Robo advisory leverages algorithms and automated platforms to provide cost-effective, data-driven investment management with minimal human intervention, ideal for investors seeking lower fees and streamlined portfolio allocation. Discretionary portfolio management involves professional fund managers actively making investment decisions tailored to clients' specific goals, risk tolerance, and market conditions, offering personalized service and expert oversight. Explore the differences between these approaches to determine which investment strategy best fits your financial objectives.

Why it is important

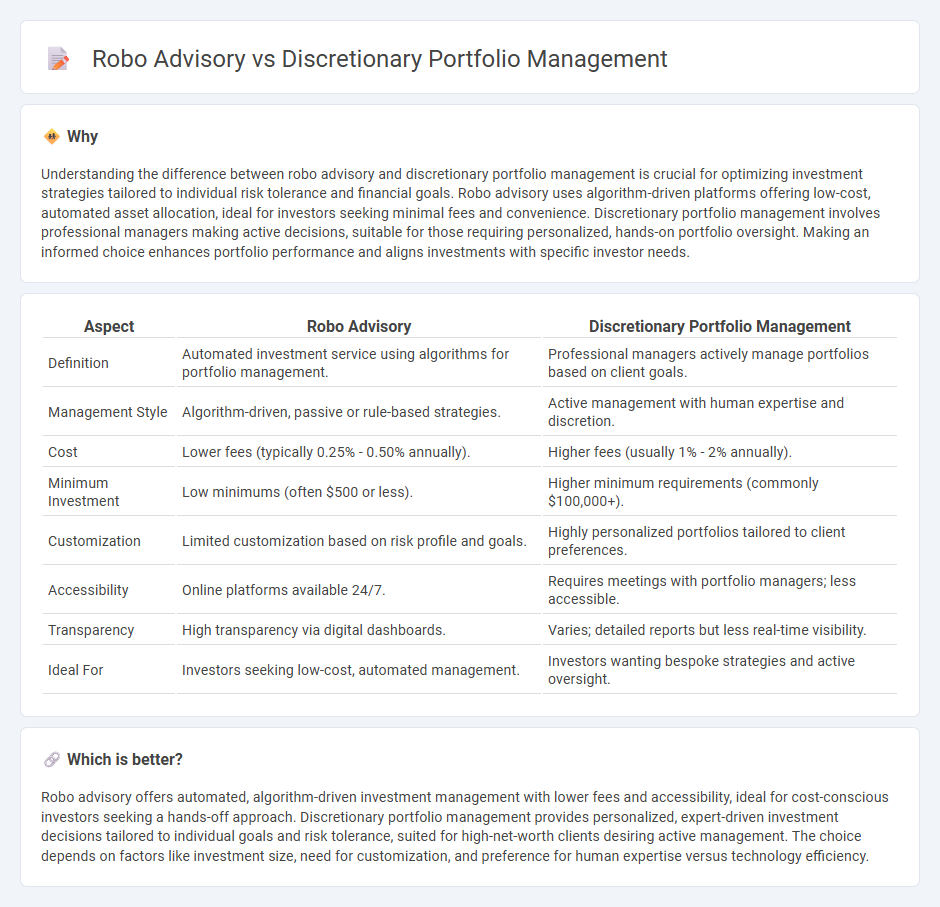

Understanding the difference between robo advisory and discretionary portfolio management is crucial for optimizing investment strategies tailored to individual risk tolerance and financial goals. Robo advisory uses algorithm-driven platforms offering low-cost, automated asset allocation, ideal for investors seeking minimal fees and convenience. Discretionary portfolio management involves professional managers making active decisions, suitable for those requiring personalized, hands-on portfolio oversight. Making an informed choice enhances portfolio performance and aligns investments with specific investor needs.

Comparison Table

| Aspect | Robo Advisory | Discretionary Portfolio Management |

|---|---|---|

| Definition | Automated investment service using algorithms for portfolio management. | Professional managers actively manage portfolios based on client goals. |

| Management Style | Algorithm-driven, passive or rule-based strategies. | Active management with human expertise and discretion. |

| Cost | Lower fees (typically 0.25% - 0.50% annually). | Higher fees (usually 1% - 2% annually). |

| Minimum Investment | Low minimums (often $500 or less). | Higher minimum requirements (commonly $100,000+). |

| Customization | Limited customization based on risk profile and goals. | Highly personalized portfolios tailored to client preferences. |

| Accessibility | Online platforms available 24/7. | Requires meetings with portfolio managers; less accessible. |

| Transparency | High transparency via digital dashboards. | Varies; detailed reports but less real-time visibility. |

| Ideal For | Investors seeking low-cost, automated management. | Investors wanting bespoke strategies and active oversight. |

Which is better?

Robo advisory offers automated, algorithm-driven investment management with lower fees and accessibility, ideal for cost-conscious investors seeking a hands-off approach. Discretionary portfolio management provides personalized, expert-driven investment decisions tailored to individual goals and risk tolerance, suited for high-net-worth clients desiring active management. The choice depends on factors like investment size, need for customization, and preference for human expertise versus technology efficiency.

Connection

Robo advisory and discretionary portfolio management both leverage algorithm-driven processes to optimize investment portfolios tailored to individual risk profiles. Robo advisors automate asset allocation and rebalancing using real-time financial data, while discretionary portfolio management involves professional managers making active investment decisions based on client mandates. The connection lies in combining automated efficiency with expert oversight to enhance portfolio performance and risk management.

Key Terms

Human Expertise vs. Algorithm-Based

Discretionary portfolio management leverages human expertise to tailor investment strategies based on the client's financial goals, risk tolerance, and market insights, providing personalized decision-making and active portfolio adjustments. In contrast, robo advisory utilizes algorithm-based models and automated processes to offer cost-effective, scalable investment solutions with minimal human intervention, often relying on quantitative data and risk assessments. Explore the advantages and limitations of both to determine which approach aligns best with your investment needs.

Customization vs. Standardization

Discretionary portfolio management offers highly personalized investment strategies tailored to individual client goals, risk tolerance, and financial situations, ensuring a bespoke portfolio that adapts to changing market conditions. Robo advisory, in contrast, delivers standardized investment solutions driven by algorithms and predefined risk profiles, providing cost-effective and efficient portfolio management with limited customization. Explore the benefits and trade-offs of customization versus standardization in wealth management to find the ideal approach for your financial objectives.

Active Management vs. Passive Management

Discretionary portfolio management emphasizes active management, where professional portfolio managers make investment decisions to outperform market benchmarks through research and strategic asset allocation. Robo advisory services primarily rely on passive management, using algorithm-driven models to create low-cost, diversified portfolios aligned with investors' risk profiles. Explore the key differences and benefits to determine which investment approach suits your financial goals best.

Source and External Links

An Overview of Discretionary Management - Discretionary portfolio management involves a Portfolio Manager making buy and sell decisions on behalf of clients based on their risk profile and financial goals, offering systematic portfolio implementation and rebalancing for high-net-worth and institutional investors.

Discretionary investment management - Wikipedia - This is a professional investment management service where investment decisions are made by a manager using their expertise rather than client direction, aiming to outperform benchmarks and suitable primarily for institutional investors and high-net-worth individuals.

Discretionary Investment Management - Corporate Finance Institute - Discretionary investment management is characterized by portfolio managers making discretionary buy and sell decisions on behalf of clients, requiring a high level of trust due to the manager's control over client capital.

dowidth.com

dowidth.com