Digital asset custody involves secure storage solutions specifically designed for cryptocurrencies and blockchain-based assets, emphasizing advanced encryption and decentralized security protocols. Broker-dealer custody refers to traditional financial institutions holding client assets, typically offering regulatory oversight and integration with conventional investment platforms. Explore the key differences and benefits of each custody method to make informed financial decisions.

Why it is important

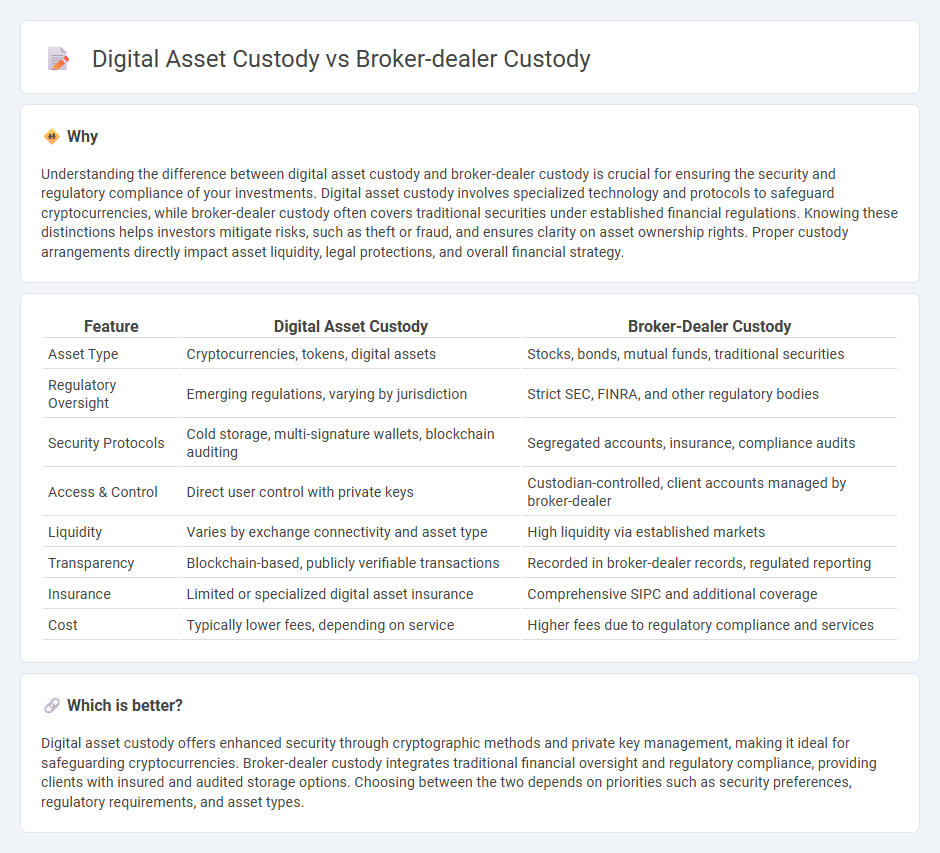

Understanding the difference between digital asset custody and broker-dealer custody is crucial for ensuring the security and regulatory compliance of your investments. Digital asset custody involves specialized technology and protocols to safeguard cryptocurrencies, while broker-dealer custody often covers traditional securities under established financial regulations. Knowing these distinctions helps investors mitigate risks, such as theft or fraud, and ensures clarity on asset ownership rights. Proper custody arrangements directly impact asset liquidity, legal protections, and overall financial strategy.

Comparison Table

| Feature | Digital Asset Custody | Broker-Dealer Custody |

|---|---|---|

| Asset Type | Cryptocurrencies, tokens, digital assets | Stocks, bonds, mutual funds, traditional securities |

| Regulatory Oversight | Emerging regulations, varying by jurisdiction | Strict SEC, FINRA, and other regulatory bodies |

| Security Protocols | Cold storage, multi-signature wallets, blockchain auditing | Segregated accounts, insurance, compliance audits |

| Access & Control | Direct user control with private keys | Custodian-controlled, client accounts managed by broker-dealer |

| Liquidity | Varies by exchange connectivity and asset type | High liquidity via established markets |

| Transparency | Blockchain-based, publicly verifiable transactions | Recorded in broker-dealer records, regulated reporting |

| Insurance | Limited or specialized digital asset insurance | Comprehensive SIPC and additional coverage |

| Cost | Typically lower fees, depending on service | Higher fees due to regulatory compliance and services |

Which is better?

Digital asset custody offers enhanced security through cryptographic methods and private key management, making it ideal for safeguarding cryptocurrencies. Broker-dealer custody integrates traditional financial oversight and regulatory compliance, providing clients with insured and audited storage options. Choosing between the two depends on priorities such as security preferences, regulatory requirements, and asset types.

Connection

Digital asset custody and broker-dealer custody intersect through the secure management and safeguarding of client assets in financial transactions. Broker-dealers increasingly incorporate digital asset custody solutions to facilitate cryptocurrency trading, ensuring compliance with regulatory standards and enhancing transactional security. The integration supports seamless asset transfer, risk mitigation, and adherence to fiduciary responsibilities within the evolving digital finance landscape.

Key Terms

Segregation of assets

Broker-dealer custody entails segregating client assets from the firm's proprietary holdings to ensure protection under regulatory frameworks like the SEC and FINRA, minimizing risk during insolvency. Digital asset custody uses cryptographic methods and multi-signature wallets to securely segregate and store cryptocurrencies, often relying on cold storage solutions to protect against cyber threats. Explore the key differences and compliance considerations for effective asset segregation in modern custody solutions.

Private key management

Broker-dealer custody involves third-party management of private keys, ensuring regulatory compliance and security through established protocols and insurance coverage. Digital asset custody emphasizes self-custody or institutional solutions with advanced cryptographic techniques like multi-signature wallets, hardware security modules (HSMs), and cold storage to mitigate hacking risks. Explore more to understand the nuances and best practices in private key management for secure digital asset custody.

Regulatory compliance

Broker-dealer custody mandates strict adherence to SEC Rule 15c3-3, requiring segregation of client assets and regular audits to prevent misuse, ensuring investor protection under traditional financial regulations. Digital asset custody faces evolving regulatory frameworks from agencies like the SEC and CFTC, emphasizing cybersecurity standards, anti-money laundering compliance, and clarity on asset classification to address the unique risks of cryptocurrency holdings. Explore the differences in regulatory compliance requirements between broker-dealer and digital asset custody to understand the impact on asset safety and investor confidence.

Source and External Links

SEC Permits Specialized Broker-Dealers to Custody Digital Asset Securities - The SEC requires broker-dealers to maintain physical possession or control of fully paid and excess margin securities and mandates written policies to ensure exclusive control and protection against theft or loss, especially tailored for digital asset securities custody by specialized broker-dealers.

A New Charter for Broker-Dealer Crypto Custody - Broker-dealers can custody crypto asset securities under the Customer Protection Rule, which demands physical holding or control at a "good control location," though unique risks from crypto have led to guidance on non-custodial trade handling methods.

FINRA Approves the First Special Purpose Broker Dealer to Custody Digital Asset Securities - FINRA's approval of special purpose broker-dealers to custody digital asset securities introduced a "walled garden" framework requiring exclusive possession, risk disclosures to customers, and written agreements to facilitate custody and transaction in digital asset securities.

dowidth.com

dowidth.com