Tax loss harvesting involves strategically selling investments at a loss to offset capital gains and reduce taxable income, optimizing overall tax liability. Tax bracket management focuses on timing income and deductions to stay within a lower tax bracket and minimize tax payments over time. Explore these strategies further to enhance your financial planning and tax efficiency.

Why it is important

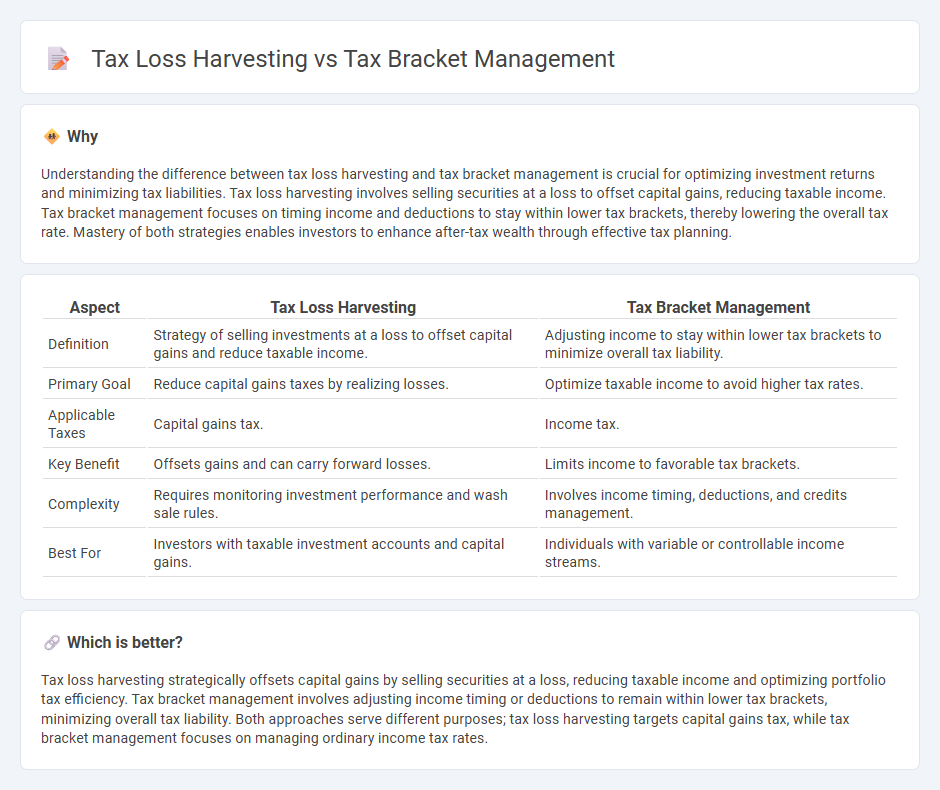

Understanding the difference between tax loss harvesting and tax bracket management is crucial for optimizing investment returns and minimizing tax liabilities. Tax loss harvesting involves selling securities at a loss to offset capital gains, reducing taxable income. Tax bracket management focuses on timing income and deductions to stay within lower tax brackets, thereby lowering the overall tax rate. Mastery of both strategies enables investors to enhance after-tax wealth through effective tax planning.

Comparison Table

| Aspect | Tax Loss Harvesting | Tax Bracket Management |

|---|---|---|

| Definition | Strategy of selling investments at a loss to offset capital gains and reduce taxable income. | Adjusting income to stay within lower tax brackets to minimize overall tax liability. |

| Primary Goal | Reduce capital gains taxes by realizing losses. | Optimize taxable income to avoid higher tax rates. |

| Applicable Taxes | Capital gains tax. | Income tax. |

| Key Benefit | Offsets gains and can carry forward losses. | Limits income to favorable tax brackets. |

| Complexity | Requires monitoring investment performance and wash sale rules. | Involves income timing, deductions, and credits management. |

| Best For | Investors with taxable investment accounts and capital gains. | Individuals with variable or controllable income streams. |

Which is better?

Tax loss harvesting strategically offsets capital gains by selling securities at a loss, reducing taxable income and optimizing portfolio tax efficiency. Tax bracket management involves adjusting income timing or deductions to remain within lower tax brackets, minimizing overall tax liability. Both approaches serve different purposes; tax loss harvesting targets capital gains tax, while tax bracket management focuses on managing ordinary income tax rates.

Connection

Tax loss harvesting strategically realizes investment losses to offset capital gains, directly impacting taxable income and influencing an investor's tax bracket. Effective tax bracket management uses this reduction in taxable income to keep investors in lower tax brackets, minimizing overall tax liability. Combining these techniques maximizes after-tax returns by aligning investment decisions with personalized tax strategies.

Key Terms

**Tax Bracket Management:**

Tax bracket management strategically involves adjusting income and deductions to remain within a desired tax bracket, minimizing tax liability by preventing income from pushing you into a higher bracket. This approach optimizes tax efficiency through careful planning of salary, investments, and retirement contributions to balance taxable income. Discover how mastering tax bracket management can enhance your financial strategy and reduce your overall tax burden.

Marginal Tax Rate

Tax bracket management involves strategically timing income and deductions to avoid moving into a higher marginal tax rate, thereby minimizing tax liability on additional income. Tax loss harvesting focuses on selling investments at a loss to offset capital gains and reduce taxable income within the current marginal tax bracket. Explore more to understand how optimizing these strategies can enhance your overall tax efficiency.

Income Shifting

Tax bracket management involves strategically timing income to remain within lower tax brackets, reducing overall taxable income and tax liability, while tax loss harvesting focuses on offsetting capital gains by selling investments at a loss. Income shifting, a key tactic in tax bracket management, allows taxpayers to transfer income to family members in lower tax brackets, optimizing tax efficiency. Explore more about effective income shifting strategies to enhance your tax planning.

Source and External Links

Tax Bracket Management - Schwab Center for Financial Research - Tax bracket management involves smoothing annual earnings to reduce long-term taxes by using strategies like Roth conversions, tax-loss/gain harvesting, retirement account contributions, and charitable giving to take advantage of lower rates now versus potentially higher rates later.

Tax Bracket Management - Aldrich Advisors - This strategy reduces taxes in high-income years by realizing additional income in lower-income years, often through deferral, and requires careful planning to avoid higher future taxes.

Mastering Tax Bracket Management - Exit Planning Exchange - Tax bracket management uses tax rate arbitrage to shift income between years, helping retirees, business owners, and others with fluctuating income minimize their tax burden by avoiding spikes into higher brackets.

dowidth.com

dowidth.com