Synthetic risk transfer (SRT) utilizes financial instruments such as credit derivatives to transfer risk without traditional reinsurance contracts, enabling more flexible and capital-efficient risk management. Reinsurance involves insurers transferring portions of risk portfolios to other insurance companies to reduce exposure and protect against significant losses. Explore how these distinct methods optimize risk strategies and capital allocation in modern finance.

Why it is important

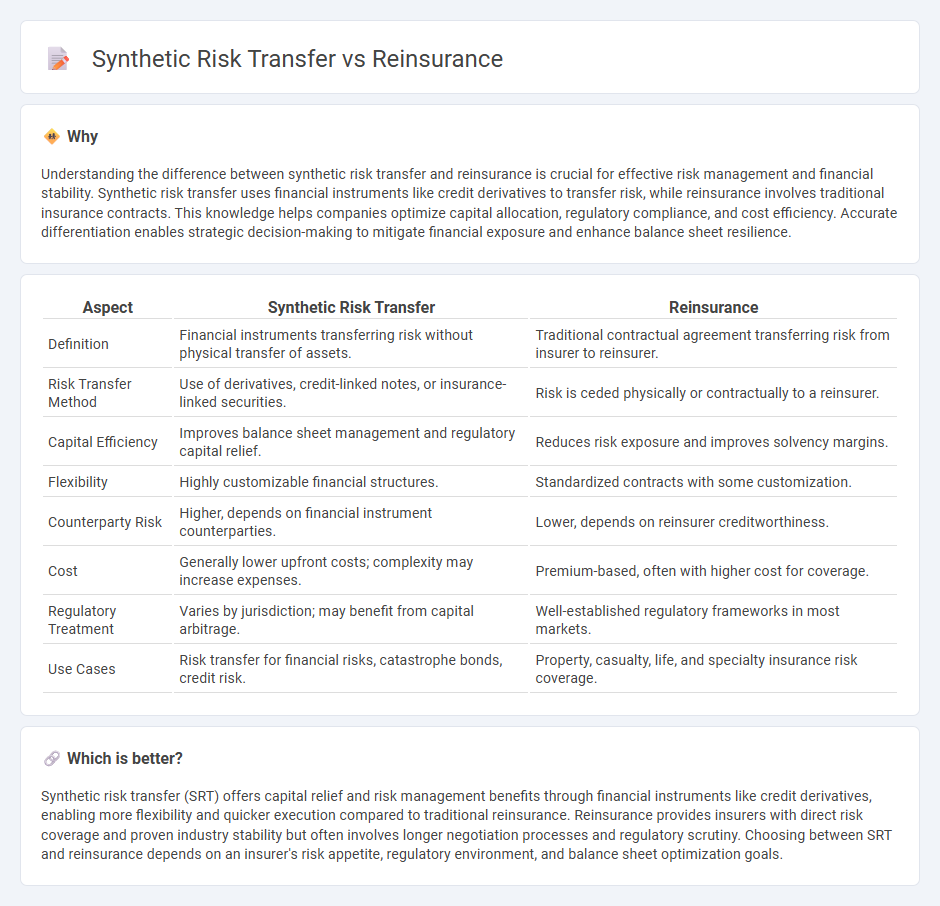

Understanding the difference between synthetic risk transfer and reinsurance is crucial for effective risk management and financial stability. Synthetic risk transfer uses financial instruments like credit derivatives to transfer risk, while reinsurance involves traditional insurance contracts. This knowledge helps companies optimize capital allocation, regulatory compliance, and cost efficiency. Accurate differentiation enables strategic decision-making to mitigate financial exposure and enhance balance sheet resilience.

Comparison Table

| Aspect | Synthetic Risk Transfer | Reinsurance |

|---|---|---|

| Definition | Financial instruments transferring risk without physical transfer of assets. | Traditional contractual agreement transferring risk from insurer to reinsurer. |

| Risk Transfer Method | Use of derivatives, credit-linked notes, or insurance-linked securities. | Risk is ceded physically or contractually to a reinsurer. |

| Capital Efficiency | Improves balance sheet management and regulatory capital relief. | Reduces risk exposure and improves solvency margins. |

| Flexibility | Highly customizable financial structures. | Standardized contracts with some customization. |

| Counterparty Risk | Higher, depends on financial instrument counterparties. | Lower, depends on reinsurer creditworthiness. |

| Cost | Generally lower upfront costs; complexity may increase expenses. | Premium-based, often with higher cost for coverage. |

| Regulatory Treatment | Varies by jurisdiction; may benefit from capital arbitrage. | Well-established regulatory frameworks in most markets. |

| Use Cases | Risk transfer for financial risks, catastrophe bonds, credit risk. | Property, casualty, life, and specialty insurance risk coverage. |

Which is better?

Synthetic risk transfer (SRT) offers capital relief and risk management benefits through financial instruments like credit derivatives, enabling more flexibility and quicker execution compared to traditional reinsurance. Reinsurance provides insurers with direct risk coverage and proven industry stability but often involves longer negotiation processes and regulatory scrutiny. Choosing between SRT and reinsurance depends on an insurer's risk appetite, regulatory environment, and balance sheet optimization goals.

Connection

Synthetic risk transfer and reinsurance both serve to manage and mitigate financial risks by shifting exposure from the original insurer to third parties. Synthetic risk transfer uses financial instruments like credit derivatives to replicate the risk transfer traditionally achieved through reinsurance contracts. This connection enables insurers to optimize capital efficiency and improve risk diversification while complying with regulatory requirements.

Key Terms

Risk Transfer

Reinsurance involves the traditional transfer of insurance risk from an insurer to a reinsurer, providing financial protection against large losses. Synthetic risk transfer, however, uses financial instruments like derivatives or insurance-linked securities to manage risk without the physical transfer of policies. Explore the nuances and applications of both methods to optimize risk management strategies.

Counterparty

Reinsurance involves a traditional contract where the reinsurer assumes underlying insurance risks, creating counterparty risk tied closely to the reinsurer's financial stability and creditworthiness. Synthetic risk transfer (SRT) uses financial instruments like credit derivatives to transfer risk without the reinsurer taking on insurance risk, shifting counterparty exposure primarily to investors or special purpose vehicles. Explore how counterparty risk profiles differ markedly between reinsurance and synthetic risk transfer to optimize risk management strategies.

Credit Derivatives

Credit derivatives play a pivotal role in both reinsurance and synthetic risk transfer by allowing the transfer of credit risk without the physical transfer of the asset. Reinsurance traditionally involves the cession of insurance liabilities to mitigate risk, whereas synthetic risk transfer uses credit derivatives like credit default swaps (CDS) to isolate and transfer specific credit exposures. Explore the nuances between these mechanisms to better understand risk management strategies in the financial and insurance sectors.

Source and External Links

REINSURANCE - Reinsurance is a risk management tool where insurers transfer some or all of their insurance risk to another insurer (reinsurer) to spread risk and manage capital, enabling coverage of larger or unusual risks and stabilizing claim levels.

Insurance Topics | Reinsurance - Reinsurance is "insurance for insurance companies," helping insurers to manage risk exposure, capital requirements, expand capacity, stabilize results, finance, and provide catastrophe protection.

What is reinsurance? - Reinsurance functions as insurance for insurance companies, paying a portion of high-cost claims to reduce premiums and support market stability, with programs often supported by federal waivers in health insurance markets.

dowidth.com

dowidth.com