Crowdlending connects businesses with a vast pool of individual investors willing to provide direct loans, offering an alternative to traditional bank financing. Factoring involves selling accounts receivable to a third party at a discount for immediate cash flow, helping companies manage short-term liquidity needs efficiently. Explore the key differences and advantages of crowdlending versus factoring to determine the best financing solution for your business.

Why it is important

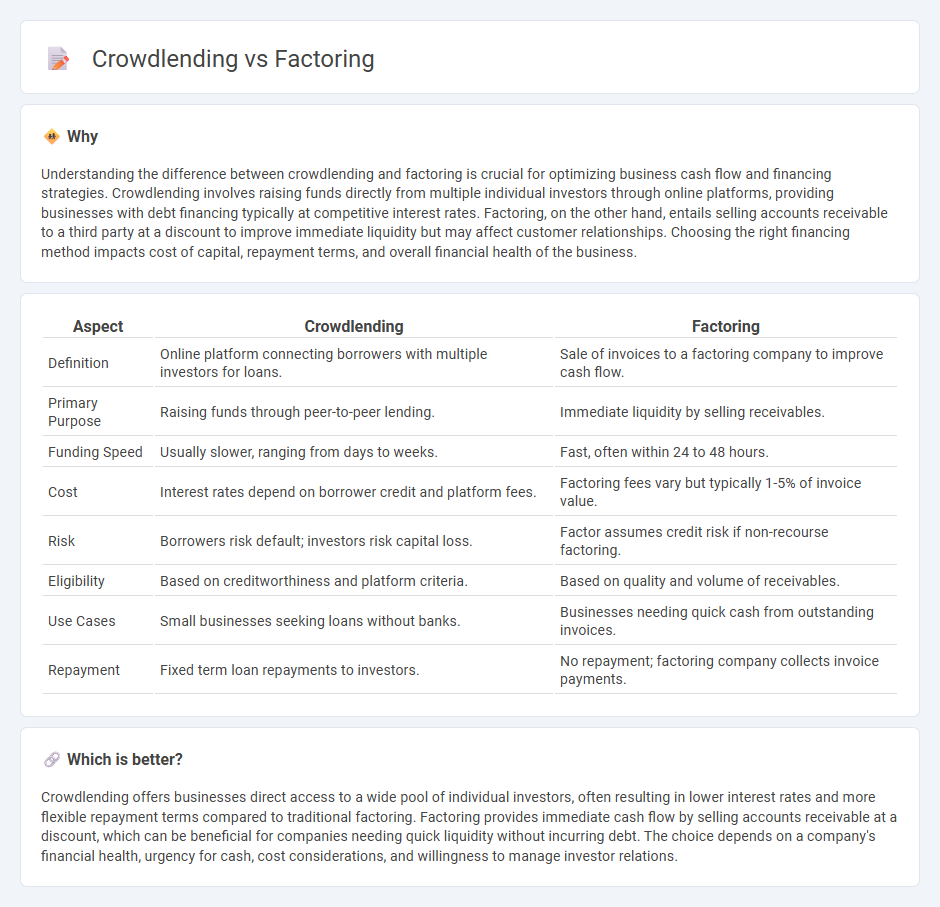

Understanding the difference between crowdlending and factoring is crucial for optimizing business cash flow and financing strategies. Crowdlending involves raising funds directly from multiple individual investors through online platforms, providing businesses with debt financing typically at competitive interest rates. Factoring, on the other hand, entails selling accounts receivable to a third party at a discount to improve immediate liquidity but may affect customer relationships. Choosing the right financing method impacts cost of capital, repayment terms, and overall financial health of the business.

Comparison Table

| Aspect | Crowdlending | Factoring |

|---|---|---|

| Definition | Online platform connecting borrowers with multiple investors for loans. | Sale of invoices to a factoring company to improve cash flow. |

| Primary Purpose | Raising funds through peer-to-peer lending. | Immediate liquidity by selling receivables. |

| Funding Speed | Usually slower, ranging from days to weeks. | Fast, often within 24 to 48 hours. |

| Cost | Interest rates depend on borrower credit and platform fees. | Factoring fees vary but typically 1-5% of invoice value. |

| Risk | Borrowers risk default; investors risk capital loss. | Factor assumes credit risk if non-recourse factoring. |

| Eligibility | Based on creditworthiness and platform criteria. | Based on quality and volume of receivables. |

| Use Cases | Small businesses seeking loans without banks. | Businesses needing quick cash from outstanding invoices. |

| Repayment | Fixed term loan repayments to investors. | No repayment; factoring company collects invoice payments. |

Which is better?

Crowdlending offers businesses direct access to a wide pool of individual investors, often resulting in lower interest rates and more flexible repayment terms compared to traditional factoring. Factoring provides immediate cash flow by selling accounts receivable at a discount, which can be beneficial for companies needing quick liquidity without incurring debt. The choice depends on a company's financial health, urgency for cash, cost considerations, and willingness to manage investor relations.

Connection

Crowdlending and factoring are connected through their role in providing alternative financing solutions for businesses, especially small and medium-sized enterprises (SMEs). Crowdlending allows companies to obtain loans directly from a network of investors, while factoring involves the sale of accounts receivable to improve cash flow. Both methods enhance liquidity and reduce reliance on traditional bank financing, fostering business growth and operational stability.

Key Terms

Accounts Receivable

Factoring involves selling accounts receivable to a third party to improve cash flow, while crowdlending allows businesses to borrow funds directly from a crowd of investors, often using receivables as collateral. Factoring provides immediate liquidity without incurring debt, whereas crowdlending creates a loan obligation with scheduled repayments. Explore in-depth comparisons to understand which financing method best fits your cash flow needs and business goals.

Investor Pool

Factoring provides investors with access to short-term, invoice-backed assets offering predictable cash flows and reduced credit risk, appealing to those seeking stable returns. Crowdlending attracts a diverse investor pool by enabling participation in loans to SMEs with varied risk profiles and potential for higher yields. Explore detailed comparisons to determine which investor pool best aligns with your financial goals.

Interest Rate

Factoring typically involves businesses selling their accounts receivable at a discount, with interest rates varying widely depending on the debtor's creditworthiness and invoice terms. Crowdlending platforms often offer fixed or variable interest rates ranging from 5% to 15%, influenced by borrower risk profiles and loan duration. Explore detailed comparisons to understand which financing option best suits your cash flow needs and borrowing capacity.

Source and External Links

Factoring (finance) - Wikipedia - Factoring is a financial transaction where a business sells its accounts receivable (invoices) to a third party (factor) at a discount to meet immediate cash needs.

Factoring in Algebra - Math is Fun - Factoring in algebra means finding the factors that multiply together to give an expression, like splitting an expression into a product of simpler expressions.

Factorization - Wikipedia - In mathematics, factoring consists of writing a number or mathematical object as a product of several simpler factors, such as integer factorization or polynomial factorization.

dowidth.com

dowidth.com