Loss harvesting involves strategically selling investments at a loss to offset capital gains and reduce taxable income, optimizing overall tax efficiency. Tax bracket management focuses on timing income and deductions to stay within a desired tax bracket, minimizing tax liability and maximizing after-tax returns. Explore deeper insights into how these strategies can enhance your financial planning and tax savings.

Why it is important

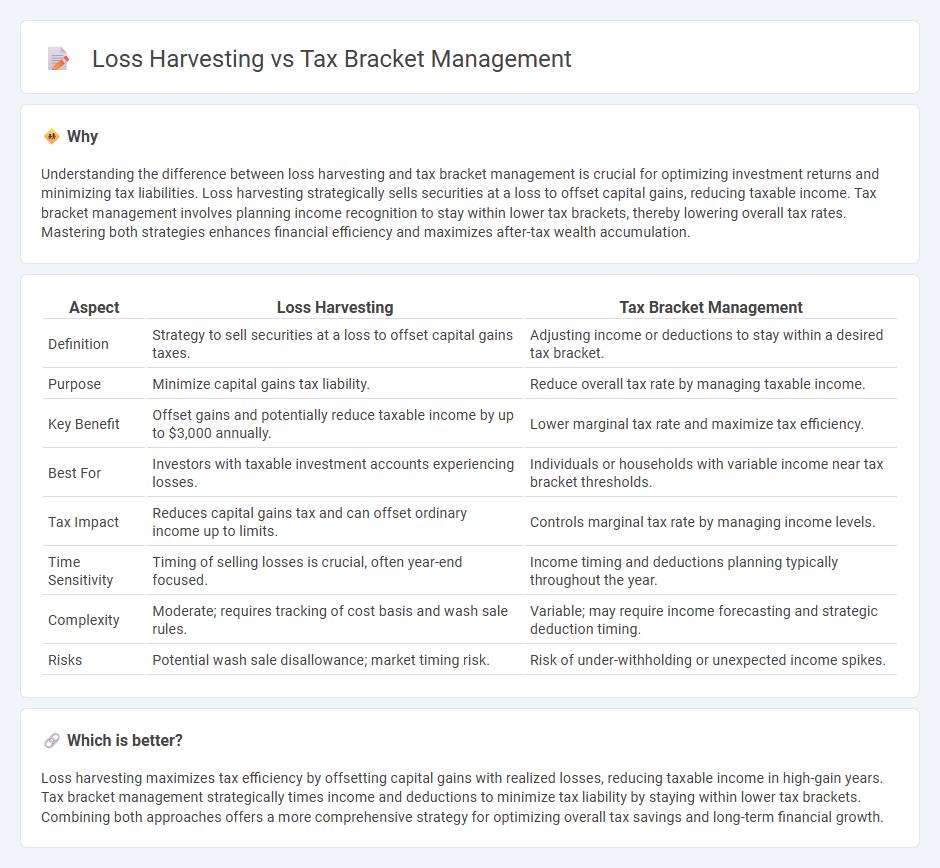

Understanding the difference between loss harvesting and tax bracket management is crucial for optimizing investment returns and minimizing tax liabilities. Loss harvesting strategically sells securities at a loss to offset capital gains, reducing taxable income. Tax bracket management involves planning income recognition to stay within lower tax brackets, thereby lowering overall tax rates. Mastering both strategies enhances financial efficiency and maximizes after-tax wealth accumulation.

Comparison Table

| Aspect | Loss Harvesting | Tax Bracket Management |

|---|---|---|

| Definition | Strategy to sell securities at a loss to offset capital gains taxes. | Adjusting income or deductions to stay within a desired tax bracket. |

| Purpose | Minimize capital gains tax liability. | Reduce overall tax rate by managing taxable income. |

| Key Benefit | Offset gains and potentially reduce taxable income by up to $3,000 annually. | Lower marginal tax rate and maximize tax efficiency. |

| Best For | Investors with taxable investment accounts experiencing losses. | Individuals or households with variable income near tax bracket thresholds. |

| Tax Impact | Reduces capital gains tax and can offset ordinary income up to limits. | Controls marginal tax rate by managing income levels. |

| Time Sensitivity | Timing of selling losses is crucial, often year-end focused. | Income timing and deductions planning typically throughout the year. |

| Complexity | Moderate; requires tracking of cost basis and wash sale rules. | Variable; may require income forecasting and strategic deduction timing. |

| Risks | Potential wash sale disallowance; market timing risk. | Risk of under-withholding or unexpected income spikes. |

Which is better?

Loss harvesting maximizes tax efficiency by offsetting capital gains with realized losses, reducing taxable income in high-gain years. Tax bracket management strategically times income and deductions to minimize tax liability by staying within lower tax brackets. Combining both approaches offers a more comprehensive strategy for optimizing overall tax savings and long-term financial growth.

Connection

Loss harvesting strategically offsets capital gains by selling investments at a loss, reducing taxable income within a specific tax bracket. Managing tax brackets involves timing these losses to avoid pushing income into a higher bracket, optimizing overall tax liability. Combining both tactics enhances after-tax returns by minimizing capital gains taxes and preserving valuable tax thresholds.

Key Terms

**Tax Bracket Management:**

Tax bracket management involves strategically timing income recognition and deductions to keep taxable income within lower tax brackets, thereby reducing overall tax liability. This method optimizes the use of standard deductions, credits, and tax rates to minimize taxes payable on earned income and investment returns. Explore more about how tax bracket management can maximize your after-tax wealth.

Marginal Tax Rate

Managing tax brackets effectively involves optimizing income to avoid pushing earnings into higher Marginal Tax Rate (MTR) brackets, which can result in increased tax liability. Loss harvesting strategically offsets capital gains by selling securities at a loss, thereby reducing taxable income and potentially lowering one's overall MTR. Explore deeper strategies to smartly manage your tax burden by understanding how MTR impacts both tax bracket management and loss harvesting.

Taxable Income

Tax bracket management strategically adjusts income to optimize taxable income within specific IRS tax brackets, minimizing overall tax liability by preventing income from spilling into higher tax rates. Loss harvesting involves selling securities at a loss to offset capital gains, directly reducing taxable income and potentially lowering tax obligations. Explore these strategies in detail to maximize your tax efficiency and financial planning.

Source and External Links

Tax Bracket Management - Aldrich Advisors - Tax bracket management is a strategy used to minimize taxes by realizing income in lower-income years to reduce tax burden in high-income years, helping to increase after-tax returns through effective timing of income and withdrawals, ideally coordinated with a tax advisor for long-term planning.

Using Tax Brackets to Manage Your Taxable Income - Schwab - Tax bracket management involves adjusting taxable income to fill up tax brackets efficiently, including strategies like Roth conversions, taking distributions before required minimum distributions (RMDs), and tax-gain harvesting to manage taxes over time.

PFP Tax Bracket Management Chart | Resources | AICPA & CIMA - This resource offers 15 bracket management strategies such as Roth conversions, timing deductions, capital gain and loss harvesting, investment asset location, and charitable giving techniques to optimize tax brackets and reduce overall taxes.

dowidth.com

dowidth.com