Flash loan attacks exploit uncollateralized loans to manipulate decentralized finance protocols rapidly, causing abrupt price distortions and liquidity issues. Pump and dump schemes involve artificially inflating asset prices through misleading information before selling off assets at a profit, leading to market crashes and investor losses. Explore the mechanisms, impacts, and defenses against these key threats to modern financial markets.

Why it is important

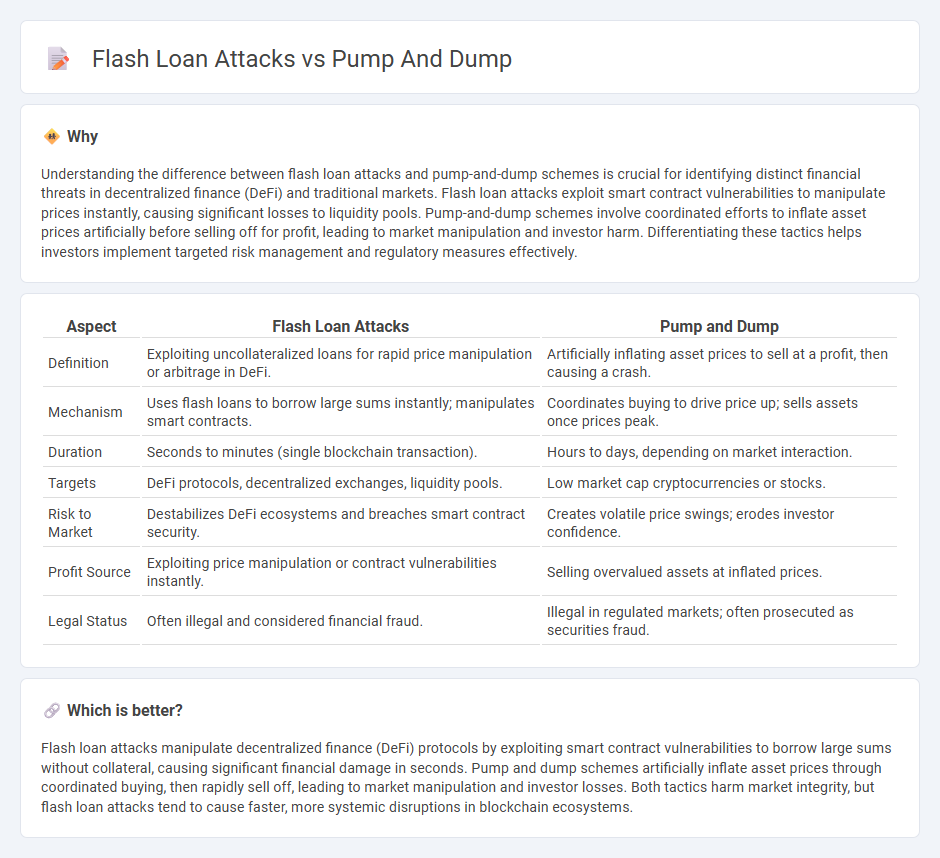

Understanding the difference between flash loan attacks and pump-and-dump schemes is crucial for identifying distinct financial threats in decentralized finance (DeFi) and traditional markets. Flash loan attacks exploit smart contract vulnerabilities to manipulate prices instantly, causing significant losses to liquidity pools. Pump-and-dump schemes involve coordinated efforts to inflate asset prices artificially before selling off for profit, leading to market manipulation and investor harm. Differentiating these tactics helps investors implement targeted risk management and regulatory measures effectively.

Comparison Table

| Aspect | Flash Loan Attacks | Pump and Dump |

|---|---|---|

| Definition | Exploiting uncollateralized loans for rapid price manipulation or arbitrage in DeFi. | Artificially inflating asset prices to sell at a profit, then causing a crash. |

| Mechanism | Uses flash loans to borrow large sums instantly; manipulates smart contracts. | Coordinates buying to drive price up; sells assets once prices peak. |

| Duration | Seconds to minutes (single blockchain transaction). | Hours to days, depending on market interaction. |

| Targets | DeFi protocols, decentralized exchanges, liquidity pools. | Low market cap cryptocurrencies or stocks. |

| Risk to Market | Destabilizes DeFi ecosystems and breaches smart contract security. | Creates volatile price swings; erodes investor confidence. |

| Profit Source | Exploiting price manipulation or contract vulnerabilities instantly. | Selling overvalued assets at inflated prices. |

| Legal Status | Often illegal and considered financial fraud. | Illegal in regulated markets; often prosecuted as securities fraud. |

Which is better?

Flash loan attacks manipulate decentralized finance (DeFi) protocols by exploiting smart contract vulnerabilities to borrow large sums without collateral, causing significant financial damage in seconds. Pump and dump schemes artificially inflate asset prices through coordinated buying, then rapidly sell off, leading to market manipulation and investor losses. Both tactics harm market integrity, but flash loan attacks tend to cause faster, more systemic disruptions in blockchain ecosystems.

Connection

Flash loan attacks and pump and dump schemes exploit vulnerabilities in decentralized finance (DeFi) markets by manipulating asset prices in short timeframes. Flash loans provide instant, uncollateralized capital that attackers use to artificially inflate token prices during pump and dump operations, enabling them to sell at inflated prices before the market corrects. This synergy allows for rapid profit extraction while destabilizing market integrity and investor trust in DeFi ecosystems.

Key Terms

Market Manipulation

Pump and dump schemes artificially inflate cryptocurrency prices by spreading misleading information to attract buyers, allowing manipulators to sell at a profit before prices collapse. Flash loan attacks exploit uncollateralized loans to manipulate market prices within decentralized finance platforms, often triggering liquidations or draining liquidity pools. Discover how these distinct market manipulation tactics impact the crypto ecosystem and measures to mitigate risks.

Liquidity

Pump and dump schemes manipulate liquidity by artificially inflating asset prices through coordinated buying, followed by rapid selling to exploit market inefficiencies and liquidity gaps. Flash loan attacks exploit smart contract vulnerabilities in decentralized finance (DeFi) platforms, leveraging enormous temporary liquidity to manipulate markets or drain funds without upfront capital. Explore deeper insights on how liquidity dynamics influence security risks in DeFi ecosystems.

Smart Contracts

Pump and dump schemes manipulate token prices through coordinated buying and selling, exploiting the liquidity and trust within decentralized finance (DeFi) smart contracts. Flash loan attacks exploit vulnerabilities in smart contracts by borrowing large amounts of crypto assets without collateral, executing rapid trades or manipulations, and repaying within a single transaction to profit off price discrepancies. Explore the mechanisms and defenses of these exploit strategies in smart contract ecosystems for a deeper understanding.

Source and External Links

Pump and dump - Wikipedia - Pump and dump is a securities fraud involving artificially inflating a stock's price through false positive statements to sell cheaply bought shares at a higher price, commonly targeting small-cap stocks and cryptocurrencies, after which the price collapses and investors lose money.

Investor Protection Guide: Micro-cap Stock Fraud ("Pump and Dump") - This fraud uses false or misleading claims to raise microcap stock prices, then promoters sell their shares at an inflated price, leaving later investors with losses, often utilizing the Internet for mass misinformation.

What is Pump and Dump? - NICE Actimize - A rogue trader manipulates a security's price by spreading false information to inflate the value and then sells their holdings at the peak before the price collapses, causing losses for other investors.

dowidth.com

dowidth.com