AI-driven portfolios leverage machine learning algorithms and big data analytics to optimize investment decisions, offering real-time adaptability to market changes and minimized human bias. Discretionary portfolios depend on the expertise and judgment of fund managers to make strategic investment choices based on market research and personal insights. Explore how these distinct approaches impact portfolio performance and risk management by learning more about AI-driven versus discretionary investing.

Why it is important

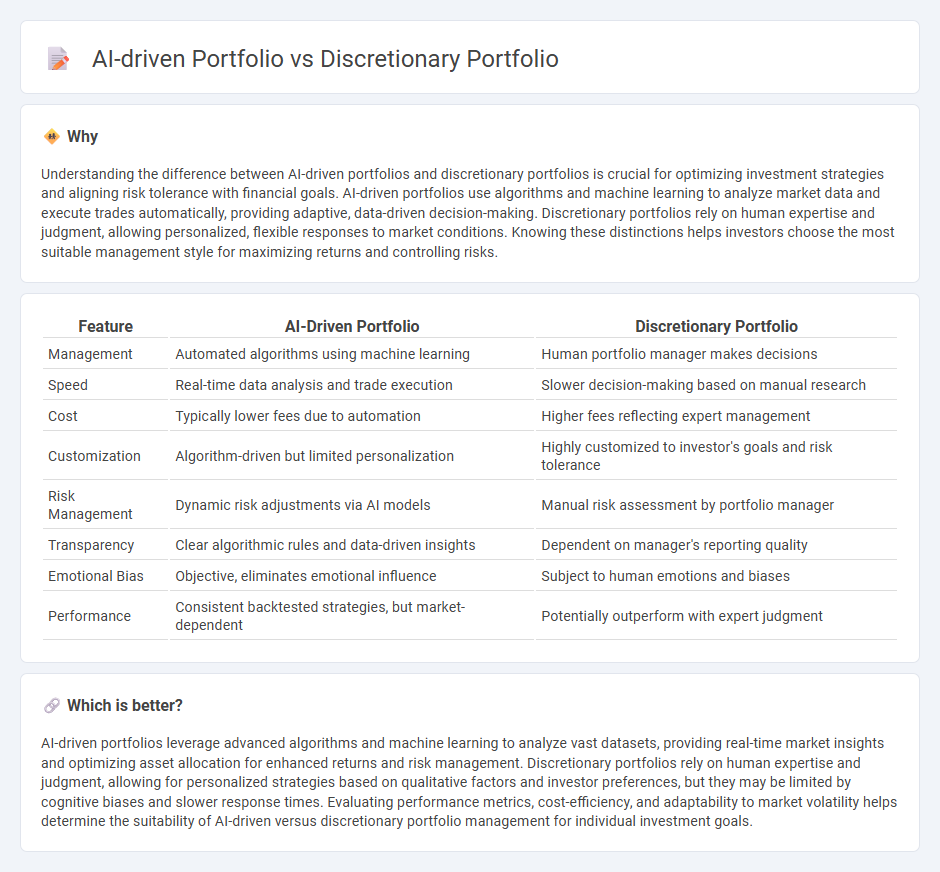

Understanding the difference between AI-driven portfolios and discretionary portfolios is crucial for optimizing investment strategies and aligning risk tolerance with financial goals. AI-driven portfolios use algorithms and machine learning to analyze market data and execute trades automatically, providing adaptive, data-driven decision-making. Discretionary portfolios rely on human expertise and judgment, allowing personalized, flexible responses to market conditions. Knowing these distinctions helps investors choose the most suitable management style for maximizing returns and controlling risks.

Comparison Table

| Feature | AI-Driven Portfolio | Discretionary Portfolio |

|---|---|---|

| Management | Automated algorithms using machine learning | Human portfolio manager makes decisions |

| Speed | Real-time data analysis and trade execution | Slower decision-making based on manual research |

| Cost | Typically lower fees due to automation | Higher fees reflecting expert management |

| Customization | Algorithm-driven but limited personalization | Highly customized to investor's goals and risk tolerance |

| Risk Management | Dynamic risk adjustments via AI models | Manual risk assessment by portfolio manager |

| Transparency | Clear algorithmic rules and data-driven insights | Dependent on manager's reporting quality |

| Emotional Bias | Objective, eliminates emotional influence | Subject to human emotions and biases |

| Performance | Consistent backtested strategies, but market-dependent | Potentially outperform with expert judgment |

Which is better?

AI-driven portfolios leverage advanced algorithms and machine learning to analyze vast datasets, providing real-time market insights and optimizing asset allocation for enhanced returns and risk management. Discretionary portfolios rely on human expertise and judgment, allowing for personalized strategies based on qualitative factors and investor preferences, but they may be limited by cognitive biases and slower response times. Evaluating performance metrics, cost-efficiency, and adaptability to market volatility helps determine the suitability of AI-driven versus discretionary portfolio management for individual investment goals.

Connection

AI-driven portfolios utilize advanced algorithms and machine learning to analyze market data and optimize asset allocation with higher precision. Discretionary portfolios are managed by professional portfolio managers who may integrate AI insights to make informed decisions and adjust investments dynamically. Combining AI-driven analysis with discretionary management enhances portfolio performance through data-driven strategies and expert judgment.

Key Terms

Active Management

Discretionary portfolios rely on human expertise and judgment for active management decisions, allowing tailored investment strategies based on market analysis and client objectives. AI-driven portfolios utilize advanced algorithms and machine learning to analyze vast datasets, enabling dynamic adjustments and risk optimization with minimal human intervention. Explore the distinctive advantages and performance insights of both approaches to active management.

Algorithmic Trading

Discretionary portfolios rely on human expertise and intuition to make investment decisions, whereas AI-driven portfolios utilize algorithmic trading powered by machine learning models to analyze vast datasets and execute trades with precision. Algorithmic trading enhances speed, reduces emotional bias, and optimizes asset allocation based on real-time market conditions and predictive analytics. Explore more about how AI-driven portfolio management is revolutionizing investment strategies through algorithmic trading innovations.

Human Judgment

Discretionary portfolios rely heavily on human judgment, allowing portfolio managers to leverage experience, intuition, and qualitative insights while adapting to market nuances. AI-driven portfolios utilize algorithmic models and machine learning to analyze vast datasets, optimize asset allocation, and execute trades with speed and precision. Explore the advantages and challenges of each approach to determine the best fit for your investment strategy.

Source and External Links

Discretionary investment management - Wikipedia - A discretionary portfolio is managed by an investment professional who makes buying and selling decisions on behalf of clients based on their judgment and within a predefined mandate, aiming to meet the client's financial goals without needing prior client approval for each trade.

Discretionary Portfolio Management - HSBC - Discretionary portfolio management lets investors set overall investment objectives and risk tolerance while the portfolio manager actively manages day-to-day investment decisions to create diversified portfolios aligned with those goals.

Discretionary Portfolio Management - MFSA - In discretionary portfolio management, the manager executes transactions without seeking prior permission, after agreeing with the client on investment objectives and risk appetite at account setup.

dowidth.com

dowidth.com