Private credit involves direct lending by non-bank institutions to businesses, offering tailored financing solutions with less regulatory oversight and often higher yields. Public credit consists of debt instruments like bonds issued and traded in open markets, providing liquidity and transparency for investors. Explore the key differences in risk, return, and accessibility between private credit and public credit to make informed financial decisions.

Why it is important

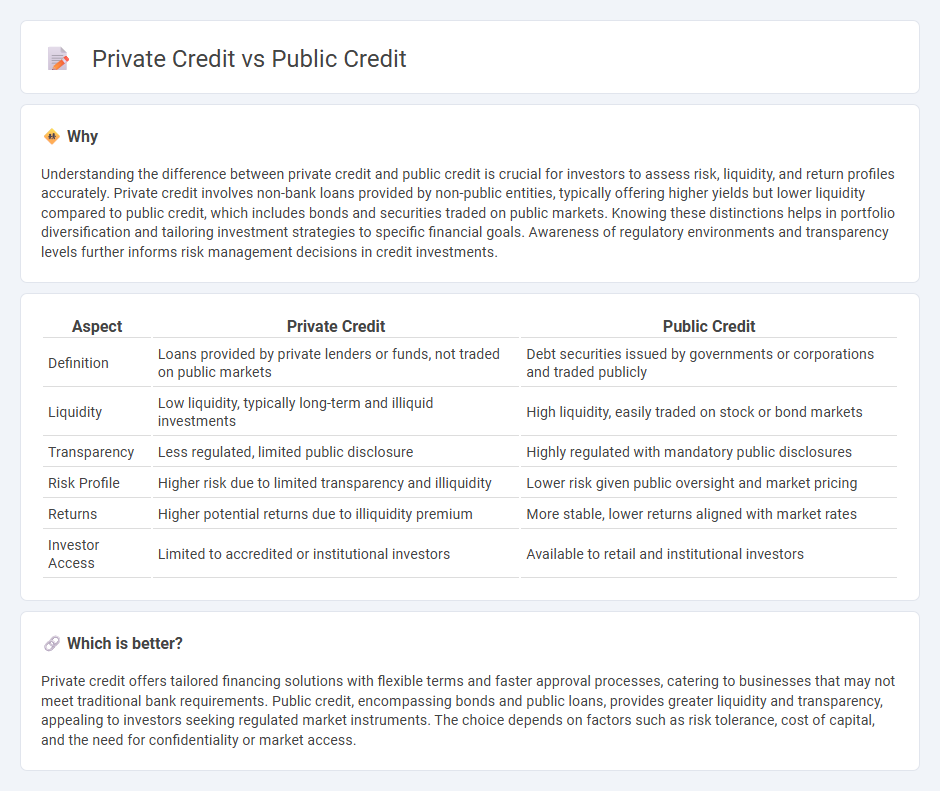

Understanding the difference between private credit and public credit is crucial for investors to assess risk, liquidity, and return profiles accurately. Private credit involves non-bank loans provided by non-public entities, typically offering higher yields but lower liquidity compared to public credit, which includes bonds and securities traded on public markets. Knowing these distinctions helps in portfolio diversification and tailoring investment strategies to specific financial goals. Awareness of regulatory environments and transparency levels further informs risk management decisions in credit investments.

Comparison Table

| Aspect | Private Credit | Public Credit |

|---|---|---|

| Definition | Loans provided by private lenders or funds, not traded on public markets | Debt securities issued by governments or corporations and traded publicly |

| Liquidity | Low liquidity, typically long-term and illiquid investments | High liquidity, easily traded on stock or bond markets |

| Transparency | Less regulated, limited public disclosure | Highly regulated with mandatory public disclosures |

| Risk Profile | Higher risk due to limited transparency and illiquidity | Lower risk given public oversight and market pricing |

| Returns | Higher potential returns due to illiquidity premium | More stable, lower returns aligned with market rates |

| Investor Access | Limited to accredited or institutional investors | Available to retail and institutional investors |

Which is better?

Private credit offers tailored financing solutions with flexible terms and faster approval processes, catering to businesses that may not meet traditional bank requirements. Public credit, encompassing bonds and public loans, provides greater liquidity and transparency, appealing to investors seeking regulated market instruments. The choice depends on factors such as risk tolerance, cost of capital, and the need for confidentiality or market access.

Connection

Private credit and public credit are connected through their roles in the broader debt market, where private credit typically involves non-bank lenders providing customized loans to businesses, while public credit consists of publicly traded debt instruments like bonds issued by corporations or governments. Both forms of credit influence corporate capital structure, cost of capital, and risk management strategies, driving liquidity and investment opportunities across financial markets. The interplay between these two credit types affects credit spreads, financing accessibility, and overall market stability.

Key Terms

Issuer

Public credit involves issuers such as governments and large corporations that raise capital through publicly traded bonds, offering transparency and regulatory oversight. Private credit deals with non-bank lenders providing direct loans to mid-sized companies or private entities, often featuring tailored terms and less regulatory scrutiny. Explore the differences in issuer types and benefits to better understand the strategic advantages of public versus private credit.

Transparency

Public credit markets offer higher transparency with standardized reporting and regulatory oversight, enabling investors to access timely financial disclosures. Private credit markets often lack comparable transparency due to less stringent reporting requirements and limited public information, impacting risk assessment and valuation. Explore the nuances of transparency in public versus private credit to enhance your investment strategy.

Regulation

Public credit markets are heavily regulated by government agencies such as the SEC, ensuring transparency and investor protection through stringent disclosure requirements and standardized reporting formats. Private credit, operating outside public exchanges, encounters less regulatory oversight, allowing for more flexible deal structures but with increased counterparty risk and limited liquidity. Explore further to understand how regulatory frameworks impact risk profiles and investment opportunities in both credit markets.

Source and External Links

Private Credit vs Public Credit - Public credit refers to debt instruments like corporate bonds issued and traded on public markets with high liquidity and regulatory oversight, typically from larger companies, whereas private credit involves privately negotiated loans often for smaller firms, with customized terms and less liquidity.

Public Credit | CPP Investments - Public Credit investing involves buying investment and sub-investment grade, publicly traded single-name credits and credit indices across global sectors, emphasizing liquidity and market accessibility.

Understanding Public and Private Credit | PIMCO - Public credit is debt issued or traded on public markets, encompassing investment grade and high yield corporate bonds, securitized products, and bank loans, with transparent ratings and broad investor access.

dowidth.com

dowidth.com