Thematic ETFs focus on investing in specific trends or sectors such as technology, healthcare, or clean energy, offering targeted exposure to long-term growth themes. Leveraged ETFs use financial derivatives and debt to amplify the returns of an underlying index, allowing investors to seek higher gains but with increased risk and volatility. Explore the key differences, benefits, and risks of Thematic ETFs versus Leveraged ETFs to enhance your investment strategy.

Why it is important

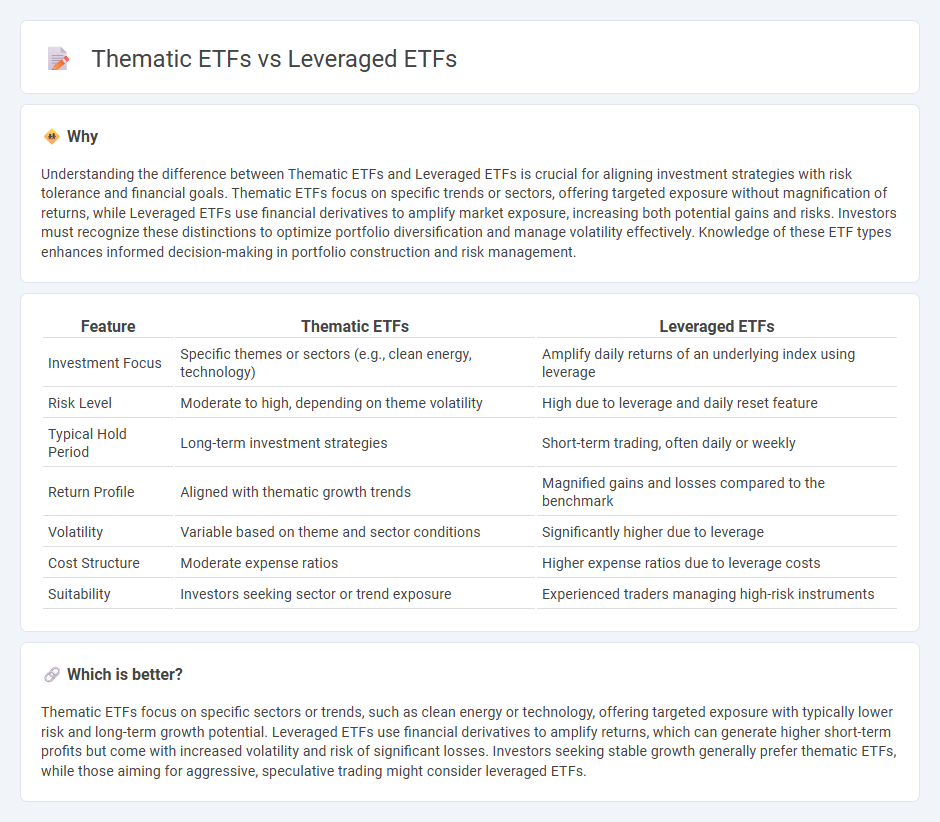

Understanding the difference between Thematic ETFs and Leveraged ETFs is crucial for aligning investment strategies with risk tolerance and financial goals. Thematic ETFs focus on specific trends or sectors, offering targeted exposure without magnification of returns, while Leveraged ETFs use financial derivatives to amplify market exposure, increasing both potential gains and risks. Investors must recognize these distinctions to optimize portfolio diversification and manage volatility effectively. Knowledge of these ETF types enhances informed decision-making in portfolio construction and risk management.

Comparison Table

| Feature | Thematic ETFs | Leveraged ETFs |

|---|---|---|

| Investment Focus | Specific themes or sectors (e.g., clean energy, technology) | Amplify daily returns of an underlying index using leverage |

| Risk Level | Moderate to high, depending on theme volatility | High due to leverage and daily reset feature |

| Typical Hold Period | Long-term investment strategies | Short-term trading, often daily or weekly |

| Return Profile | Aligned with thematic growth trends | Magnified gains and losses compared to the benchmark |

| Volatility | Variable based on theme and sector conditions | Significantly higher due to leverage |

| Cost Structure | Moderate expense ratios | Higher expense ratios due to leverage costs |

| Suitability | Investors seeking sector or trend exposure | Experienced traders managing high-risk instruments |

Which is better?

Thematic ETFs focus on specific sectors or trends, such as clean energy or technology, offering targeted exposure with typically lower risk and long-term growth potential. Leveraged ETFs use financial derivatives to amplify returns, which can generate higher short-term profits but come with increased volatility and risk of significant losses. Investors seeking stable growth generally prefer thematic ETFs, while those aiming for aggressive, speculative trading might consider leveraged ETFs.

Connection

Thematic ETFs focus on specific investment themes or sectors, such as technology or clean energy, targeting growth driven by emerging trends. Leveraged ETFs use financial derivatives and debt to amplify the returns of an underlying index, often applied to thematic ETFs to increase potential gains or losses. Combining thematic and leveraged ETFs allows investors to capitalize on high-conviction trends with magnified exposure, but entails heightened risk and volatility.

Key Terms

Leverage Ratio

Leveraged ETFs typically use financial derivatives and debt to amplify returns, often targeting a 2x or 3x leverage ratio relative to the underlying index, while Thematic ETFs concentrate on specific investment themes such as renewable energy or artificial intelligence, without employing leverage. The leverage ratio in Leveraged ETFs increases both potential gains and risks, necessitating careful consideration of volatility decay and daily rebalancing effects. Explore our detailed analysis to understand how leverage ratios impact performance and risk in these distinct ETF categories.

Sector Exposure

Leveraged ETFs amplify returns of specific sectors by using financial derivatives, offering high-risk, high-reward exposure to targeted industries such as technology or healthcare. Thematic ETFs invest in broader, trend-driven themes like clean energy or digital innovation, providing diversified sector exposure aligned with long-term market trends. Explore our detailed analysis to understand which option aligns best with your investment strategy.

Volatility

Leveraged ETFs amplify market movements through debt and derivatives, resulting in significantly higher volatility compared to thematic ETFs, which concentrate on specific sectors or trends and typically exhibit moderate volatility levels. The daily rebalancing mechanism in leveraged ETFs contributes to compounding effects that can intensify price swings, while thematic ETFs offer more stable exposure aligned with long-term growth themes such as clean energy or artificial intelligence. Explore the nuances of volatility dynamics in leveraged and thematic ETFs to make informed investment decisions.

Source and External Links

Leveraged ETFs - Leveraged ETFs aim to deliver daily returns that are a multiple (e.g., 2x or 3x) of the underlying index or asset, but these amplified returns (or losses) are reset daily and do not compound simply over longer periods.

Leveraged ETFs: A Risky Double That Doesn't Multiply - Over time, leveraged ETFs can significantly underperform--or, less commonly, outperform--their expected multiple due to daily rebalancing and compounding effects, with risk and return volatility far exceeding those of traditional ETFs.

7 Best Leveraged ETFs for July 2025 - Leveraged ETFs use borrowed money and derivatives like futures or options to magnify gains and losses, making them far riskier and more expensive than conventional ETFs.

dowidth.com

dowidth.com