Nonfungible tokens (NFTs) fractionalization allows multiple investors to own a portion of a unique digital asset, enhancing liquidity and accessibility in the digital collectibles market. Real estate tokenization converts physical property assets into tradable digital tokens, enabling easier investment, transfer, and diversification in the real estate sector. Explore how these innovative financing methods revolutionize asset ownership and investment opportunities.

Why it is important

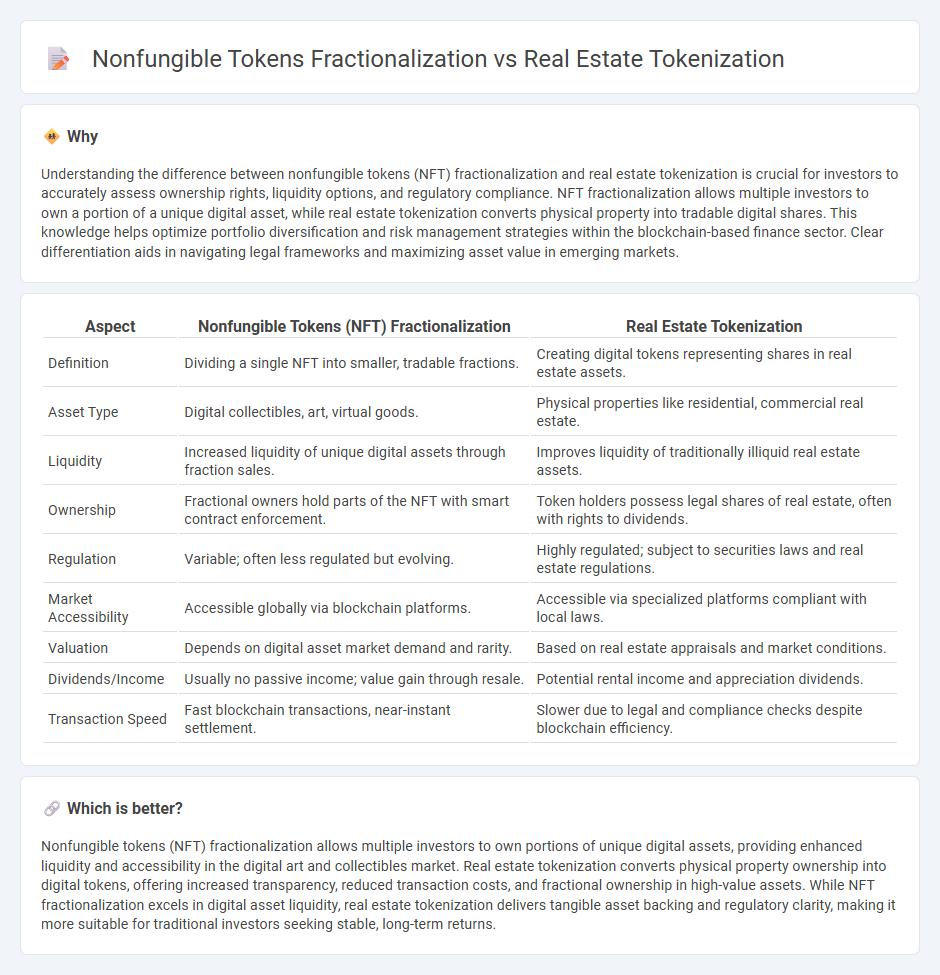

Understanding the difference between nonfungible tokens (NFT) fractionalization and real estate tokenization is crucial for investors to accurately assess ownership rights, liquidity options, and regulatory compliance. NFT fractionalization allows multiple investors to own a portion of a unique digital asset, while real estate tokenization converts physical property into tradable digital shares. This knowledge helps optimize portfolio diversification and risk management strategies within the blockchain-based finance sector. Clear differentiation aids in navigating legal frameworks and maximizing asset value in emerging markets.

