Nonfungible token (NFT) fractionalization enables multiple investors to own shares of a unique digital asset, increasing liquidity and access in the digital collectibles market. Private equity syndication involves pooling capital from multiple accredited investors to invest in privately held companies, typically requiring significant minimum commitments and longer investment horizons. Explore the distinct benefits and risks of these innovative investment structures to determine which aligns with your financial goals.

Why it is important

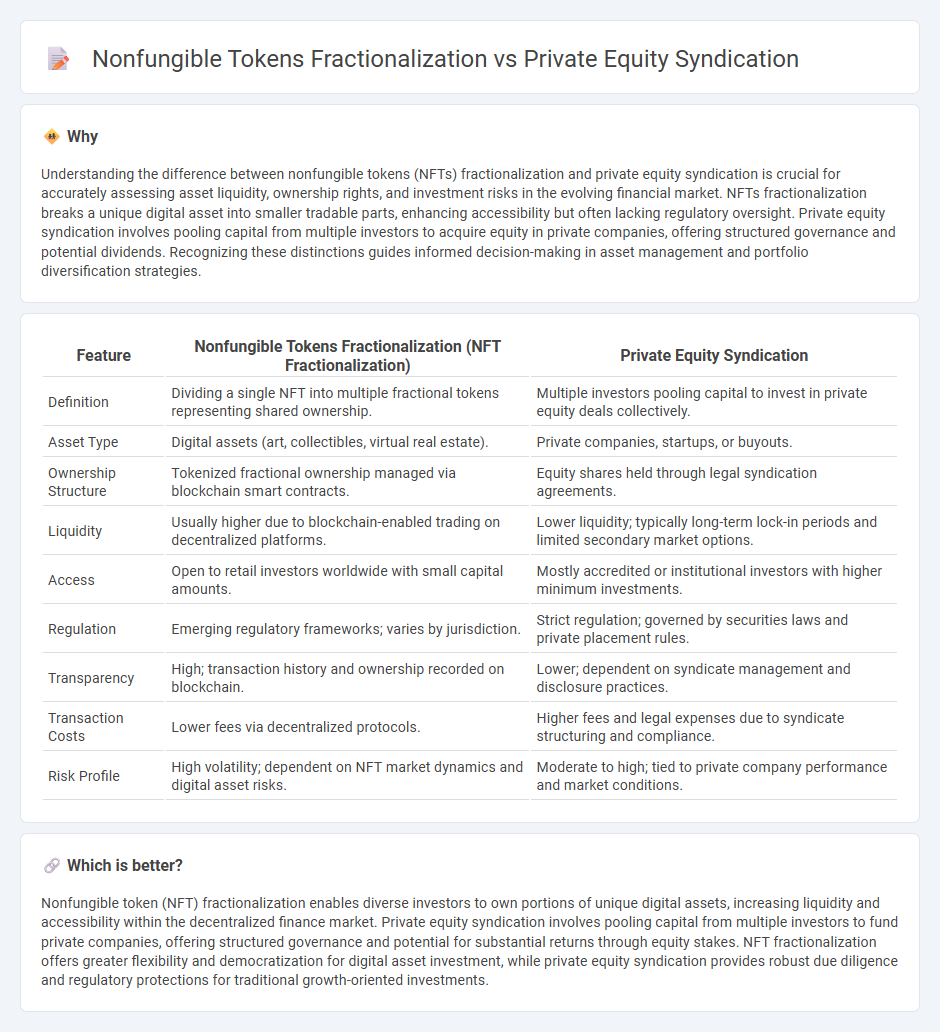

Understanding the difference between nonfungible tokens (NFTs) fractionalization and private equity syndication is crucial for accurately assessing asset liquidity, ownership rights, and investment risks in the evolving financial market. NFTs fractionalization breaks a unique digital asset into smaller tradable parts, enhancing accessibility but often lacking regulatory oversight. Private equity syndication involves pooling capital from multiple investors to acquire equity in private companies, offering structured governance and potential dividends. Recognizing these distinctions guides informed decision-making in asset management and portfolio diversification strategies.

