Zero day options expire on the same day they are traded, offering traders high-risk, short-term opportunities to capitalize on intraday price movements with enhanced liquidity and tighter spreads. Quarterly options, expiring every three months, provide longer time frames for strategic hedging and portfolio management, allowing for more calculated risk exposure and time decay considerations. Explore the key differences between zero day options and quarterly options to optimize your trading strategy.

Why it is important

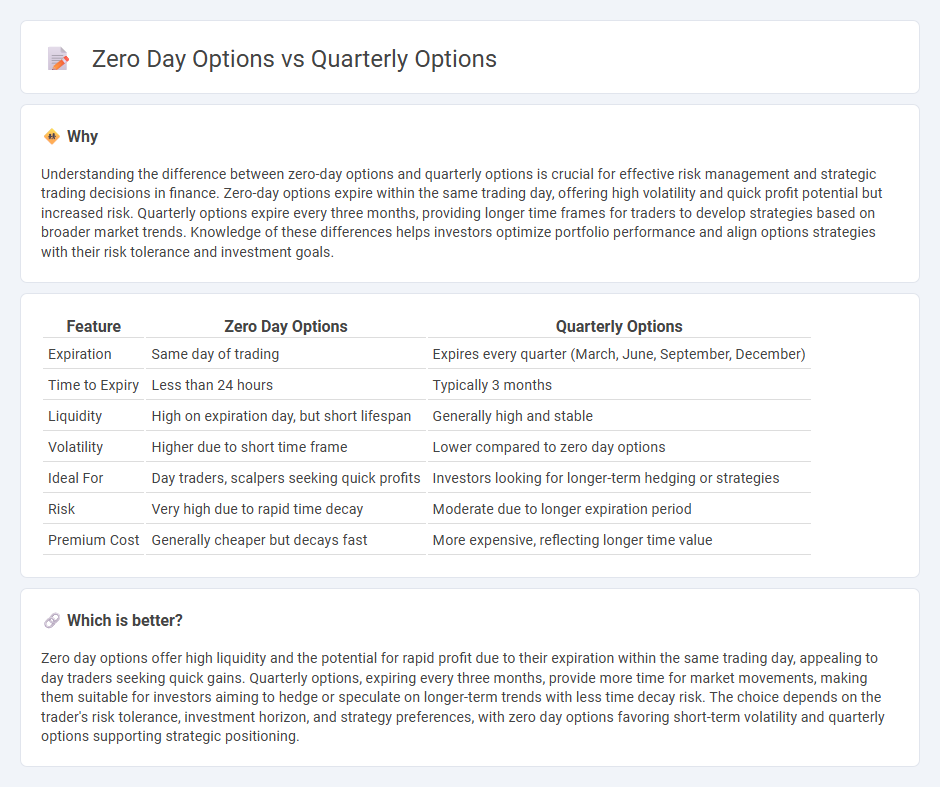

Understanding the difference between zero-day options and quarterly options is crucial for effective risk management and strategic trading decisions in finance. Zero-day options expire within the same trading day, offering high volatility and quick profit potential but increased risk. Quarterly options expire every three months, providing longer time frames for traders to develop strategies based on broader market trends. Knowledge of these differences helps investors optimize portfolio performance and align options strategies with their risk tolerance and investment goals.

Comparison Table

| Feature | Zero Day Options | Quarterly Options |

|---|---|---|

| Expiration | Same day of trading | Expires every quarter (March, June, September, December) |

| Time to Expiry | Less than 24 hours | Typically 3 months |

| Liquidity | High on expiration day, but short lifespan | Generally high and stable |

| Volatility | Higher due to short time frame | Lower compared to zero day options |

| Ideal For | Day traders, scalpers seeking quick profits | Investors looking for longer-term hedging or strategies |

| Risk | Very high due to rapid time decay | Moderate due to longer expiration period |

| Premium Cost | Generally cheaper but decays fast | More expensive, reflecting longer time value |

Which is better?

Zero day options offer high liquidity and the potential for rapid profit due to their expiration within the same trading day, appealing to day traders seeking quick gains. Quarterly options, expiring every three months, provide more time for market movements, making them suitable for investors aiming to hedge or speculate on longer-term trends with less time decay risk. The choice depends on the trader's risk tolerance, investment horizon, and strategy preferences, with zero day options favoring short-term volatility and quarterly options supporting strategic positioning.

Connection

Zero day options and quarterly options are connected through their expiration cycles, where zero day options expire on the same day they are traded, providing ultra-short-term trading opportunities, while quarterly options expire on the last trading day of a specific quarter, offering longer-term strategies aligned with financial reporting periods. Both types of options enhance portfolio diversification by catering to different investor risk appetites and market outlooks. The linkage facilitates advanced hedging techniques and dynamic trading strategies in equity and index options markets.

Key Terms

Expiration Cycle

Quarterly options expire every three months, offering consistent expiration dates such as the third Friday of March, June, September, and December, enabling traders to plan longer-term strategies. Zero day options, on the other hand, expire on the same day they are traded, providing ultra-short-term opportunities with high risk and reward potential for day traders and scalpers. Explore more about how expiration cycles influence your trading tactics and risk management.

Time Decay

Quarterly options exhibit slower time decay due to their longer expiration periods, allowing traders more flexibility and reduced daily devaluation risk. Zero day options experience rapid theta decay, making them highly sensitive to time passage and ideal for short-term strategies focused on intraday volatility. Explore in-depth comparisons and strategies to optimize your options trading portfolio.

Trading Strategy

Quarterly options offer traders extended time horizons and typically lower time decay, making them suitable for strategies involving longer-term market expectations and reduced volatility sensitivity. Zero day options present opportunities for high-risk, high-reward trades due to their expiration within the same trading day, necessitating precise timing and rapid decision-making. Explore detailed trading strategies and risk management techniques for both option types to optimize your portfolio performance.

Source and External Links

Quarterly Options - OCC - Quarterly options are options contracts expiring on the last business day of each financial quarter (March, June, September, December) with similar product specifications to monthly options, including exercise style and strike price intervals, and are settled based on the closing values of the underlying ETF or index components.

Nasdaq Weekly and Quarterly Options - Quarterly options expire on the last business day of each calendar quarter and are PM settled, meaning their exercise settlement value is based on the closing level of the underlying index on expiration day.

Understanding listings and expirations - CME Group - Quarterly options on Micro E-mini futures expire on the third Friday of March, June, September, and December; they are American-style options that can be exercised any time prior to expiration and settle using a Special Opening Quotation based on constituent stocks' prices.

dowidth.com

dowidth.com