Tokenization of real-world assets leverages blockchain technology to fractionalize ownership, enhancing liquidity and accessibility compared to traditional direct investments, which often require substantial capital and involve longer transaction times. By converting physical assets into digital tokens, investors can trade and manage diverse portfolios with greater transparency and reduced barriers. Explore how this innovative approach is transforming asset management and investment strategies.

Why it is important

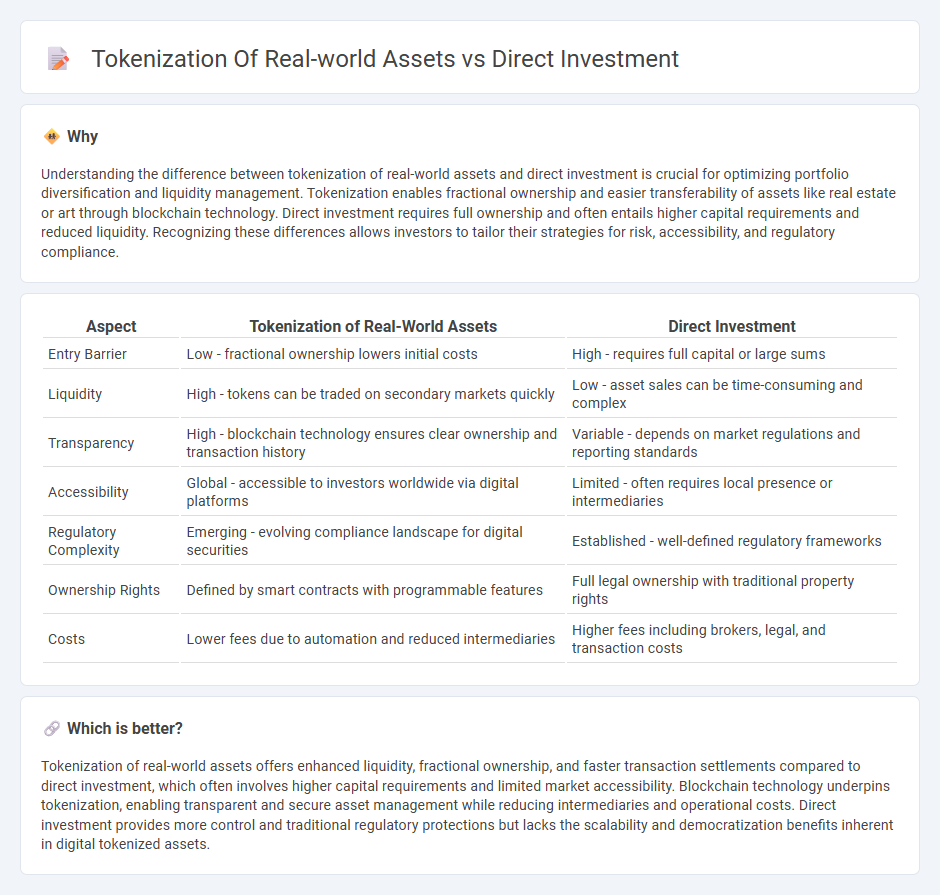

Understanding the difference between tokenization of real-world assets and direct investment is crucial for optimizing portfolio diversification and liquidity management. Tokenization enables fractional ownership and easier transferability of assets like real estate or art through blockchain technology. Direct investment requires full ownership and often entails higher capital requirements and reduced liquidity. Recognizing these differences allows investors to tailor their strategies for risk, accessibility, and regulatory compliance.

Comparison Table

| Aspect | Tokenization of Real-World Assets | Direct Investment |

|---|---|---|

| Entry Barrier | Low - fractional ownership lowers initial costs | High - requires full capital or large sums |

| Liquidity | High - tokens can be traded on secondary markets quickly | Low - asset sales can be time-consuming and complex |

| Transparency | High - blockchain technology ensures clear ownership and transaction history | Variable - depends on market regulations and reporting standards |

| Accessibility | Global - accessible to investors worldwide via digital platforms | Limited - often requires local presence or intermediaries |

| Regulatory Complexity | Emerging - evolving compliance landscape for digital securities | Established - well-defined regulatory frameworks |

| Ownership Rights | Defined by smart contracts with programmable features | Full legal ownership with traditional property rights |

| Costs | Lower fees due to automation and reduced intermediaries | Higher fees including brokers, legal, and transaction costs |

Which is better?

Tokenization of real-world assets offers enhanced liquidity, fractional ownership, and faster transaction settlements compared to direct investment, which often involves higher capital requirements and limited market accessibility. Blockchain technology underpins tokenization, enabling transparent and secure asset management while reducing intermediaries and operational costs. Direct investment provides more control and traditional regulatory protections but lacks the scalability and democratization benefits inherent in digital tokenized assets.

Connection

Tokenization of real-world assets transforms physical assets into digital tokens on blockchain platforms, enabling fractional ownership and increased liquidity. This innovation directly facilitates direct investment by allowing investors to buy and hold specific asset fractions without intermediaries. Consequently, tokenization lowers entry barriers and streamlines access to previously inaccessible markets for individual investors.

Key Terms

Ownership Structure

Direct investment in real-world assets involves acquiring full ownership rights and control, usually requiring significant capital and complex legal processes. Tokenization splits asset ownership into digital tokens on a blockchain, enabling fractional ownership, enhanced liquidity, and seamless transferability. Explore how these contrasting ownership structures impact investment accessibility and security by learning more about each approach.

Liquidity

Direct investment in real-world assets often faces challenges with liquidity due to lengthy transaction processes and restricted market access. Tokenization leverages blockchain technology to create digital tokens representing asset shares, enabling fractional ownership and faster, more flexible trading on global markets. Discover how tokenization transforms liquidity dynamics in asset investment.

Custody

Direct investment in real-world assets requires secure custody solutions, involving physical storage or traditional financial custodians to mitigate risks of loss or theft. Tokenization leverages blockchain technology to digitize ownership, enabling decentralized custody options through digital wallets and smart contracts, enhancing transparency and liquidity. Explore the advantages and security implications of both custody methods to optimize your investment strategy.

Source and External Links

Direct Investments - Direct investment involves investing directly in a company or asset as a standalone investment or co-investment, appealing particularly to institutional investors and wealthy individuals seeking to avoid management fees and align investments with personal values.

What Is Direct Investment? - Back to Basics Compilation Book - Direct investment refers to investing in an enterprise in another economy with the goal of gaining control or significant influence over its management, including greenfield and brownfield investments.

Foreign direct investment - Foreign direct investment (FDI) is the controlling ownership in a business enterprise in one country by an entity from another country, involving a lasting management interest typically of 10% or more of voting stock and distinguished by the element of control from foreign portfolio investment.

dowidth.com

dowidth.com