Comparison Table

| Aspect | Nonfungible Tokens (NFT) Fractionalization | Real Estate Tokenization |

|---|---|---|

| Definition | Dividing a single NFT into smaller, tradable fractions. | Creating digital tokens representing shares in real estate assets. |

| Asset Type | Digital collectibles, art, virtual goods. | Physical properties like residential, commercial real estate. |

| Liquidity | Increased liquidity of unique digital assets through fraction sales. | Improves liquidity of traditionally illiquid real estate assets. |

| Ownership | Fractional owners hold parts of the NFT with smart contract enforcement. | Token holders possess legal shares of real estate, often with rights to dividends. |

| Regulation | Variable; often less regulated but evolving. | Highly regulated; subject to securities laws and real estate regulations. |

| Market Accessibility | Accessible globally via blockchain platforms. | Accessible via specialized platforms compliant with local laws. |

| Valuation | Depends on digital asset market demand and rarity. | Based on real estate appraisals and market conditions. |

| Dividends/Income | Usually no passive income; value gain through resale. | Potential rental income and appreciation dividends. |

| Transaction Speed | Fast blockchain transactions, near-instant settlement. | Slower due to legal and compliance checks despite blockchain efficiency. |

Which is better?

Nonfungible tokens (NFT) fractionalization allows multiple investors to own portions of unique digital assets, providing enhanced liquidity and accessibility in the digital art and collectibles market. Real estate tokenization converts physical property ownership into digital tokens, offering increased transparency, reduced transaction costs, and fractional ownership in high-value assets. While NFT fractionalization excels in digital asset liquidity, real estate tokenization delivers tangible asset backing and regulatory clarity, making it more suitable for traditional investors seeking stable, long-term returns.

Connection

Nonfungible tokens (NFTs) fractionalization and real estate tokenization are interconnected by enabling the division of unique assets into smaller, tradable digital shares on blockchain platforms. Fractionalized NFTs allow multiple investors to own portions of a single digital asset, similar to how real estate tokenization breaks down property ownership into transferable tokens. Both innovations enhance liquidity, accessibility, and transparency in asset management by leveraging smart contracts and decentralized networks.

Key Terms

Ownership Rights

Real estate tokenization transforms property ownership into blockchain-based tokens, enhancing liquidity and enabling fractional ownership that is legally recognized and transferable. Nonfungible tokens (NFTs) fractionalization divides a single NFT into smaller stakes, representing shared ownership but often lacks standardized legal frameworks ensuring property rights. Explore how these innovative methods redefine asset ownership and investor participation.

Liquidity

Real estate tokenization enhances liquidity by converting property assets into tradable digital tokens on blockchain platforms, allowing fractional ownership and seamless market access. Nonfungible tokens (NFTs) fractionalization breaks a single NFT into multiple fungible tokens, enabling smaller investors to gain exposure but often lacks the regulatory framework and market depth present in real estate tokenization. Explore the distinctions and benefits of these blockchain innovations to better understand their impact on asset liquidity.

Regulatory Compliance

Real estate tokenization involves converting property ownership into digital tokens on a blockchain, offering enhanced liquidity and transparent asset management, while nonfungible tokens (NFTs) fractionalization divides a unique digital asset into smaller shares, enabling multiple investors to hold partial ownership. Regulatory compliance in real estate tokenization typically demands adherence to securities laws, investor protection regulations, and anti-money laundering requirements, which can vary significantly across jurisdictions. Explore further to understand how these evolving frameworks impact investment strategies and secure digital asset transactions.

Source and External Links

Real Estate Tokenization: Unlocking the Future of Property Investment - Real estate tokenization converts property ownership or its cash flows into digital tokens on a blockchain, enabling full property tokenization, fractional ownership, or tokenized cash flows, thus allowing investors to buy portions of property or income streams securely and transparently through smart contracts.

Tokenization - From illiquid to liquid real estate ownership - EY - Tokenization uses blockchain to fragment real estate ownership into digital tokens that represent property rights and obligations, automating transactions and reducing traditional costs such as notary and land transfer fees, thereby increasing liquidity and efficiency in real estate markets.

An introduction to real estate tokenization on AWS - Amazon.com - Real estate tokenization creates blockchain-based digital assets representing property ownership, enabling automation of ownership transfers, reducing intermediary costs, and providing fractional ownership opportunities, with smart contracts supporting legal processes for ownership changes.

dowidth.com

dowidth.com