Liquid staking offers enhanced liquidity by allowing users to stake assets and receive transferable tokens representing their staked positions, contrasting with DeFi savings protocols that provide earning opportunities through lending or yield farming without locking funds in staking. DeFi savings protocols typically involve risk from smart contract vulnerabilities and market fluctuations, while liquid staking minimizes opportunity costs by maintaining asset flexibility alongside staking rewards. Explore the detailed differences and benefits of liquid staking versus DeFi savings protocols to optimize your digital asset strategy.

Why it is important

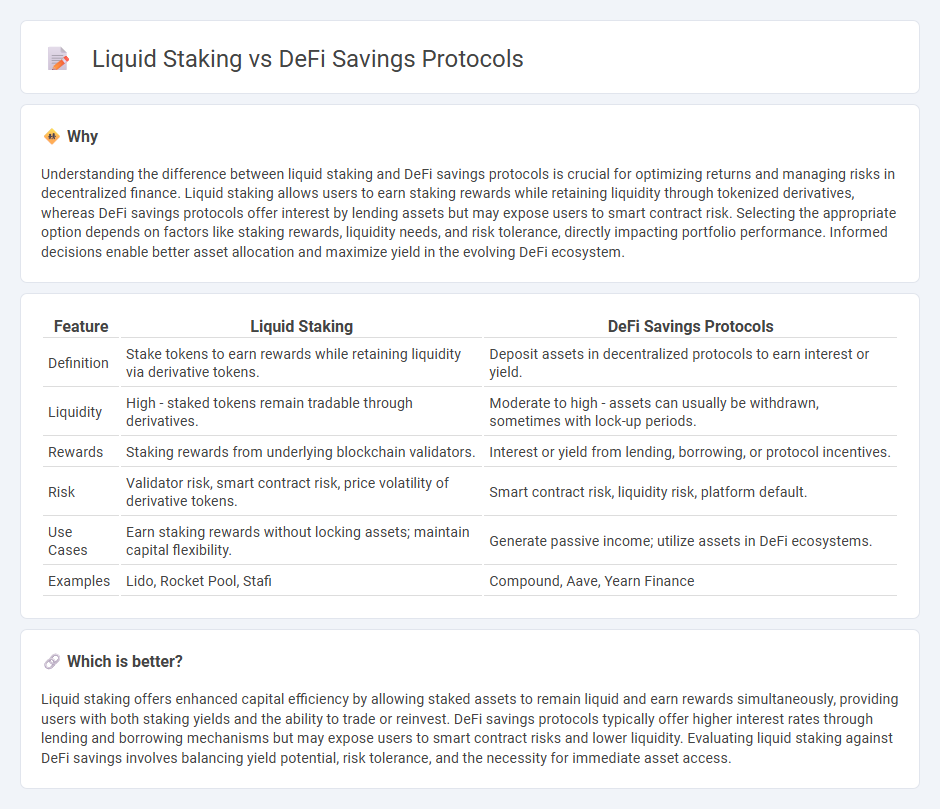

Understanding the difference between liquid staking and DeFi savings protocols is crucial for optimizing returns and managing risks in decentralized finance. Liquid staking allows users to earn staking rewards while retaining liquidity through tokenized derivatives, whereas DeFi savings protocols offer interest by lending assets but may expose users to smart contract risk. Selecting the appropriate option depends on factors like staking rewards, liquidity needs, and risk tolerance, directly impacting portfolio performance. Informed decisions enable better asset allocation and maximize yield in the evolving DeFi ecosystem.

Comparison Table

| Feature | Liquid Staking | DeFi Savings Protocols |

|---|---|---|

| Definition | Stake tokens to earn rewards while retaining liquidity via derivative tokens. | Deposit assets in decentralized protocols to earn interest or yield. |

| Liquidity | High - staked tokens remain tradable through derivatives. | Moderate to high - assets can usually be withdrawn, sometimes with lock-up periods. |

| Rewards | Staking rewards from underlying blockchain validators. | Interest or yield from lending, borrowing, or protocol incentives. |

| Risk | Validator risk, smart contract risk, price volatility of derivative tokens. | Smart contract risk, liquidity risk, platform default. |

| Use Cases | Earn staking rewards without locking assets; maintain capital flexibility. | Generate passive income; utilize assets in DeFi ecosystems. |

| Examples | Lido, Rocket Pool, Stafi | Compound, Aave, Yearn Finance |

Which is better?

Liquid staking offers enhanced capital efficiency by allowing staked assets to remain liquid and earn rewards simultaneously, providing users with both staking yields and the ability to trade or reinvest. DeFi savings protocols typically offer higher interest rates through lending and borrowing mechanisms but may expose users to smart contract risks and lower liquidity. Evaluating liquid staking against DeFi savings involves balancing yield potential, risk tolerance, and the necessity for immediate asset access.

Connection

Liquid staking allows users to earn rewards on staked assets while maintaining liquidity, enabling seamless participation in DeFi savings protocols for enhanced yield opportunities. DeFi savings protocols leverage staked tokens from liquid staking to provide higher interest rates through decentralized lending and borrowing mechanisms. This integration optimizes capital efficiency by combining staking rewards with DeFi interest, driving innovative financial products in the blockchain ecosystem.

Key Terms

Yield

DeFi savings protocols offer variable yields by lending user assets across decentralized platforms, often providing higher returns but increased exposure to smart contract risks, whereas liquid staking generates staking rewards combined with the flexibility of using staked tokens as liquidity, balancing yield with usability. Yield rates on DeFi protocols fluctuate based on market demand and protocol incentives, while liquid staking rewards are generally steadier, derived from blockchain consensus mechanisms like Ethereum 2.0 or Polygon PoS. Discover more about optimizing your crypto portfolio through strategic yield generation methods.

Liquidity

DeFi savings protocols provide liquidity through lending pools, allowing users to earn interest while retaining asset accessibility. Liquid staking enhances liquidity by tokenizing staked assets, enabling users to trade or utilize derivatives without unstaking. Explore the nuances of liquidity management in DeFi and liquid staking to optimize your crypto portfolio.

Tokenization

DeFi savings protocols offer users the ability to earn interest by lending or staking assets, while liquid staking enables tokenization of staked tokens, providing liquidity without sacrificing staking rewards. Tokenization in liquid staking creates derivative tokens representing staked assets, which can be traded or used in other DeFi applications, enhancing capital efficiency and flexibility. Explore the intricate differences between these models and their impact on DeFi liquidity and yield opportunities.

Source and External Links

Getting Started with DeFi: Your Comprehensive Guide ... - CoW DAO - Yearn Finance is a notable DeFi savings protocol offering automated yield farming strategies that help users optimize returns on their crypto assets.

Top 15 DeFi Protocols: The Future of Finance Unveiled - DeFi savings protocols provide yield farming and staking opportunities by locking up assets in decentralized smart contracts, empowering users with transparent, secure, and cost-efficient financial services without intermediaries.

DeFi - Best Decentralized Finance Projects | What is DeFi in Crypto - DeFi platforms include various categories such as yield aggregators and staking protocols, which serve as DeFi savings protocols by enabling users to earn rewards through decentralized finance mechanisms.

dowidth.com

dowidth.com