Decentralized autonomous organization (DAO) treasuries leverage blockchain technology to enable transparent, community-driven fund management with real-time governance and automated smart contracts. Venture capital (VC) funds operate through centralized management, pooling capital from limited partners to invest in startups with the goal of maximizing returns over a longer horizon. Explore the differences in fund control and investment strategies to understand which financing model aligns best with innovative business ventures.

Why it is important

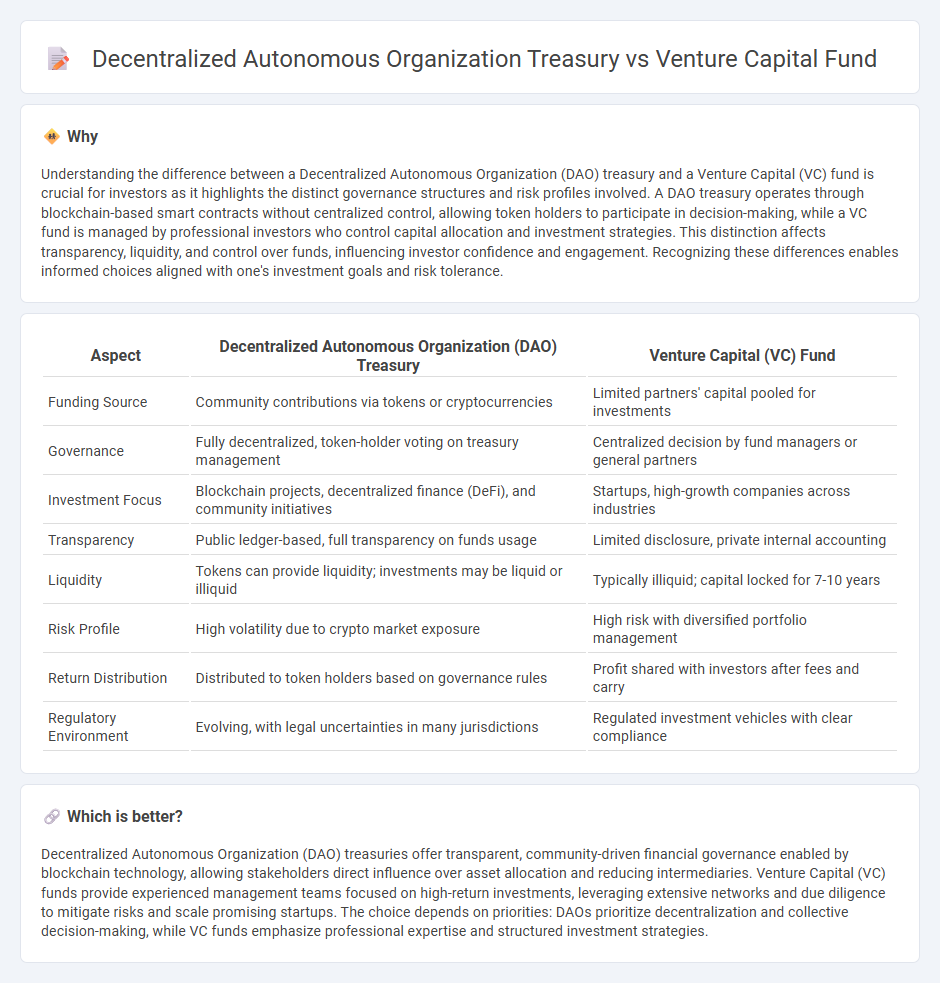

Understanding the difference between a Decentralized Autonomous Organization (DAO) treasury and a Venture Capital (VC) fund is crucial for investors as it highlights the distinct governance structures and risk profiles involved. A DAO treasury operates through blockchain-based smart contracts without centralized control, allowing token holders to participate in decision-making, while a VC fund is managed by professional investors who control capital allocation and investment strategies. This distinction affects transparency, liquidity, and control over funds, influencing investor confidence and engagement. Recognizing these differences enables informed choices aligned with one's investment goals and risk tolerance.

