Tokenized treasuries represent digital assets backed by government securities, offering transparency, security, and liquidity through blockchain technology. Stablecoins provide price stability by pegging their value to fiat currencies, facilitating seamless digital payments and reducing volatility compared to cryptocurrencies. Explore how these financial innovations impact investment strategies and digital finance ecosystems.

Why it is important

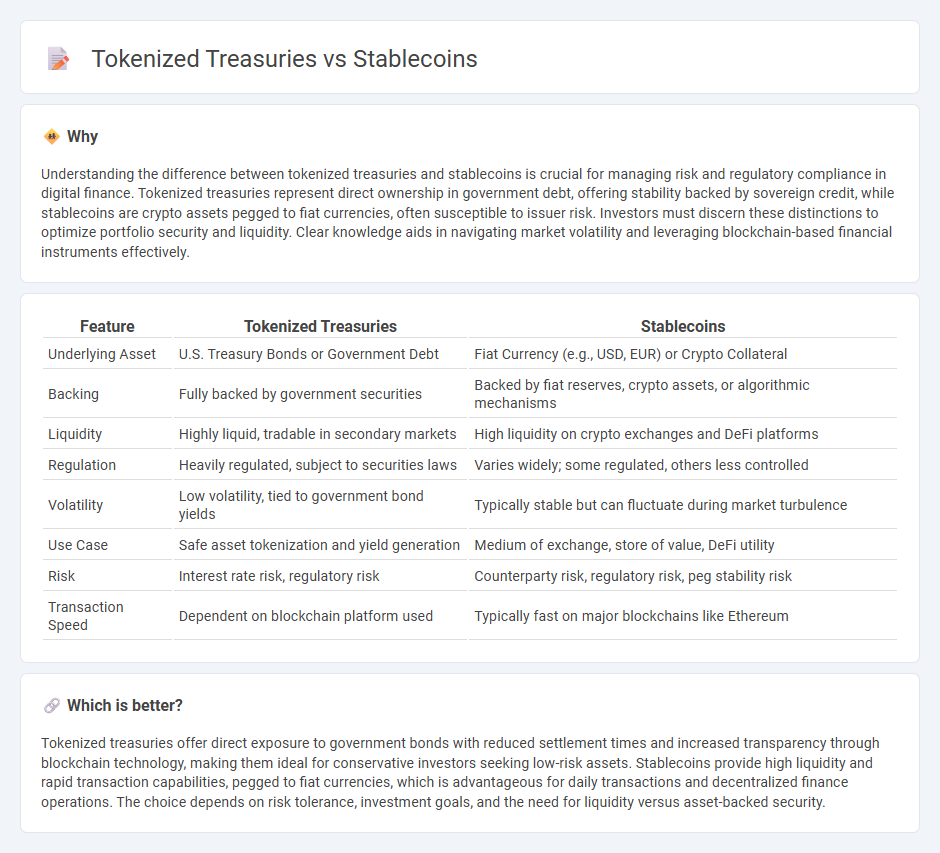

Understanding the difference between tokenized treasuries and stablecoins is crucial for managing risk and regulatory compliance in digital finance. Tokenized treasuries represent direct ownership in government debt, offering stability backed by sovereign credit, while stablecoins are crypto assets pegged to fiat currencies, often susceptible to issuer risk. Investors must discern these distinctions to optimize portfolio security and liquidity. Clear knowledge aids in navigating market volatility and leveraging blockchain-based financial instruments effectively.

Comparison Table

| Feature | Tokenized Treasuries | Stablecoins |

|---|---|---|

| Underlying Asset | U.S. Treasury Bonds or Government Debt | Fiat Currency (e.g., USD, EUR) or Crypto Collateral |

| Backing | Fully backed by government securities | Backed by fiat reserves, crypto assets, or algorithmic mechanisms |

| Liquidity | Highly liquid, tradable in secondary markets | High liquidity on crypto exchanges and DeFi platforms |

| Regulation | Heavily regulated, subject to securities laws | Varies widely; some regulated, others less controlled |

| Volatility | Low volatility, tied to government bond yields | Typically stable but can fluctuate during market turbulence |

| Use Case | Safe asset tokenization and yield generation | Medium of exchange, store of value, DeFi utility |

| Risk | Interest rate risk, regulatory risk | Counterparty risk, regulatory risk, peg stability risk |

| Transaction Speed | Dependent on blockchain platform used | Typically fast on major blockchains like Ethereum |

Which is better?

Tokenized treasuries offer direct exposure to government bonds with reduced settlement times and increased transparency through blockchain technology, making them ideal for conservative investors seeking low-risk assets. Stablecoins provide high liquidity and rapid transaction capabilities, pegged to fiat currencies, which is advantageous for daily transactions and decentralized finance operations. The choice depends on risk tolerance, investment goals, and the need for liquidity versus asset-backed security.

Connection

Tokenized treasuries enable the digitization of government securities, allowing these assets to be traded seamlessly on blockchain platforms. Stablecoins often utilize tokenized treasuries as collateral to maintain price stability, securely pegging their value to fiat currencies. This connection enhances liquidity and transparency in financial markets by integrating traditional assets with decentralized finance ecosystems.

Key Terms

Collateralization

Stablecoins maintain value by being collateralized with assets like fiat currency, cryptocurrencies, or commodities to minimize price volatility and support liquidity. Tokenized treasuries represent government bonds or other debt instruments on blockchain platforms, providing transparency, security, and direct ownership backed by sovereign credit. Explore deeper insights into how collateralization mechanisms influence trust and stability in digital asset ecosystems.

Yield

Stablecoins offer yield primarily through decentralized finance platforms where liquidity provision and staking enable returns typically ranging from 5% to 15% annually. Tokenized treasuries, backed by government debt, provide more stable, lower-risk yields averaging around 1% to 3%, ideal for conservative investors seeking capital preservation with modest income. Explore detailed comparisons to understand which asset suits your yield-focused investment strategy best.

Liquidity

Stablecoins offer high liquidity by enabling instant transfers and seamless trading on various blockchain platforms, making them a preferred choice for fast, reliable transactions in decentralized finance. Tokenized treasuries provide liquidity through fractional ownership of government securities, allowing investors to access traditionally illiquid assets with improved flexibility and reduced entry barriers. Discover how these financial instruments reshape liquidity dynamics in modern markets.

Source and External Links

What is a stablecoin? - Coinbase - Stablecoins are cryptocurrencies pegged to an asset like fiat money or gold to maintain stable value, offering an alternative to volatile cryptocurrencies for everyday transactions and blockchain financial services.

Stablecoin - Wikipedia - A stablecoin is a cryptocurrency pegged to a reference asset such as fiat currency or commodities to reduce volatility, but their actual stability depends on the issuer's ability to maintain adequate reserves.

What are stablecoins, and how are they regulated? | Brookings - Stablecoins are digital tokens pegged to assets like the US dollar, operating on blockchains with reserves managed by issuers who alone can mint and redeem tokens, relying on trust and regulatory frameworks.

dowidth.com

dowidth.com