Copy trading platforms enable investors to automatically replicate the trades of experienced traders, leveraging real-time market data and performance analytics to optimize portfolio growth. Signal providers offer actionable trade alerts based on market analysis and algorithm-driven insights, empowering users to make informed decisions without full automation. Explore the advantages and features of both methods to enhance your trading strategy effectively.

Why it is important

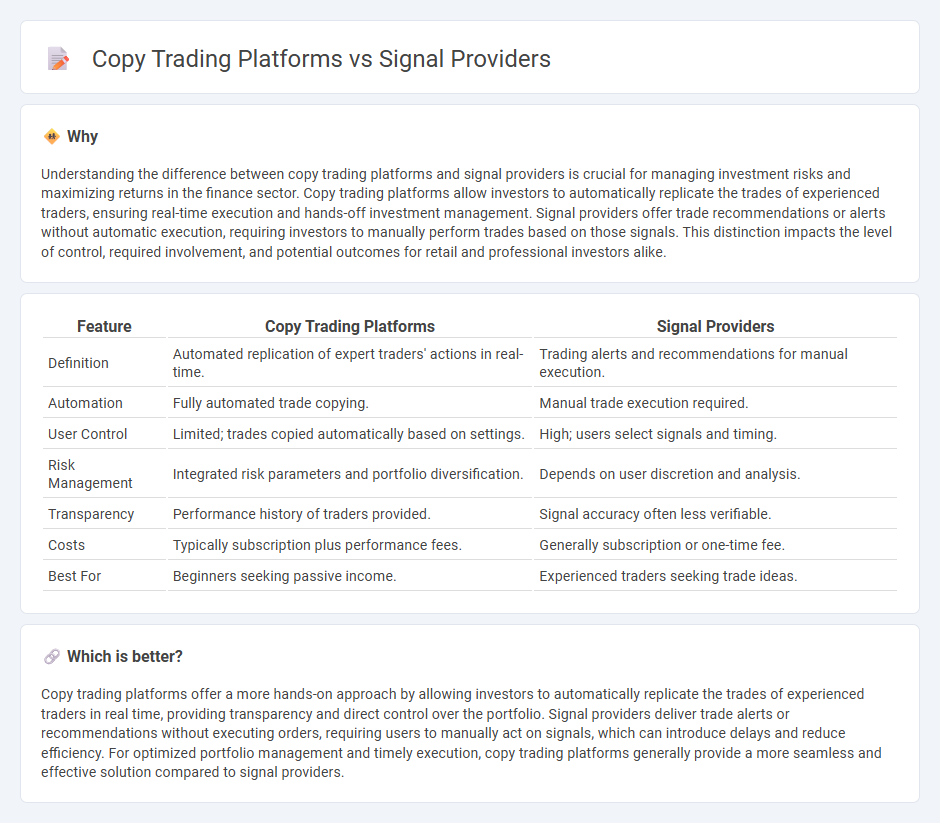

Understanding the difference between copy trading platforms and signal providers is crucial for managing investment risks and maximizing returns in the finance sector. Copy trading platforms allow investors to automatically replicate the trades of experienced traders, ensuring real-time execution and hands-off investment management. Signal providers offer trade recommendations or alerts without automatic execution, requiring investors to manually perform trades based on those signals. This distinction impacts the level of control, required involvement, and potential outcomes for retail and professional investors alike.

Comparison Table

| Feature | Copy Trading Platforms | Signal Providers |

|---|---|---|

| Definition | Automated replication of expert traders' actions in real-time. | Trading alerts and recommendations for manual execution. |

| Automation | Fully automated trade copying. | Manual trade execution required. |

| User Control | Limited; trades copied automatically based on settings. | High; users select signals and timing. |

| Risk Management | Integrated risk parameters and portfolio diversification. | Depends on user discretion and analysis. |

| Transparency | Performance history of traders provided. | Signal accuracy often less verifiable. |

| Costs | Typically subscription plus performance fees. | Generally subscription or one-time fee. |

| Best For | Beginners seeking passive income. | Experienced traders seeking trade ideas. |

Which is better?

Copy trading platforms offer a more hands-on approach by allowing investors to automatically replicate the trades of experienced traders in real time, providing transparency and direct control over the portfolio. Signal providers deliver trade alerts or recommendations without executing orders, requiring users to manually act on signals, which can introduce delays and reduce efficiency. For optimized portfolio management and timely execution, copy trading platforms generally provide a more seamless and effective solution compared to signal providers.

Connection

Copy trading platforms and signal providers operate symbiotically by transmitting verified trading signals to users who replicate those trades automatically, optimizing real-time decision-making. Signal providers analyze market data using advanced algorithms and technical indicators to generate precise trade recommendations, which copy trading platforms integrate to execute trades on behalf of investors. This connection enhances market accessibility, allowing traders to leverage expert strategies and improve portfolio performance with minimal active management.

Key Terms

Trade Execution

Signal providers deliver trade alerts that require manual execution, which may delay entry and affect trade timing, impacting overall performance. Copy trading platforms automate trade execution by mirroring expert traders' moves in real-time, ensuring quicker and more accurate order placement. Explore the benefits of both approaches to optimize your trading strategy and execution speed.

Subscription Model

Signal providers typically charge a monthly or annual subscription fee for access to trading signals derived from expert analysis or algorithmic models. Copy trading platforms often implement subscription models based on tiered access to top traders' portfolios or profit-based fees to align incentives. Explore subscription model variations to identify the best option for your trading strategy and risk appetite.

Risk Management

Signal providers deliver trading alerts based on market analysis, allowing investors to manually execute trades while maintaining full control over risk parameters. Copy trading platforms automate position replication from expert traders, streamlining the investment process but requiring cautious selection to mitigate potential drawdowns. Explore how advanced risk management techniques differ across these tools to optimize your trading strategy effectively.

Source and External Links

Best Forex Signal Providers 2025 - Detailed reviews of top Forex signal providers like 1000pip Builder, Signals365, and Market Expert Group, emphasizing real-time alerts, win rates around 70%, and platforms such as Telegram and MT4/MT5 copiers for efficient trade signals.

MetaTrader 5 - Forex Signals - A copy-trading service offering thousands of Forex signals with detailed statistics including growth rates, win percentages, and reliability scores, enabling automatic copying of successful traders' deals directly to your account.

Best Trading Signal Providers In 2025 - Comparison of leading brokers providing trading signals such as NinjaTrader, Moomoo, and xChief, including information on their trust ratings, fees, mobile accessibility, and client popularity for informed choice of signal services.

dowidth.com

dowidth.com