Trader funding programs offer capital to skilled traders, allowing them to access significant trading funds without risking personal money, typically involving performance-based profit sharing. Crowdfunding platforms enable multiple investors to pool resources and fund projects or businesses, spreading risk among participants while promoting diverse investment opportunities. Explore the key differences and benefits of each approach to enhance your financial strategy.

Why it is important

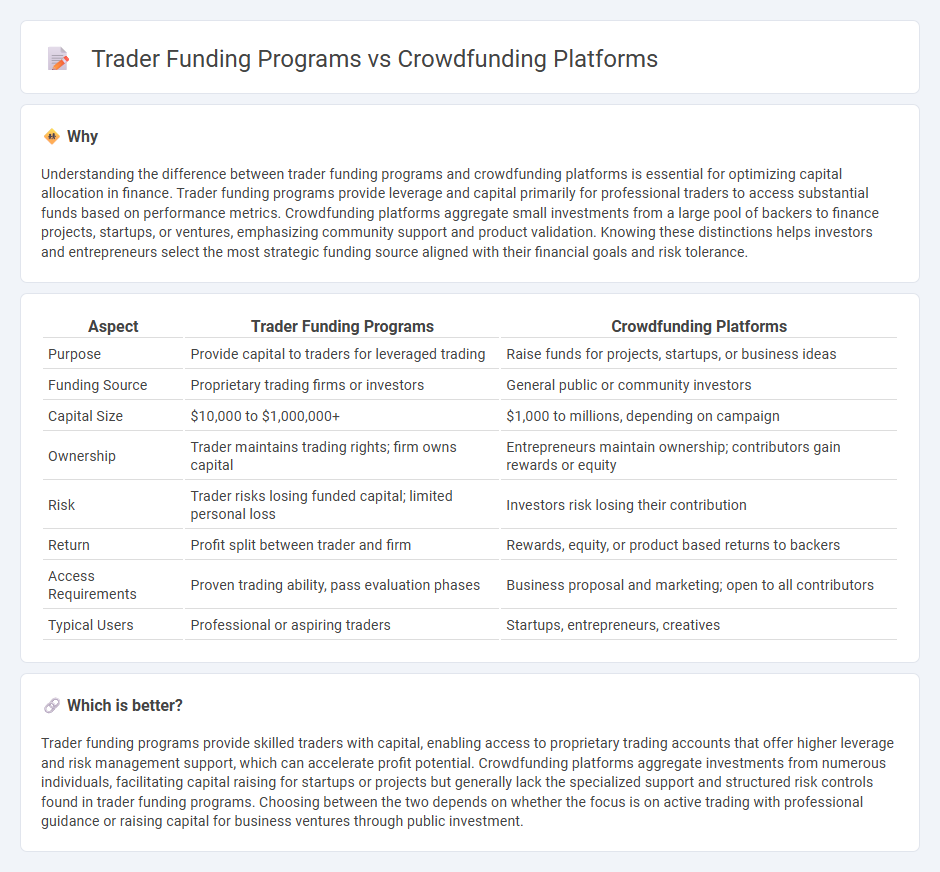

Understanding the difference between trader funding programs and crowdfunding platforms is essential for optimizing capital allocation in finance. Trader funding programs provide leverage and capital primarily for professional traders to access substantial funds based on performance metrics. Crowdfunding platforms aggregate small investments from a large pool of backers to finance projects, startups, or ventures, emphasizing community support and product validation. Knowing these distinctions helps investors and entrepreneurs select the most strategic funding source aligned with their financial goals and risk tolerance.

Comparison Table

| Aspect | Trader Funding Programs | Crowdfunding Platforms |

|---|---|---|

| Purpose | Provide capital to traders for leveraged trading | Raise funds for projects, startups, or business ideas |

| Funding Source | Proprietary trading firms or investors | General public or community investors |

| Capital Size | $10,000 to $1,000,000+ | $1,000 to millions, depending on campaign |

| Ownership | Trader maintains trading rights; firm owns capital | Entrepreneurs maintain ownership; contributors gain rewards or equity |

| Risk | Trader risks losing funded capital; limited personal loss | Investors risk losing their contribution |

| Return | Profit split between trader and firm | Rewards, equity, or product based returns to backers |

| Access Requirements | Proven trading ability, pass evaluation phases | Business proposal and marketing; open to all contributors |

| Typical Users | Professional or aspiring traders | Startups, entrepreneurs, creatives |

Which is better?

Trader funding programs provide skilled traders with capital, enabling access to proprietary trading accounts that offer higher leverage and risk management support, which can accelerate profit potential. Crowdfunding platforms aggregate investments from numerous individuals, facilitating capital raising for startups or projects but generally lack the specialized support and structured risk controls found in trader funding programs. Choosing between the two depends on whether the focus is on active trading with professional guidance or raising capital for business ventures through public investment.

Connection

Trader funding programs and crowdfunding platforms are connected through their shared goal of providing capital to traders without requiring upfront personal investment. These programs leverage crowd-sourced funds to pool resources from multiple investors, allowing traders to access substantial trading capital while distributing risk. The synergy between trader funding and crowdfunding enhances liquidity and democratizes access to financial markets for independent traders.

Key Terms

**Crowdfunding Platforms:**

Crowdfunding platforms enable entrepreneurs and startups to raise capital by pooling small investments from a large number of individuals, often through multimedia campaigns and social sharing, which enhances market visibility and customer engagement. These platforms typically offer flexible funding models such as all-or-nothing or keep-it-all, attracting diverse investors while minimizing upfront financing risks. Explore the most effective crowdfunding strategies and top platforms to maximize your fundraising success.

Equity

Crowdfunding platforms enable startups to raise equity capital from a broad base of individual investors, often providing access to diverse funding sources and market validation. Trader funding programs typically offer capital to experienced traders in exchange for a share of profits, focusing on financial performance rather than equity ownership. Explore the key differences and strategic advantages of each funding model to determine the best fit for your business or investment goals.

Backers

Crowdfunding platforms empower backers by offering direct investment opportunities in innovative projects with potential high returns, fostering community engagement and transparency. Trader funding programs, however, provide backers with exposure to financial trading strategies managed by professionals, combining risk management with profit-sharing models. Explore the distinct benefits and risks each funding approach presents to backers to make informed investment decisions.

Source and External Links

10 Best Crowdfunding Sites and Platforms in 2025 - Lists top crowdfunding platforms like Kickstarter and Indiegogo, highlighting Indiegogo's flexible funding options, fees, and suitability for various projects.

How to Choose the Best Crowdfunding Website for Your ... - Focuses on GoFundMe as a leading platform for personal and nonprofit fundraising, noting its free start and low fees, and offers specialized options for nonprofits.

Top 10 US Crowdfunding Platforms (Reward and Equity) - Provides an overview of major US platforms including Kickstarter, Indiegogo, and Patreon, comparing their fees, funding models, and success rates.

dowidth.com

dowidth.com