Comparison Table

| Aspect | Decentralized Autonomous Organization (DAO) Treasury | Venture Capital (VC) Fund |

|---|---|---|

| Funding Source | Community contributions via tokens or cryptocurrencies | Limited partners' capital pooled for investments |

| Governance | Fully decentralized, token-holder voting on treasury management | Centralized decision by fund managers or general partners |

| Investment Focus | Blockchain projects, decentralized finance (DeFi), and community initiatives | Startups, high-growth companies across industries |

| Transparency | Public ledger-based, full transparency on funds usage | Limited disclosure, private internal accounting |

| Liquidity | Tokens can provide liquidity; investments may be liquid or illiquid | Typically illiquid; capital locked for 7-10 years |

| Risk Profile | High volatility due to crypto market exposure | High risk with diversified portfolio management |

| Return Distribution | Distributed to token holders based on governance rules | Profit shared with investors after fees and carry |

| Regulatory Environment | Evolving, with legal uncertainties in many jurisdictions | Regulated investment vehicles with clear compliance |

Which is better?

Decentralized Autonomous Organization (DAO) treasuries offer transparent, community-driven financial governance enabled by blockchain technology, allowing stakeholders direct influence over asset allocation and reducing intermediaries. Venture Capital (VC) funds provide experienced management teams focused on high-return investments, leveraging extensive networks and due diligence to mitigate risks and scale promising startups. The choice depends on priorities: DAOs prioritize decentralization and collective decision-making, while VC funds emphasize professional expertise and structured investment strategies.

Connection

Decentralized Autonomous Organization (DAO) treasuries and Venture Capital (VC) funds both serve as financial management entities that allocate capital to foster innovation and growth in blockchain and startup ecosystems. DAO treasuries accumulate and deploy digital assets through community governance, enabling decentralized investment decisions often parallel to VC funding strategies. Their connection lies in their shared goal of supporting early-stage projects, where DAOs may act as alternative or complementary funding sources alongside traditional VC funds.

Key Terms

Equity

Venture capital funds primarily invest in equity stakes of startups, providing capital in exchange for ownership and influence over company growth, leveraging traditional legal structures for asset management and investor rights. Decentralized Autonomous Organization (DAO) treasuries operate through blockchain-based smart contracts, holding and deploying funds without centralized control, often using tokens that may represent voting power but do not guarantee equity ownership. Explore the evolving dynamics of equity representation in VC funds versus DAOs to understand how investment control and value creation differ in these models.

Governance token

Governance tokens play a pivotal role in the management structure of both venture capital funds and decentralized autonomous organization (DAO) treasuries, enabling token holders to influence investment decisions and protocol updates. In venture capital funds, governance is typically centralized with limited token-holder involvement, whereas DAO treasuries offer a decentralized framework where token holders vote on asset allocations and strategic direction. Explore the evolving impact of governance tokens on investment governance and decentralized finance.

Smart contract

Venture capital funds typically rely on traditional legal frameworks and centralized management for investment decisions, whereas decentralized autonomous organization treasuries utilize blockchain-based smart contracts to automate governance and fund allocation transparently. Smart contracts in DAOs execute predefined rules without intermediaries, enabling real-time adjustments and decentralized voting mechanisms that enhance security and reduce operational costs. Explore how these differing approaches to smart contracts shape the future of investment management and democratized funding.

Source and External Links

Venture Capital Funds: What they are & how to invest in them - A venture capital fund pools money from investors to finance early-stage startups with high growth potential, actively supporting them and aiming to exit via IPO or acquisition to return capital to investors.

What is a Venture Capital Fund? | AngelList Education Center - Venture capital funds are pooled investment vehicles managed by general partners investing in startups for ownership stakes, generating returns typically from IPOs or acquisitions over a 6-10 year horizon.

How Would a Person Start a Venture Capital Fund? - SaaStr - Venture capital firms usually operate on a "2-and-20" fee model, charging 2% annual fees on committed capital and taking 20% of profits, with returns coming primarily from successful exits after many years.

dowidth.com

dowidth.com