Robo advisory services utilize advanced algorithms and artificial intelligence to provide automated, low-cost portfolio management tailored to individual risk profiles. Digital investment platforms offer a broader range of tools, including self-directed trading options, research resources, and customizable investment strategies. Explore the differences and benefits of robo advisory and digital investment platforms to enhance your financial decision-making.

Why it is important

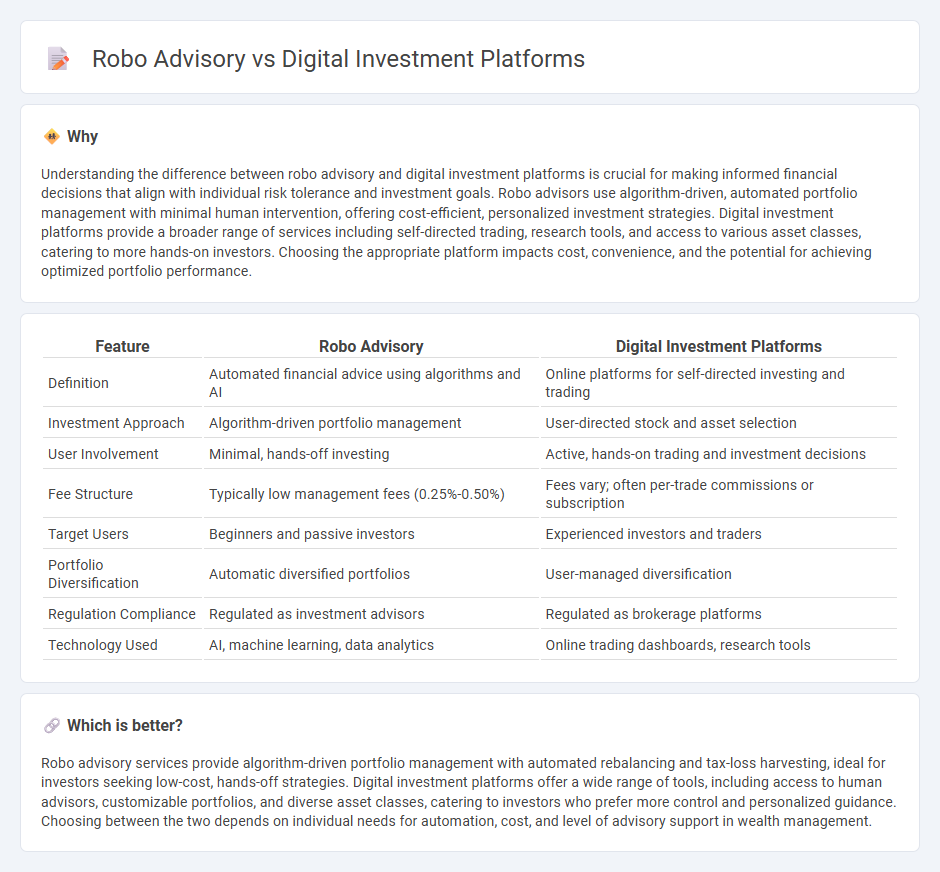

Understanding the difference between robo advisory and digital investment platforms is crucial for making informed financial decisions that align with individual risk tolerance and investment goals. Robo advisors use algorithm-driven, automated portfolio management with minimal human intervention, offering cost-efficient, personalized investment strategies. Digital investment platforms provide a broader range of services including self-directed trading, research tools, and access to various asset classes, catering to more hands-on investors. Choosing the appropriate platform impacts cost, convenience, and the potential for achieving optimized portfolio performance.

Comparison Table

| Feature | Robo Advisory | Digital Investment Platforms |

|---|---|---|

| Definition | Automated financial advice using algorithms and AI | Online platforms for self-directed investing and trading |

| Investment Approach | Algorithm-driven portfolio management | User-directed stock and asset selection |

| User Involvement | Minimal, hands-off investing | Active, hands-on trading and investment decisions |

| Fee Structure | Typically low management fees (0.25%-0.50%) | Fees vary; often per-trade commissions or subscription |

| Target Users | Beginners and passive investors | Experienced investors and traders |

| Portfolio Diversification | Automatic diversified portfolios | User-managed diversification |

| Regulation Compliance | Regulated as investment advisors | Regulated as brokerage platforms |

| Technology Used | AI, machine learning, data analytics | Online trading dashboards, research tools |

Which is better?

Robo advisory services provide algorithm-driven portfolio management with automated rebalancing and tax-loss harvesting, ideal for investors seeking low-cost, hands-off strategies. Digital investment platforms offer a wide range of tools, including access to human advisors, customizable portfolios, and diverse asset classes, catering to investors who prefer more control and personalized guidance. Choosing between the two depends on individual needs for automation, cost, and level of advisory support in wealth management.

Connection

Robo advisory and digital investment platforms are interconnected through automated portfolio management systems that leverage algorithms and artificial intelligence to optimize investment strategies. These platforms provide personalized financial advice by analyzing user data, risk tolerance, and market trends to deliver cost-effective, efficient asset allocation. The integration of robo advisors into digital investment platforms enhances accessibility, reduces fees, and democratizes investment opportunities for a broader audience.

Key Terms

Algorithmic Portfolio Management

Algorithmic Portfolio Management represents the core feature distinguishing digital investment platforms and robo advisory services, utilizing sophisticated algorithms to optimize asset allocation based on investor risk profiles and market trends. Digital investment platforms often offer customizable algorithmic strategies integrating human oversight, whereas robo advisory relies primarily on fully automated, AI-driven portfolio adjustments. Explore the evolving capabilities of algorithm-based management to enhance your investment approach.

Automated Financial Planning

Automated financial planning is revolutionized by digital investment platforms and robo advisory, where digital investment platforms offer user-driven management tools while robo advisors provide algorithm-based portfolio management with personalized recommendations. These platforms utilize artificial intelligence and machine learning to optimize asset allocation, risk assessment, and tax-efficient strategies, creating tailored investment plans for diverse financial goals. Explore how these innovative technologies can transform your financial future with smart, automated planning solutions.

User-Controlled Investment Selection

Digital investment platforms offer users full control over selecting individual stocks, bonds, and ETFs, catering to experienced investors who prefer hands-on portfolio management. Robo advisory services utilize algorithms to create and manage diversified portfolios based on user risk profiles, reducing the need for manual selection and ongoing monitoring. Explore how user control impacts investment outcomes by comparing these two approaches in detail.

Source and External Links

Schwab Intelligent Portfolios - Automated Investing - Schwab offers a robo-advisor platform that builds, monitors, and automatically rebalances diversified ETF portfolios with no advisory fees, designed to match users' goals and risk tolerance.

Robo-Advisor - Automated Investing Services - Vanguard - Vanguard Digital Advisor provides personalized automated investing with risk assessment, goal setting, and premium financial planning tools including tax-loss harvesting.

Digital platforms and AI are empowering individual investors - Digital investment platforms enhanced by AI offer individuals predictive insights and tailored advice, revolutionizing investment decision-making and promoting financial inclusion.

dowidth.com

dowidth.com