Basis trading exploits price differentials between a futures contract and its underlying asset, aiming to profit from the convergence of their values before contract expiration. Risk arbitrage involves capitalizing on price discrepancies in securities during merger or acquisition events, often by purchasing the target company's stock below the expected acquisition price. Explore deeper insights into how these distinct strategies impact portfolio performance and market dynamics.

Why it is important

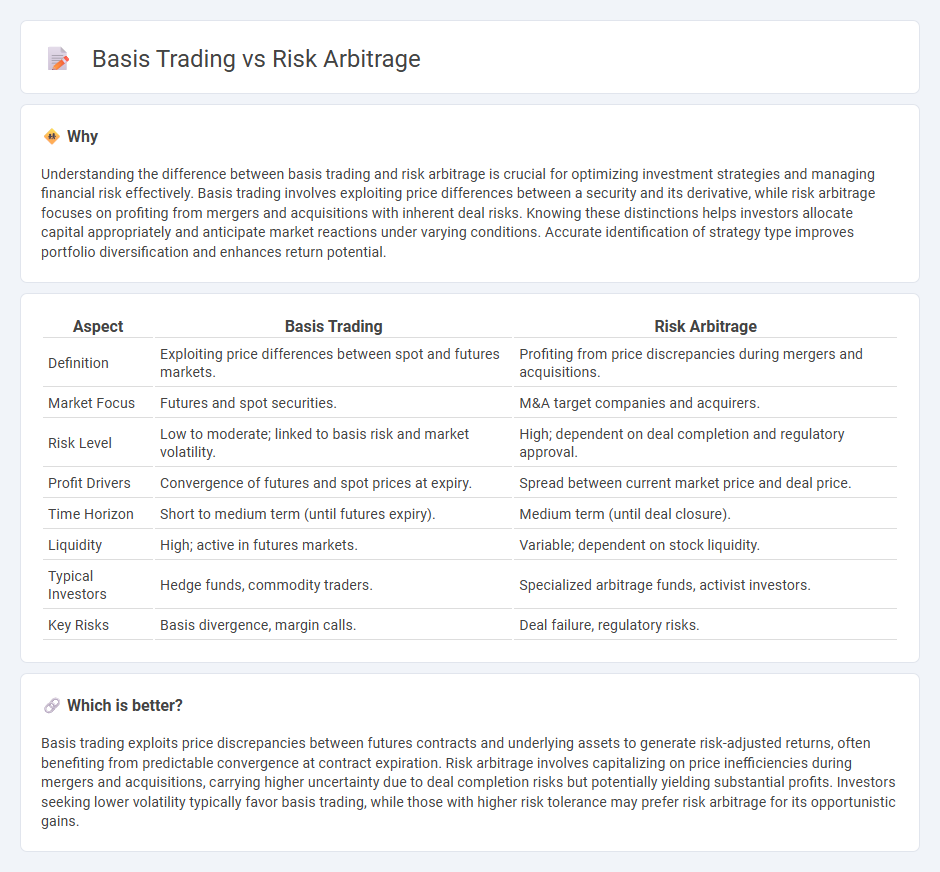

Understanding the difference between basis trading and risk arbitrage is crucial for optimizing investment strategies and managing financial risk effectively. Basis trading involves exploiting price differences between a security and its derivative, while risk arbitrage focuses on profiting from mergers and acquisitions with inherent deal risks. Knowing these distinctions helps investors allocate capital appropriately and anticipate market reactions under varying conditions. Accurate identification of strategy type improves portfolio diversification and enhances return potential.

Comparison Table

| Aspect | Basis Trading | Risk Arbitrage |

|---|---|---|

| Definition | Exploiting price differences between spot and futures markets. | Profiting from price discrepancies during mergers and acquisitions. |

| Market Focus | Futures and spot securities. | M&A target companies and acquirers. |

| Risk Level | Low to moderate; linked to basis risk and market volatility. | High; dependent on deal completion and regulatory approval. |

| Profit Drivers | Convergence of futures and spot prices at expiry. | Spread between current market price and deal price. |

| Time Horizon | Short to medium term (until futures expiry). | Medium term (until deal closure). |

| Liquidity | High; active in futures markets. | Variable; dependent on stock liquidity. |

| Typical Investors | Hedge funds, commodity traders. | Specialized arbitrage funds, activist investors. |

| Key Risks | Basis divergence, margin calls. | Deal failure, regulatory risks. |

Which is better?

Basis trading exploits price discrepancies between futures contracts and underlying assets to generate risk-adjusted returns, often benefiting from predictable convergence at contract expiration. Risk arbitrage involves capitalizing on price inefficiencies during mergers and acquisitions, carrying higher uncertainty due to deal completion risks but potentially yielding substantial profits. Investors seeking lower volatility typically favor basis trading, while those with higher risk tolerance may prefer risk arbitrage for its opportunistic gains.

Connection

Basis trading and risk arbitrage are interconnected through their focus on exploiting price discrepancies in financial markets. Basis trading involves capitalizing on the difference between the spot price of an asset and its futures price, while risk arbitrage targets price inefficiencies arising from corporate events such as mergers and acquisitions. Both strategies rely on identifying and managing market risks to achieve potential arbitrage profits.

Key Terms

Merger Spread

Risk arbitrage involves profiting from the merger spread, which is the difference between a target company's stock price and the acquisition price in a pending merger deal. Basis trading focuses on exploiting the price discrepancies between futures contracts and the underlying assets, often unrelated to specific merger events. Explore more to understand how merger spread dynamics uniquely impact risk arbitrage strategies.

Convergence

Risk arbitrage exploits price discrepancies in merger and acquisition scenarios, relying on the convergence of target and acquirer's stock prices post-deal announcement. Basis trading capitalizes on the convergence between futures contracts and their underlying asset prices as expiration approaches, minimizing risk through relative price adjustments. Explore the nuances of convergence-driven strategies in financial markets to enhance your investment tactics.

Event Risk

Risk arbitrage involves profiting from price discrepancies during mergers and acquisitions by assessing event risk such as deal approvals or regulatory hurdles. Basis trading focuses on exploiting differences between futures and spot prices, where event risk may stem from unexpected market-moving news affecting asset valuation. Explore deeper insights on managing event risk in these strategies to enhance your trading edge.

Source and External Links

Risk arbitrage - Wikipedia - Risk arbitrage, or merger arbitrage, is an investment strategy that seeks to profit from the spread between the target company's stock price and the acquisition price following a merger announcement, involving risks if the deal fails and returns that tend to be positive but asymmetrically exposed to market downturns.

Characteristics of Risk and Return in Risk Arbitrage - GitHub Pages - This academic paper analyzes thousands of mergers and concludes risk arbitrage captures excess returns by profiting from the arbitrage spread when mergers succeed, but these returns are sensitive to market declines and transaction costs.

Merger (Risk) Arbitrage Strategy - AIMA Canada - The main risks in merger arbitrage include deal risk (factors delaying or preventing deal closure) and portfolio risk, with market conditions and interest rates significantly affecting the strategy's outcomes.

dowidth.com

dowidth.com