Crowdlending allows businesses to obtain funds directly from multiple individual investors through online platforms, offering flexible financing without traditional bank involvement. Lease financing provides companies with the option to acquire assets by paying periodic lease rentals instead of upfront capital expenditure, preserving cash flow and offering potential tax benefits. Explore the advantages and differences between crowdlending and lease financing to identify the optimal funding solution for your business.

Why it is important

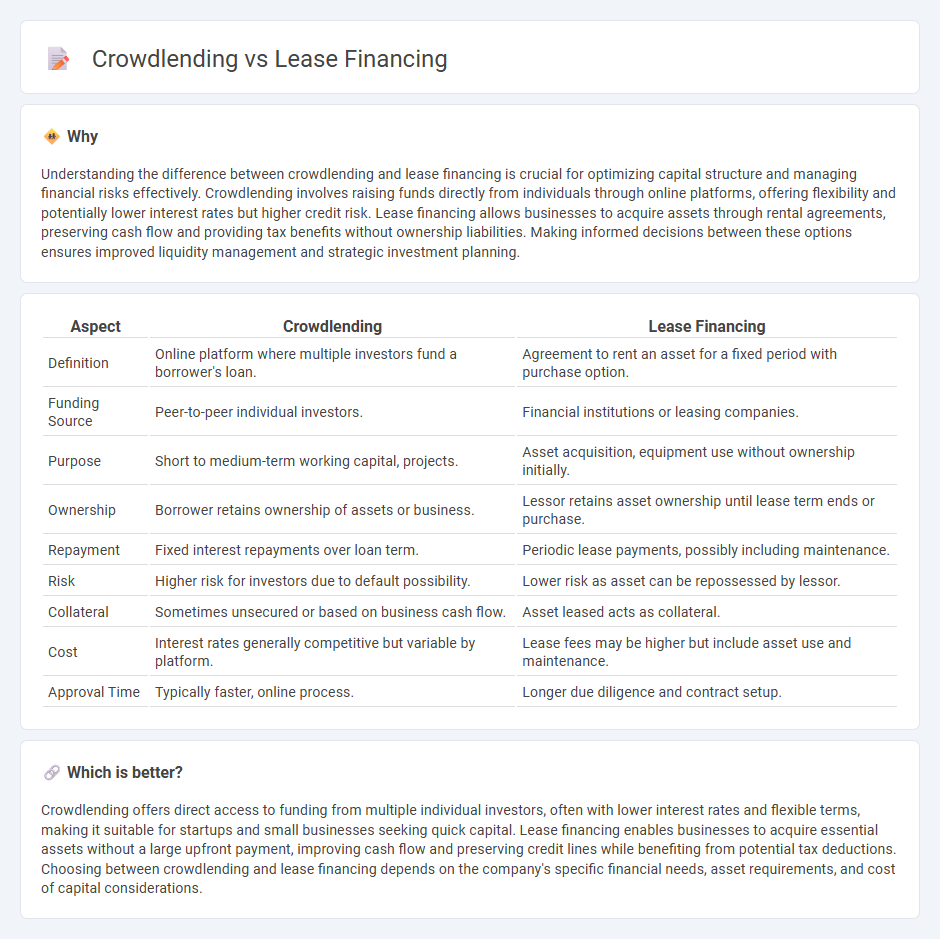

Understanding the difference between crowdlending and lease financing is crucial for optimizing capital structure and managing financial risks effectively. Crowdlending involves raising funds directly from individuals through online platforms, offering flexibility and potentially lower interest rates but higher credit risk. Lease financing allows businesses to acquire assets through rental agreements, preserving cash flow and providing tax benefits without ownership liabilities. Making informed decisions between these options ensures improved liquidity management and strategic investment planning.

Comparison Table

| Aspect | Crowdlending | Lease Financing |

|---|---|---|

| Definition | Online platform where multiple investors fund a borrower's loan. | Agreement to rent an asset for a fixed period with purchase option. |

| Funding Source | Peer-to-peer individual investors. | Financial institutions or leasing companies. |

| Purpose | Short to medium-term working capital, projects. | Asset acquisition, equipment use without ownership initially. |

| Ownership | Borrower retains ownership of assets or business. | Lessor retains asset ownership until lease term ends or purchase. |

| Repayment | Fixed interest repayments over loan term. | Periodic lease payments, possibly including maintenance. |

| Risk | Higher risk for investors due to default possibility. | Lower risk as asset can be repossessed by lessor. |

| Collateral | Sometimes unsecured or based on business cash flow. | Asset leased acts as collateral. |

| Cost | Interest rates generally competitive but variable by platform. | Lease fees may be higher but include asset use and maintenance. |

| Approval Time | Typically faster, online process. | Longer due diligence and contract setup. |

Which is better?

Crowdlending offers direct access to funding from multiple individual investors, often with lower interest rates and flexible terms, making it suitable for startups and small businesses seeking quick capital. Lease financing enables businesses to acquire essential assets without a large upfront payment, improving cash flow and preserving credit lines while benefiting from potential tax deductions. Choosing between crowdlending and lease financing depends on the company's specific financial needs, asset requirements, and cost of capital considerations.

Connection

Crowdlending and lease financing intersect through their roles in alternative funding for businesses seeking capital without traditional bank loans. Crowdlending, by enabling multiple investors to fund a business loan, complements lease financing by providing the upfront capital required for acquiring equipment or assets through leasing arrangements. Both mechanisms enhance cash flow management and support asset acquisition strategies in financial planning.

Key Terms

Asset Ownership

Lease financing allows businesses to use assets without owning them, providing operational flexibility and preserving capital. Crowdlending involves raising funds from multiple investors while the borrower retains full asset ownership and control. Explore more to understand which financing option aligns best with your asset management strategy.

Interest Rate

Lease financing typically involves fixed interest rates determined by the leasing company, often resulting in predictable monthly payments. Crowdlending interest rates can vary widely based on the borrower's credit profile and market demand, sometimes offering lower rates but with greater risk exposure. Explore the nuances of both financing options to determine which interest rate structure aligns best with your financial goals.

Investor Pool

Lease financing typically involves a small group of institutional investors or banks providing capital directly to businesses, ensuring a controlled and stable investor pool. Crowdlending opens access to a diverse range of individual investors, often leading to a broader but less predictable funding base. Explore the distinctions in investor engagement and risk profiles to choose the best fit for your investment strategy.

Source and External Links

Lease Financing : Meaning, Advantages and Disadvantages - Lease financing is a financing method where the owner (lessor) grants use of an asset to another party (lessee) for periodic payments, with ownership retained by the lessor or optionally transferred to the lessee after the lease period.

Finance lease - Wikipedia - A finance lease is a commercial arrangement where the lessee uses an asset purchased by the lessor, pays rentals, and usually has the option to acquire ownership at lease end, transferring economic risks and rewards to the lessee.

Lease financing: What is it? | Credibly - Lease financing allows businesses to use assets without a large upfront investment, spreading out costs with fixed terms and preserving ownership without equity dilution.

dowidth.com

dowidth.com