to a tax-free growth account, while tax loss harvesting lowers current taxable income by offsetting gains with losses. Strategically balancing Roth conversions and tax loss harvesting can optimize overall tax liability across both current and future tax years. Explore detailed strategies to effectively manage your taxable income through these methods.

Capital Gains/Losses

Roth conversion involves paying taxes on pre-tax retirement funds now to enable tax-free withdrawals later, potentially triggering significant capital gains taxes in the conversion year. Tax loss harvesting strategically sells investments at a loss to offset capital gains, reducing current tax liability without immediate tax outlay. Explore detailed strategies on managing capital gains and optimizing tax impacts through Roth conversions and tax loss harvesting.

Tax Deferral

A Roth conversion involves paying taxes upfront on traditional IRA funds to allow tax-free growth and withdrawals, optimizing long-term tax deferral benefits. Tax loss harvesting strategically sells securities at a loss to offset capital gains, thereby reducing current tax liability and deferring taxes on investment gains. Explore how Roth conversions and tax loss harvesting can be tailored to your financial strategy for maximum tax efficiency.

Source and External Links

Roth IRA Conversion Rules and FAQ - A Roth conversion is moving assets from a Traditional IRA or similar employer-sponsored retirement plans to a Roth IRA, paying ordinary income tax on the converted amount but avoiding the 10% early withdrawal penalty, with benefits including tax-free earnings withdrawals after five years and no required minimum distributions during your lifetime.

Is a Roth IRA conversion right for you? - Vanguard - Roth conversions can be done from various pre-tax retirement accounts like traditional IRAs, 401(k)s, or SEP IRAs, requiring paying income taxes on the converted amounts, with some specific rules such as a 2-year waiting period for SIMPLE IRAs and limitations on 529 plan rollovers.

Why Should You Consider a Roth IRA Conversion? - A Roth conversion allows converting traditional IRA funds to a Roth IRA at any income level, and it is often recommended to do so over several years to manage taxes; taxes from conversion should ideally be paid from outside IRA funds to preserve tax-free growth potential.

dowidth.com

dowidth.com