Quantamental investing integrates quantitative models with fundamental analysis to identify undervalued stocks by analyzing financial statements and market data simultaneously. Factor investing targets specific drivers such as value, momentum, or quality factors to build a portfolio aimed at capturing systematic risk premia. Explore deeper insights to understand the strategic advantages and applications of both investment approaches.

Why it is important

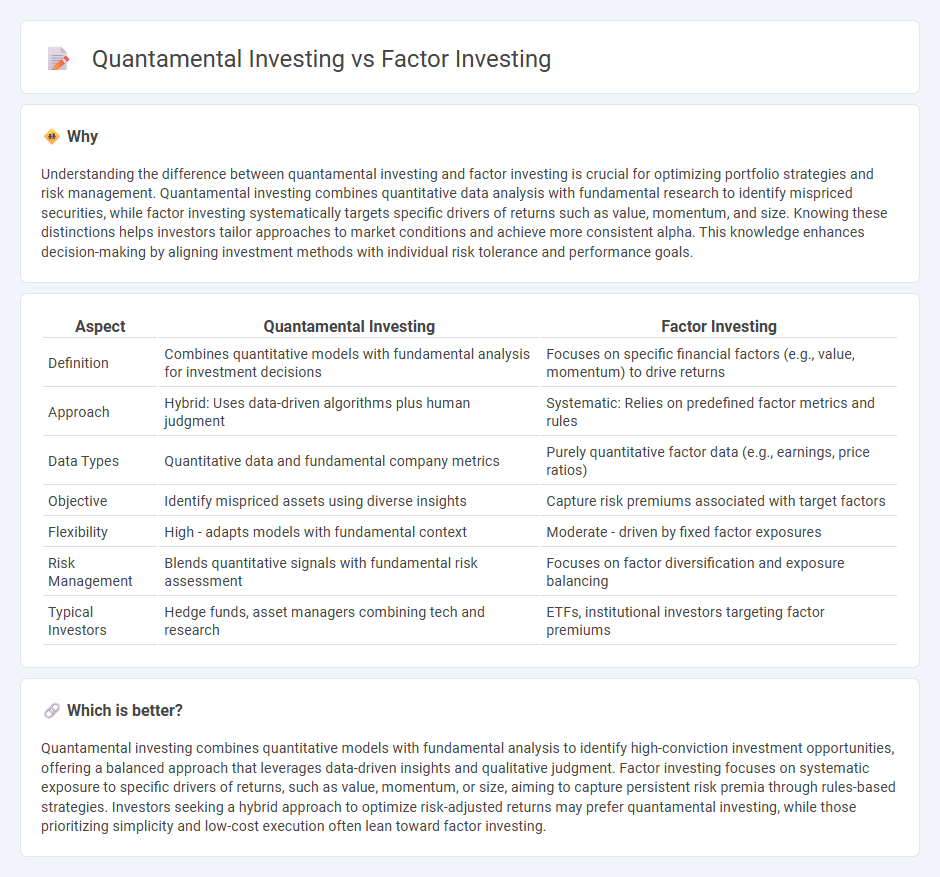

Understanding the difference between quantamental investing and factor investing is crucial for optimizing portfolio strategies and risk management. Quantamental investing combines quantitative data analysis with fundamental research to identify mispriced securities, while factor investing systematically targets specific drivers of returns such as value, momentum, and size. Knowing these distinctions helps investors tailor approaches to market conditions and achieve more consistent alpha. This knowledge enhances decision-making by aligning investment methods with individual risk tolerance and performance goals.

Comparison Table

| Aspect | Quantamental Investing | Factor Investing |

|---|---|---|

| Definition | Combines quantitative models with fundamental analysis for investment decisions | Focuses on specific financial factors (e.g., value, momentum) to drive returns |

| Approach | Hybrid: Uses data-driven algorithms plus human judgment | Systematic: Relies on predefined factor metrics and rules |

| Data Types | Quantitative data and fundamental company metrics | Purely quantitative factor data (e.g., earnings, price ratios) |

| Objective | Identify mispriced assets using diverse insights | Capture risk premiums associated with target factors |

| Flexibility | High - adapts models with fundamental context | Moderate - driven by fixed factor exposures |

| Risk Management | Blends quantitative signals with fundamental risk assessment | Focuses on factor diversification and exposure balancing |

| Typical Investors | Hedge funds, asset managers combining tech and research | ETFs, institutional investors targeting factor premiums |

Which is better?

Quantamental investing combines quantitative models with fundamental analysis to identify high-conviction investment opportunities, offering a balanced approach that leverages data-driven insights and qualitative judgment. Factor investing focuses on systematic exposure to specific drivers of returns, such as value, momentum, or size, aiming to capture persistent risk premia through rules-based strategies. Investors seeking a hybrid approach to optimize risk-adjusted returns may prefer quantamental investing, while those prioritizing simplicity and low-cost execution often lean toward factor investing.

Connection

Quantamental investing blends quantitative analysis with fundamental research by using data-driven models to select stocks based on fundamental value metrics, while factor investing targets specific drivers like value, momentum, or quality to achieve consistent returns. Both strategies rely on identifying factors--such as earnings growth, price-to-book ratio, or volatility--that explain asset performance and enhance portfolio construction. The synergy between quantamental and factor investing enables investors to harness systematic models grounded in fundamental insights for optimized risk-adjusted returns.

Key Terms

Factor Investing:

Factor investing targets specific drivers of returns, such as value, momentum, size, or quality, by systematically selecting stocks based on these attributes to enhance portfolio performance. It relies on academic research and empirical evidence to identify factors that historically outperform the market, aiming for risk-adjusted returns and diversification benefits. Explore more to understand how factor investing can optimize your investment strategy and contribute to long-term growth.

Risk Premiums

Factor investing targets specific risk premiums such as value, momentum, and size to achieve consistent returns by systematically exploiting market inefficiencies. Quantamental investing combines quantitative models with fundamental analysis to enhance the identification and assessment of risk premiums, blending data-driven signals with qualitative insights. Explore how integrating risk premiums in these strategies can optimize portfolio performance and risk management.

Style Factors

Factor investing targets specific style factors such as value, momentum, size, and quality to systematically enhance portfolio returns and manage risk. Quantamental investing combines quantitative models with fundamental analysis to refine factor exposure and improve stock selection accuracy. Explore more to understand how integrating these strategies can optimize your investment approach.

Source and External Links

What is Factor Investing? - NEPC - Factor investing aims to capture premiums related to specific risks to achieve long-term excess returns by constructing diversified multi-factor portfolios tailored to individual investment goals, mitigating short-term downsides while enhancing returns over time.

Guide to factor investing in equity markets - Robeco - Factor investing involves targeting market segments with characteristics like value, momentum, low volatility, and quality that have historically delivered higher risk-adjusted returns than passive market investments, offering a premium over the market in the long run.

What are factor based funds? | Vanguard - Factor-based funds are actively managed portfolios that deliberately tilt toward specific stock characteristics such as value, momentum, quality, minimum volatility, or a multifactor combination, aiming to provide consistent exposure to factors with long-term capital appreciation potential.

dowidth.com

dowidth.com