Dark pool trading enables institutional investors to execute large orders anonymously without revealing their strategies to the broader market, contrasting with lit exchanges where trade orders are visible, promoting transparency and price discovery. Lit exchange trading is characterized by real-time public order books that facilitate market liquidity and investor confidence, but it can expose trading intentions to competitors. Explore the differences in execution, pricing, and market impact between dark pools and lit exchanges to enhance your trading strategy.

Why it is important

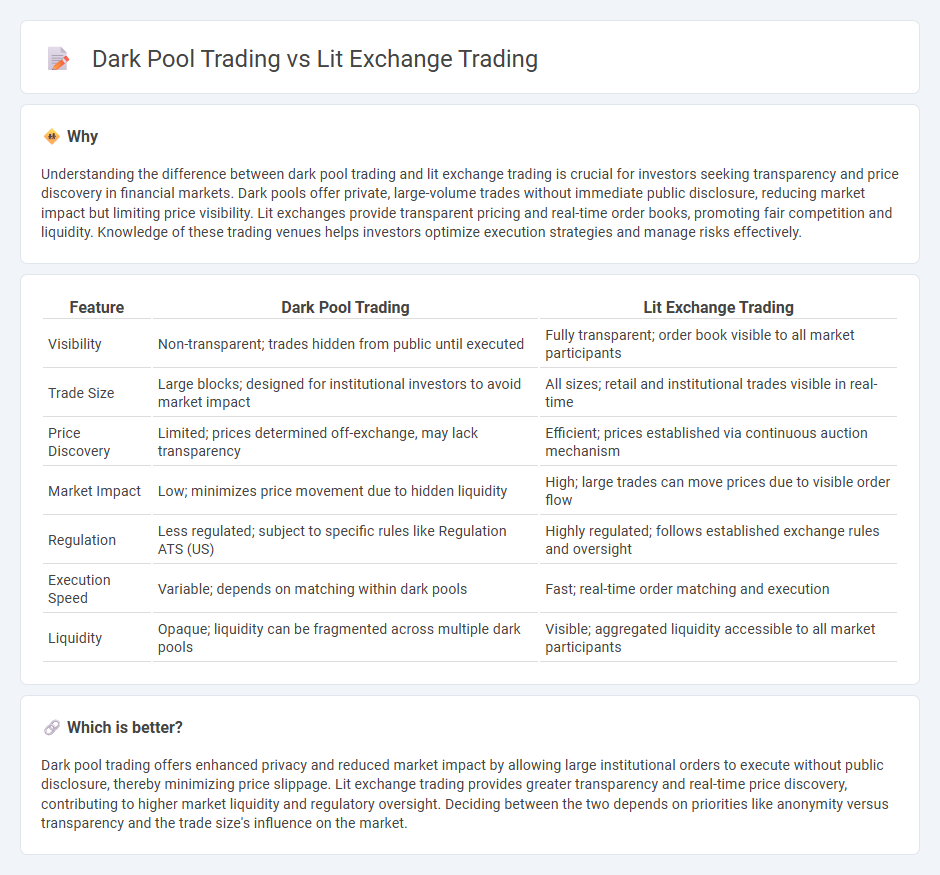

Understanding the difference between dark pool trading and lit exchange trading is crucial for investors seeking transparency and price discovery in financial markets. Dark pools offer private, large-volume trades without immediate public disclosure, reducing market impact but limiting price visibility. Lit exchanges provide transparent pricing and real-time order books, promoting fair competition and liquidity. Knowledge of these trading venues helps investors optimize execution strategies and manage risks effectively.

Comparison Table

| Feature | Dark Pool Trading | Lit Exchange Trading |

|---|---|---|

| Visibility | Non-transparent; trades hidden from public until executed | Fully transparent; order book visible to all market participants |

| Trade Size | Large blocks; designed for institutional investors to avoid market impact | All sizes; retail and institutional trades visible in real-time |

| Price Discovery | Limited; prices determined off-exchange, may lack transparency | Efficient; prices established via continuous auction mechanism |

| Market Impact | Low; minimizes price movement due to hidden liquidity | High; large trades can move prices due to visible order flow |

| Regulation | Less regulated; subject to specific rules like Regulation ATS (US) | Highly regulated; follows established exchange rules and oversight |

| Execution Speed | Variable; depends on matching within dark pools | Fast; real-time order matching and execution |

| Liquidity | Opaque; liquidity can be fragmented across multiple dark pools | Visible; aggregated liquidity accessible to all market participants |

Which is better?

Dark pool trading offers enhanced privacy and reduced market impact by allowing large institutional orders to execute without public disclosure, thereby minimizing price slippage. Lit exchange trading provides greater transparency and real-time price discovery, contributing to higher market liquidity and regulatory oversight. Deciding between the two depends on priorities like anonymity versus transparency and the trade size's influence on the market.

Connection

Dark pool trading and lit exchange trading are interconnected components of modern financial markets, where dark pools provide private venues for large institutional investors to execute sizable orders without impacting public prices, while lit exchanges offer transparent order books visible to all market participants. The interplay between these trading venues affects market liquidity, price discovery, and the overall trading ecosystem by balancing anonymity and transparency. Understanding their relationship helps investors optimize execution strategies and regulatory bodies to monitor market fairness and efficiency.

Key Terms

Transparency

Lit exchange trading provides high transparency by publicly displaying order books and executed trades in real time, allowing investors to see price movements and trading volumes. Dark pool trading, by contrast, offers limited transparency as orders are not publicly visible until after execution, aiming to reduce market impact and protect large trades from revealing strategies. Explore more to understand how transparency affects trading strategies and market efficiency.

Price Discovery

Lit exchange trading enhances price discovery by displaying real-time order books with transparent bid and ask prices, allowing market participants to gauge supply and demand effectively. Dark pool trading, in contrast, hides order details to minimize market impact but can obscure true price signals, potentially delaying accurate price formation. Explore more about how each trading venue impacts market efficiency and investor strategies.

Liquidity

Lit exchange trading provides transparent order books with visible bid and ask prices, facilitating price discovery and immediate liquidity access for all market participants. Dark pool trading operates off-exchange, allowing large block trades to occur anonymously, reducing market impact but often resulting in less visible liquidity. Explore the nuances between these trading venues to better understand their liquidity dynamics and impacts on your trading strategy.

Source and External Links

Dark Pool vs. Lit Exchange: Transparency Trade-Offs - A lit exchange is a publicly regulated trading venue where all buy and sell orders are visible, providing full price transparency, real-time market data, and strong price discovery, allowing market participants equal access to supply and demand information.

Lit pool - Wikipedia - Lit pools or lit markets display bids and offers openly at all times and form the majority of stock exchanges, accounting for about 70% of trades, offering transparency that benefits price discovery compared to dark pools.

Lit pool: Explained - TIOmarkets - Trading in lit pools provides advantages such as transparency and price discovery but also disadvantages like price slippage and risk of information leakage that can lead to predatory trading practices like front-running.

dowidth.com

dowidth.com