Tokenization transforms assets into digital tokens on a blockchain, enhancing liquidity and fractional ownership, while bilateral transfers involve direct asset exchanges between two parties without intermediary platforms. Tokenization offers increased transparency, security, and efficiency compared to traditional bilateral transfers that often rely on complex intermediaries. Explore more to understand the detailed benefits and applications of tokenization versus bilateral transfer in modern finance.

Why it is important

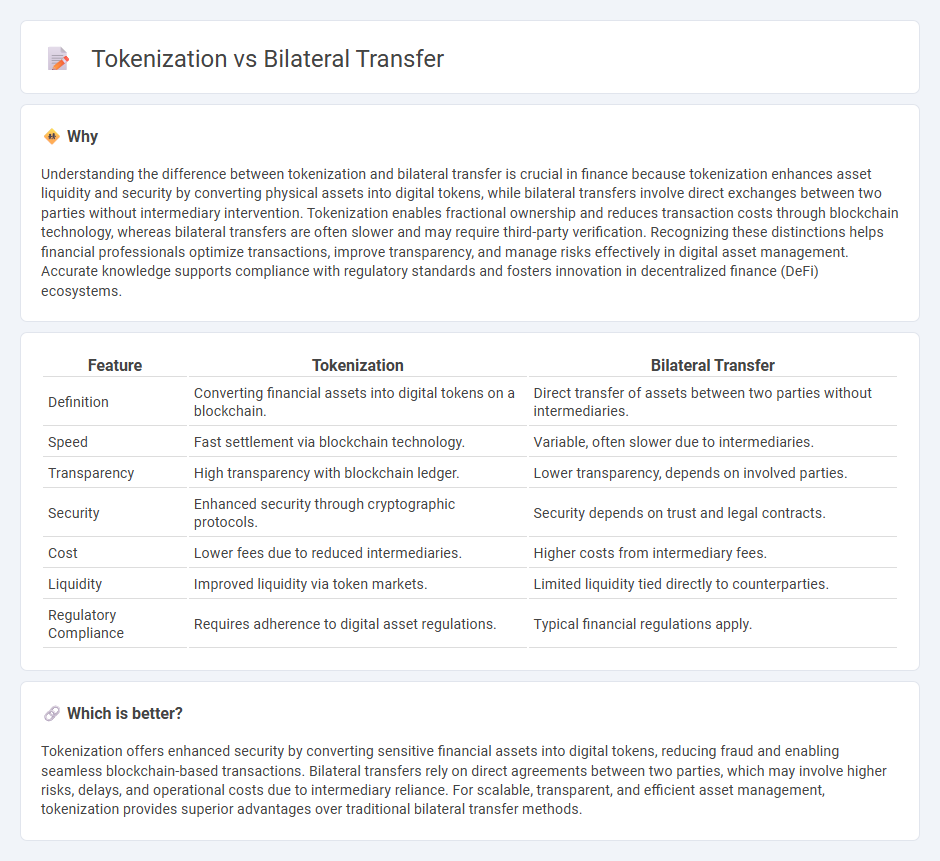

Understanding the difference between tokenization and bilateral transfer is crucial in finance because tokenization enhances asset liquidity and security by converting physical assets into digital tokens, while bilateral transfers involve direct exchanges between two parties without intermediary intervention. Tokenization enables fractional ownership and reduces transaction costs through blockchain technology, whereas bilateral transfers are often slower and may require third-party verification. Recognizing these distinctions helps financial professionals optimize transactions, improve transparency, and manage risks effectively in digital asset management. Accurate knowledge supports compliance with regulatory standards and fosters innovation in decentralized finance (DeFi) ecosystems.

Comparison Table

| Feature | Tokenization | Bilateral Transfer |

|---|---|---|

| Definition | Converting financial assets into digital tokens on a blockchain. | Direct transfer of assets between two parties without intermediaries. |

| Speed | Fast settlement via blockchain technology. | Variable, often slower due to intermediaries. |

| Transparency | High transparency with blockchain ledger. | Lower transparency, depends on involved parties. |

| Security | Enhanced security through cryptographic protocols. | Security depends on trust and legal contracts. |

| Cost | Lower fees due to reduced intermediaries. | Higher costs from intermediary fees. |

| Liquidity | Improved liquidity via token markets. | Limited liquidity tied directly to counterparties. |

| Regulatory Compliance | Requires adherence to digital asset regulations. | Typical financial regulations apply. |

Which is better?

Tokenization offers enhanced security by converting sensitive financial assets into digital tokens, reducing fraud and enabling seamless blockchain-based transactions. Bilateral transfers rely on direct agreements between two parties, which may involve higher risks, delays, and operational costs due to intermediary reliance. For scalable, transparent, and efficient asset management, tokenization provides superior advantages over traditional bilateral transfer methods.

Connection

Tokenization in finance converts assets into digital tokens, enabling seamless bilateral transfers by allowing two parties to directly exchange ownership without intermediaries. This process enhances transaction efficiency, transparency, and security through blockchain technology or distributed ledgers. The integration of tokenization with bilateral transfers reduces settlement times and lowers operational costs in financial markets.

Key Terms

Counterparty Risk

Bilateral transfer involves direct settlement between two parties, increasing counterparty risk due to potential default before final exchange, whereas tokenization leverages blockchain technology to represent assets digitally, minimizing counterparty risk through secure, immutable transactions. Tokenization enhances transparency and instantaneous settlement, reducing settlement delays and credit exposure inherent in bilateral transfers. Explore further to understand how tokenization is revolutionizing counterparty risk management in financial transactions.

Digital Asset

Bilateral transfer in digital assets involves direct transactions between two parties, ensuring ownership transfer without intermediaries, enhancing security and reducing costs. Tokenization converts physical or digital assets into blockchain-based tokens, enabling fractional ownership, improved liquidity, and seamless trading on digital platforms. Explore more about how these mechanisms revolutionize digital asset management and investment opportunities.

Settlement Layer

Bilateral transfer in the settlement layer involves direct asset exchanges between two parties, ensuring secure, peer-to-peer settlements without intermediaries. Tokenization converts physical or traditional assets into digital tokens on the settlement layer, enabling faster, transparent, and programmable settlements. Explore detailed comparisons to understand their impacts on transaction efficiency and security.

Source and External Links

Bilateral transfer | EBSCO Research Starters - Bilateral transfer is the phenomenon where learning a skill with one limb facilitates performing the same skill with the opposite limb, relevant in sports and rehabilitation and influenced by factors like handedness and mental imagery.

Bilateral Transfer Techniques - Dictionary - Mini Course Generator - Bilateral transfer techniques use skill learning in one limb to improve performance in the opposite limb, widely applied in physical therapy and sports training to aid recovery and enhance motor function.

Bilateral transfer of motor performance as a function of motor ... - Bilateral transfer, also known as cross-education, involves the transfer of improved motor activity performance from a trained limb to the untrained contralateral limb, with research spanning neuromechanisms and directional characteristics of transfer.

dowidth.com

dowidth.com