Retail algorithmic trading employs computer algorithms to execute trades at high speed, optimizing order placement and timing based on predefined criteria. Order flow trading focuses on analyzing the real-time flow of buy and sell orders to predict price movements and market sentiment. Explore the nuances and strategies behind each approach to enhance your trading insights.

Why it is important

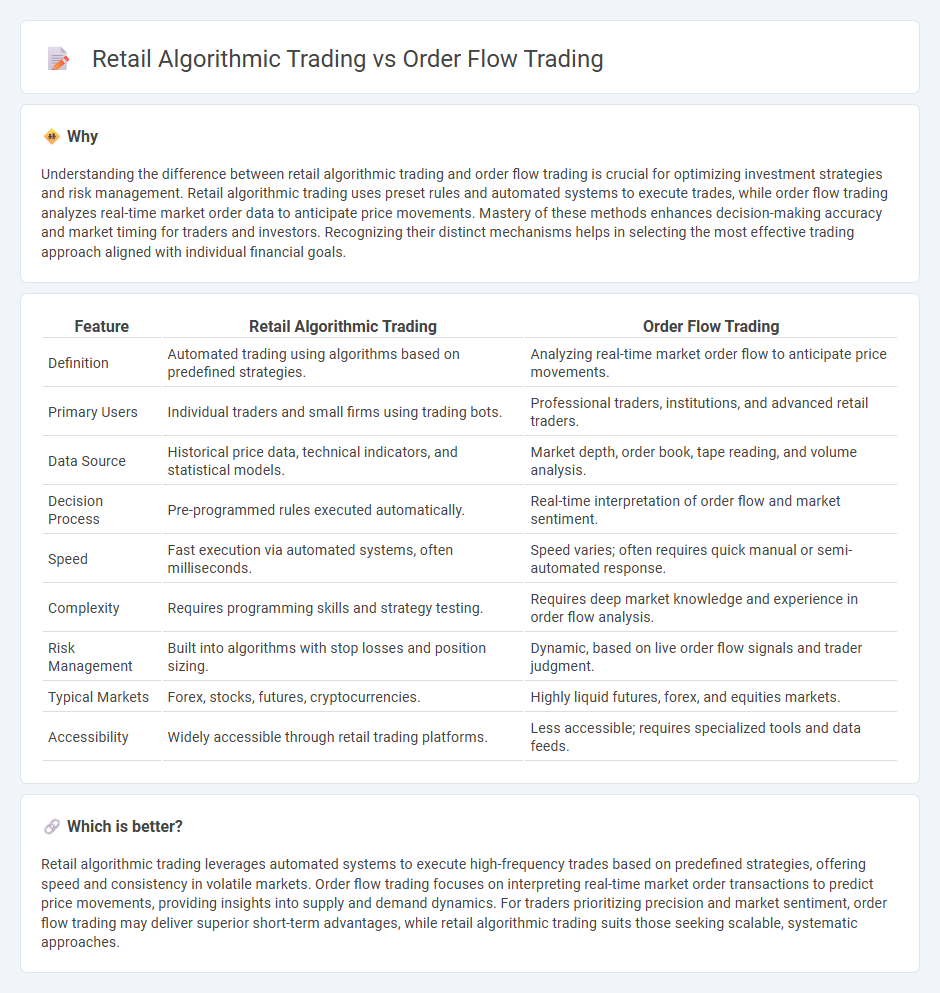

Understanding the difference between retail algorithmic trading and order flow trading is crucial for optimizing investment strategies and risk management. Retail algorithmic trading uses preset rules and automated systems to execute trades, while order flow trading analyzes real-time market order data to anticipate price movements. Mastery of these methods enhances decision-making accuracy and market timing for traders and investors. Recognizing their distinct mechanisms helps in selecting the most effective trading approach aligned with individual financial goals.

Comparison Table

| Feature | Retail Algorithmic Trading | Order Flow Trading |

|---|---|---|

| Definition | Automated trading using algorithms based on predefined strategies. | Analyzing real-time market order flow to anticipate price movements. |

| Primary Users | Individual traders and small firms using trading bots. | Professional traders, institutions, and advanced retail traders. |

| Data Source | Historical price data, technical indicators, and statistical models. | Market depth, order book, tape reading, and volume analysis. |

| Decision Process | Pre-programmed rules executed automatically. | Real-time interpretation of order flow and market sentiment. |

| Speed | Fast execution via automated systems, often milliseconds. | Speed varies; often requires quick manual or semi-automated response. |

| Complexity | Requires programming skills and strategy testing. | Requires deep market knowledge and experience in order flow analysis. |

| Risk Management | Built into algorithms with stop losses and position sizing. | Dynamic, based on live order flow signals and trader judgment. |

| Typical Markets | Forex, stocks, futures, cryptocurrencies. | Highly liquid futures, forex, and equities markets. |

| Accessibility | Widely accessible through retail trading platforms. | Less accessible; requires specialized tools and data feeds. |

Which is better?

Retail algorithmic trading leverages automated systems to execute high-frequency trades based on predefined strategies, offering speed and consistency in volatile markets. Order flow trading focuses on interpreting real-time market order transactions to predict price movements, providing insights into supply and demand dynamics. For traders prioritizing precision and market sentiment, order flow trading may deliver superior short-term advantages, while retail algorithmic trading suits those seeking scalable, systematic approaches.

Connection

Retail algorithmic trading leverages automated systems to execute trades based on pre-set criteria, directly influencing order flow by generating a high volume of granular transactions. Order flow trading analyzes the real-time buying and selling activity, allowing traders to anticipate market movements and optimize trade execution. The connection lies in how retail algorithms contribute to and respond to order flow dynamics, enhancing market liquidity and price discovery.

Key Terms

**Order Flow Trading:**

Order flow trading centers on analyzing real-time market transactions to gauge supply and demand dynamics, enabling traders to anticipate price movements more precisely than traditional methods. It utilizes data such as bid-ask spreads, executed trades, and order book depth to identify short-term market imbalances and liquidity shifts. Discover how mastering order flow trading can enhance decision-making and improve trading performance in volatile markets.

Liquidity

Order flow trading centers on real-time analysis of market liquidity by interpreting the actual buy and sell orders to anticipate price movements, providing traders with dynamic insights into market depth and order book imbalances. Retail algorithmic trading often relies on pre-set quantitative models or historical data patterns, which may not capture immediate liquidity fluctuations as effectively as order flow methods. Explore the nuances of liquidity impact in both strategies to enhance your trading performance.

Market Depth

Order flow trading analyzes real-time Market Depth to capture liquidity imbalances and anticipate price movements by reading the bid and ask volumes at various price levels. Retail algorithmic trading often relies on predefined strategies and technical indicators, which may overlook nuanced Market Depth data crucial for understanding supply and demand dynamics. Explore deeper insights into how Market Depth influences trading outcomes for both approaches.

Source and External Links

Technical Analysis vs. Order Flow: Techniques and Tools for Traders - Order flow trading involves analyzing the real-time buy and sell orders' size and aggressiveness to predict price movements, using techniques like reading the order book and volume analysis to identify support/resistance zones.

Lesson 1 - The Basics of Order Flow - Jigsaw Trading - Order flow trading is based on understanding how market orders hit and remove limit orders at bid and ask prices, causing price movements through buying and selling pressure.

Order Flow Trading & Volumetric Bars | NinjaTrader - Order flow trading uses tools like volumetric bars, volume profile, and cumulative delta to visualize buying and selling pressure, helping traders confirm trends and identify key price levels in real time.

dowidth.com

dowidth.com