Comparison Table

| Feature | Nonfungible Tokens Fractionalization (NFT Fractionalization) | Private Equity Syndication |

|---|---|---|

| Definition | Dividing a single NFT into multiple fractional tokens representing shared ownership. | Multiple investors pooling capital to invest in private equity deals collectively. |

| Asset Type | Digital assets (art, collectibles, virtual real estate). | Private companies, startups, or buyouts. |

| Ownership Structure | Tokenized fractional ownership managed via blockchain smart contracts. | Equity shares held through legal syndication agreements. |

| Liquidity | Usually higher due to blockchain-enabled trading on decentralized platforms. | Lower liquidity; typically long-term lock-in periods and limited secondary market options. |

| Access | Open to retail investors worldwide with small capital amounts. | Mostly accredited or institutional investors with higher minimum investments. |

| Regulation | Emerging regulatory frameworks; varies by jurisdiction. | Strict regulation; governed by securities laws and private placement rules. |

| Transparency | High; transaction history and ownership recorded on blockchain. | Lower; dependent on syndicate management and disclosure practices. |

| Transaction Costs | Lower fees via decentralized protocols. | Higher fees and legal expenses due to syndicate structuring and compliance. |

| Risk Profile | High volatility; dependent on NFT market dynamics and digital asset risks. | Moderate to high; tied to private company performance and market conditions. |

Which is better?

Nonfungible token (NFT) fractionalization enables diverse investors to own portions of unique digital assets, increasing liquidity and accessibility within the decentralized finance market. Private equity syndication involves pooling capital from multiple investors to fund private companies, offering structured governance and potential for substantial returns through equity stakes. NFT fractionalization offers greater flexibility and democratization for digital asset investment, while private equity syndication provides robust due diligence and regulatory protections for traditional growth-oriented investments.

Connection

Nonfungible tokens (NFTs) fractionalization enables the division of unique digital assets into smaller ownership stakes, similar to how private equity syndication pools investor capital to acquire equity in private companies. Both mechanisms enhance liquidity and broaden access to high-value investment opportunities by allowing multiple investors to hold fractional interests. This synergy bridges traditional private equity markets with decentralized digital asset platforms, driving innovation in asset tokenization and investment democratization.

Key Terms

Joint Investment Agreement

Private equity syndication involves multiple investors pooling capital under a Joint Investment Agreement (JIA) to collectively acquire equity stakes, ensuring aligned governance and shared risk. Nonfungible tokens (NFTs) fractionalization leverages blockchain technology to divide unique digital assets into tradable fractions, enabling diverse investor participation without traditional joint governance structures. Explore deeper insights into how Joint Investment Agreements distinctively shape these investment modalities.

Tokenization

Private equity syndication involves pooling funds from multiple investors to collectively invest in private equity, leveraging traditional financial frameworks and legal structures. In contrast, nonfungible tokens (NFTs) fractionalization utilizes blockchain technology to divide ownership of a unique digital asset into tradable, transparent tokens, enhancing liquidity and accessibility. Explore how tokenization is revolutionizing asset ownership and investment strategies in both traditional and digital markets.

Secondary Market Liquidity

Private equity syndication involves pooling resources from multiple investors to acquire shares in private companies, enhancing secondary market liquidity through structured buyouts and negotiated exits. Nonfungible tokens (NFTs) fractionalization breaks down high-value NFTs into smaller, tradable units, enabling increased liquidity by democratizing ownership and facilitating secondary sales on blockchain marketplaces. Explore how these distinct methods impact liquidity dynamics and investor accessibility in evolving financial ecosystems.

Source and External Links

What is Syndication in Private Equity? How It Works & Why It Matters - Private equity syndication is a collaborative investment strategy where a group of investors pool capital to invest in a deal, typically led by a General Partner who manages the investment process, allowing more investors to participate, spreading risk, and increasing capital efficiency.

Funds vs. Syndications: A Comprehensive Guide for LP Investors - Syndication focuses on pooling investor capital into a single asset or project, offering LPs the chance for higher returns through focused investment but with increased risk since it is tied to one asset rather than diversified portfolios like funds.

What Is Syndication? Raising Outside Capital For Investment - Syndication involves assembling a group of investors to engage in financial transactions, requiring compliance with SEC regulations and coordinated management to maximize potential returns while addressing risks such as reliance on the syndicator and capital loss.

dowidth.com

dowidth.com