Payment for order flow (PFOF) involves brokers receiving compensation for directing client orders to specific market makers, influencing trade execution costs and transparency. Request for quote (RFQ) is a process where investors solicit price quotes from multiple dealers to obtain competitive pricing and liquidity, commonly used in bond and over-the-counter markets. Explore the differences between PFOF and RFQ to understand their impact on trading strategies and market efficiency.

Why it is important

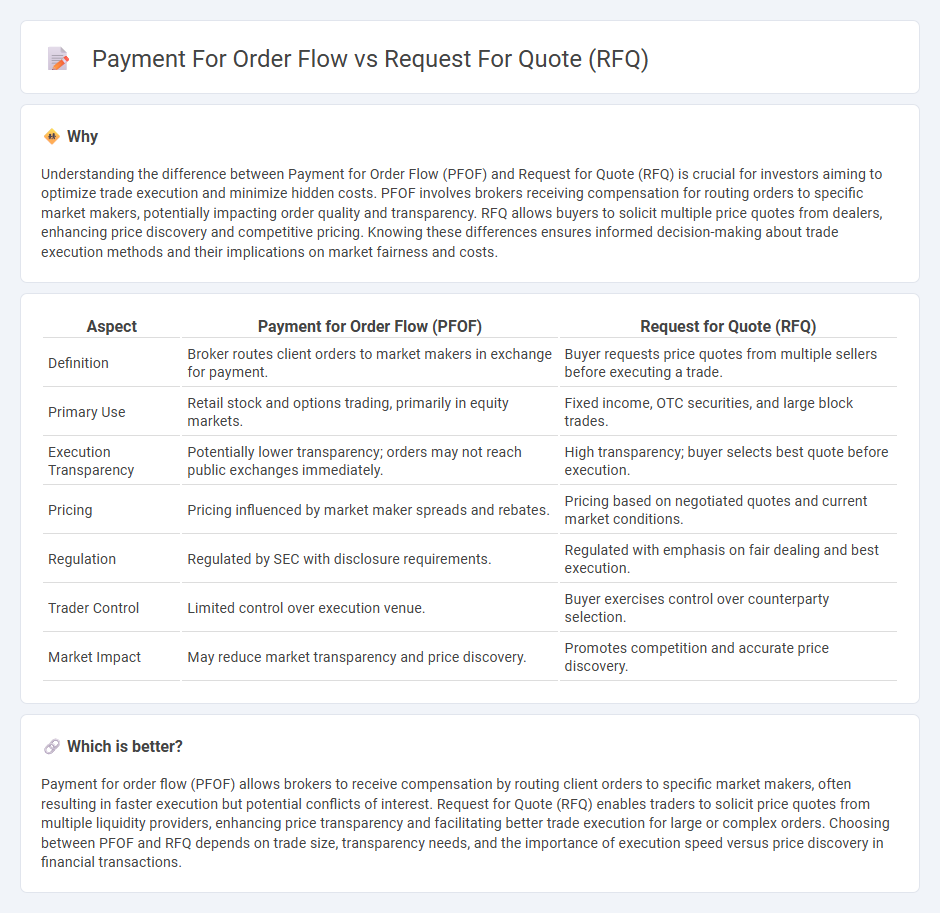

Understanding the difference between Payment for Order Flow (PFOF) and Request for Quote (RFQ) is crucial for investors aiming to optimize trade execution and minimize hidden costs. PFOF involves brokers receiving compensation for routing orders to specific market makers, potentially impacting order quality and transparency. RFQ allows buyers to solicit multiple price quotes from dealers, enhancing price discovery and competitive pricing. Knowing these differences ensures informed decision-making about trade execution methods and their implications on market fairness and costs.

Comparison Table

| Aspect | Payment for Order Flow (PFOF) | Request for Quote (RFQ) |

|---|---|---|

| Definition | Broker routes client orders to market makers in exchange for payment. | Buyer requests price quotes from multiple sellers before executing a trade. |

| Primary Use | Retail stock and options trading, primarily in equity markets. | Fixed income, OTC securities, and large block trades. |

| Execution Transparency | Potentially lower transparency; orders may not reach public exchanges immediately. | High transparency; buyer selects best quote before execution. |

| Pricing | Pricing influenced by market maker spreads and rebates. | Pricing based on negotiated quotes and current market conditions. |

| Regulation | Regulated by SEC with disclosure requirements. | Regulated with emphasis on fair dealing and best execution. |

| Trader Control | Limited control over execution venue. | Buyer exercises control over counterparty selection. |

| Market Impact | May reduce market transparency and price discovery. | Promotes competition and accurate price discovery. |

Which is better?

Payment for order flow (PFOF) allows brokers to receive compensation by routing client orders to specific market makers, often resulting in faster execution but potential conflicts of interest. Request for Quote (RFQ) enables traders to solicit price quotes from multiple liquidity providers, enhancing price transparency and facilitating better trade execution for large or complex orders. Choosing between PFOF and RFQ depends on trade size, transparency needs, and the importance of execution speed versus price discovery in financial transactions.

Connection

Payment for Order Flow (PFOF) and Request for Quote (RFQ) are interconnected in financial markets through the mechanism of trade execution and liquidity provision. PFOF involves brokers receiving compensation from market makers for directing orders to them, while RFQ is a process where buyers request price quotes from multiple dealers to achieve the best execution price. Both systems impact market transparency, execution quality, and the pricing efficiency of securities within equity and fixed income markets.

Key Terms

Order execution

Request for quote (RFQ) provides transparent price discovery by soliciting competitive bids from multiple market makers, enhancing order execution quality through visible and firm quotes. Payment for order flow (PFOF) involves brokers receiving compensation for routing orders to specific market makers, which can create potential conflicts affecting the best execution of trades. Explore detailed comparisons to understand how each impacts order execution efficiency and investor outcomes.

Market transparency

Request for Quote (RFQ) systems enhance market transparency by providing clear, firm prices from multiple dealers before trade execution, allowing investors to compare and select the best offer. In contrast, Payment for Order Flow (PFOF) often reduces transparency as brokers route orders to market makers primarily for financial incentives, potentially leading to conflicts of interest and less favorable prices for investors. Explore the nuances of how these mechanisms impact market transparency for informed trading decisions.

Broker compensation

Request for Quote (RFQ) models enable brokers to earn compensation directly from clients or market makers based on price transparency and execution quality. Payment for Order Flow (PFOF) involves brokers receiving fees from third-party market makers in exchange for routing client orders, which can influence broker incentives and trade execution quality. Explore further to understand how these compensation structures impact broker behavior and investor outcomes.

Source and External Links

Request for quotation - A request for quotation (RfQ) is a business process where a company requests a quote from suppliers for specific products or services, often including detailed specifications to ensure comparable and accurate bids.

Request for Quote (RFQ) - An RFQ is a document asking suppliers to provide price quotes, focusing primarily on cost and payment terms, often used when the buyer knows exactly what is needed and price is a key factor.

Request For Proposal vs. Request For Quote - An RFQ is a process for soliciting detailed price bids from suppliers for specific products or services, enabling companies to compare itemized costs accurately.

dowidth.com

dowidth.com