ESG integration involves systematically incorporating environmental, social, and governance factors into financial analysis and investment decisions to improve risk-adjusted returns and promote sustainable outcomes. Thematic investing targets specific trends or themes, such as clean energy or social equality, to capitalize on long-term growth opportunities aligning with investor values. Explore deeper insights to understand how these approaches shape modern financial strategies.

Why it is important

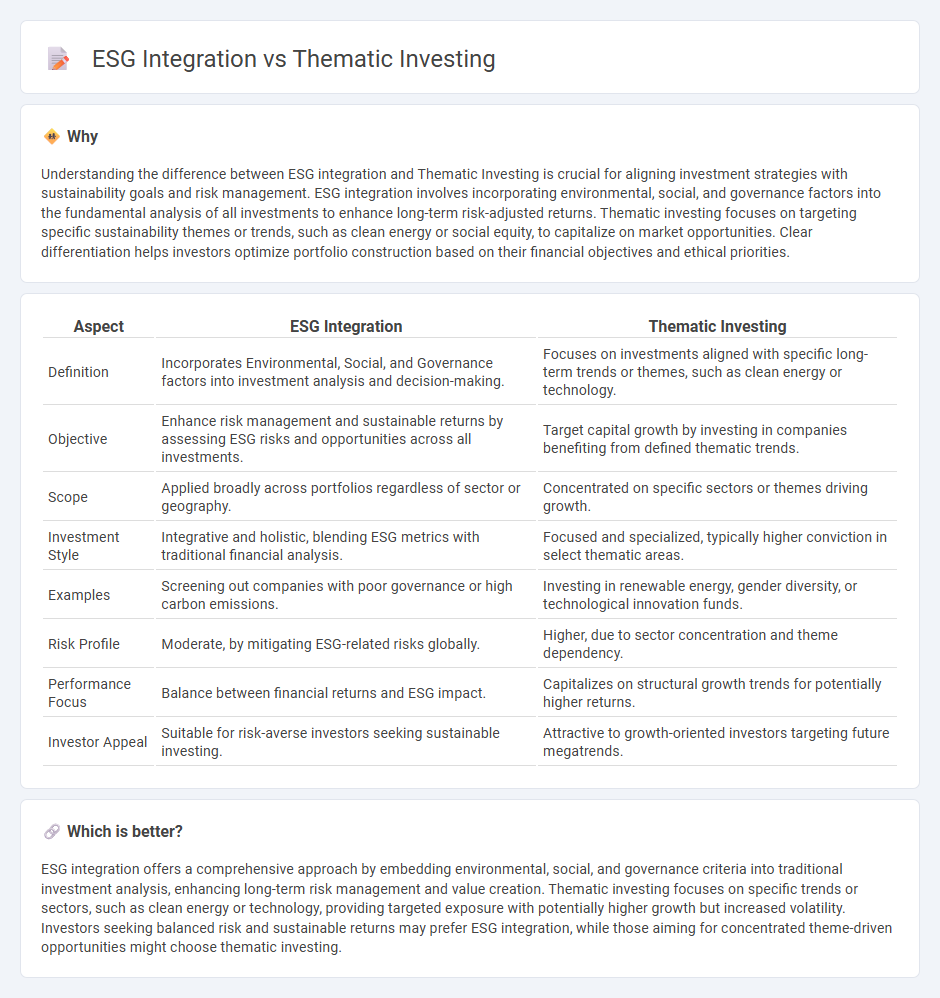

Understanding the difference between ESG integration and Thematic Investing is crucial for aligning investment strategies with sustainability goals and risk management. ESG integration involves incorporating environmental, social, and governance factors into the fundamental analysis of all investments to enhance long-term risk-adjusted returns. Thematic investing focuses on targeting specific sustainability themes or trends, such as clean energy or social equity, to capitalize on market opportunities. Clear differentiation helps investors optimize portfolio construction based on their financial objectives and ethical priorities.

Comparison Table

| Aspect | ESG Integration | Thematic Investing |

|---|---|---|

| Definition | Incorporates Environmental, Social, and Governance factors into investment analysis and decision-making. | Focuses on investments aligned with specific long-term trends or themes, such as clean energy or technology. |

| Objective | Enhance risk management and sustainable returns by assessing ESG risks and opportunities across all investments. | Target capital growth by investing in companies benefiting from defined thematic trends. |

| Scope | Applied broadly across portfolios regardless of sector or geography. | Concentrated on specific sectors or themes driving growth. |

| Investment Style | Integrative and holistic, blending ESG metrics with traditional financial analysis. | Focused and specialized, typically higher conviction in select thematic areas. |

| Examples | Screening out companies with poor governance or high carbon emissions. | Investing in renewable energy, gender diversity, or technological innovation funds. |

| Risk Profile | Moderate, by mitigating ESG-related risks globally. | Higher, due to sector concentration and theme dependency. |

| Performance Focus | Balance between financial returns and ESG impact. | Capitalizes on structural growth trends for potentially higher returns. |

| Investor Appeal | Suitable for risk-averse investors seeking sustainable investing. | Attractive to growth-oriented investors targeting future megatrends. |

Which is better?

ESG integration offers a comprehensive approach by embedding environmental, social, and governance criteria into traditional investment analysis, enhancing long-term risk management and value creation. Thematic investing focuses on specific trends or sectors, such as clean energy or technology, providing targeted exposure with potentially higher growth but increased volatility. Investors seeking balanced risk and sustainable returns may prefer ESG integration, while those aiming for concentrated theme-driven opportunities might choose thematic investing.

Connection

ESG integration involves incorporating environmental, social, and governance factors into financial analysis to enhance risk assessment and investment decisions. Thematic investing targets specific sustainability-related themes such as clean energy or social impact, aligning portfolios with long-term ESG trends. Both approaches emphasize sustainability by directing capital toward companies that prioritize ethical practices and address global challenges.

Key Terms

Investment Theme

Thematic investing targets specific investment themes such as clean energy, technology innovation, or demographic shifts, allowing investors to capitalize on long-term structural trends. ESG integration systematically incorporates environmental, social, and governance factors into traditional investment analysis to enhance risk management and identify sustainable opportunities. Explore the distinctions and benefits of thematic investing versus ESG integration to optimize your investment strategy.

Environmental, Social, and Governance (ESG) Criteria

Thematic investing targets specific environmental, social, or governance trends by selecting companies aligned with particular themes such as clean energy or social equity, whereas ESG integration systematically incorporates ESG criteria into the overall investment analysis and decision-making process across all sectors. ESG scores and metrics drive risk assessment and value creation, enhancing portfolio resilience and sustainability impact. Explore how combining thematic investing with ESG integration can optimize financial returns and positive societal outcomes.

Risk Assessment

Thematic investing targets specific sectors or trends such as clean energy or technology, emphasizing growth potential and market disruption while integrating ESG factors often concentrates on risk assessment by embedding environmental, social, and governance criteria directly into investment analysis to mitigate potential liabilities. ESG integration systematically evaluates risks like regulatory changes, reputational damage, or supply chain issues, enhancing portfolio resilience against long-term uncertainties. Explore deeper insights into how these strategies manage risk and align with sustainable financial goals.

Source and External Links

What is Thematic Investing? | Charles Schwab - Thematic investing targets ideas, personal values, or trends--like artificial intelligence or renewable energy--that cut across traditional sectors, grouping relevant companies into customizable portfolios for investors to easily access emerging opportunities.

Thematic investing - Wikipedia - Thematic investing identifies macro-level trends such as demographic shifts or technological advancements, constructing portfolios from companies across various sectors that are positioned to benefit from these long-term, transformative themes.

Thematic Investing: Tomorrow's themes, today - BlackRock - Thematic investing allows investors to align their portfolios with dynamic, future-shaping trends by capturing returns from themes that persist over time and drive equity market performance beyond traditional sector or industry classifications.

dowidth.com

dowidth.com