Buy Now Pay Later (BNPL) integration offers consumers flexible installment payments directly linked to their credit accounts, enhancing purchase power without immediate financial burden. Prepaid card integration limits spending to the available balance on the card, promoting budget control but restricting transaction amounts. Explore how these payment solutions reshape consumer behavior and merchant strategies in modern finance.

Why it is important

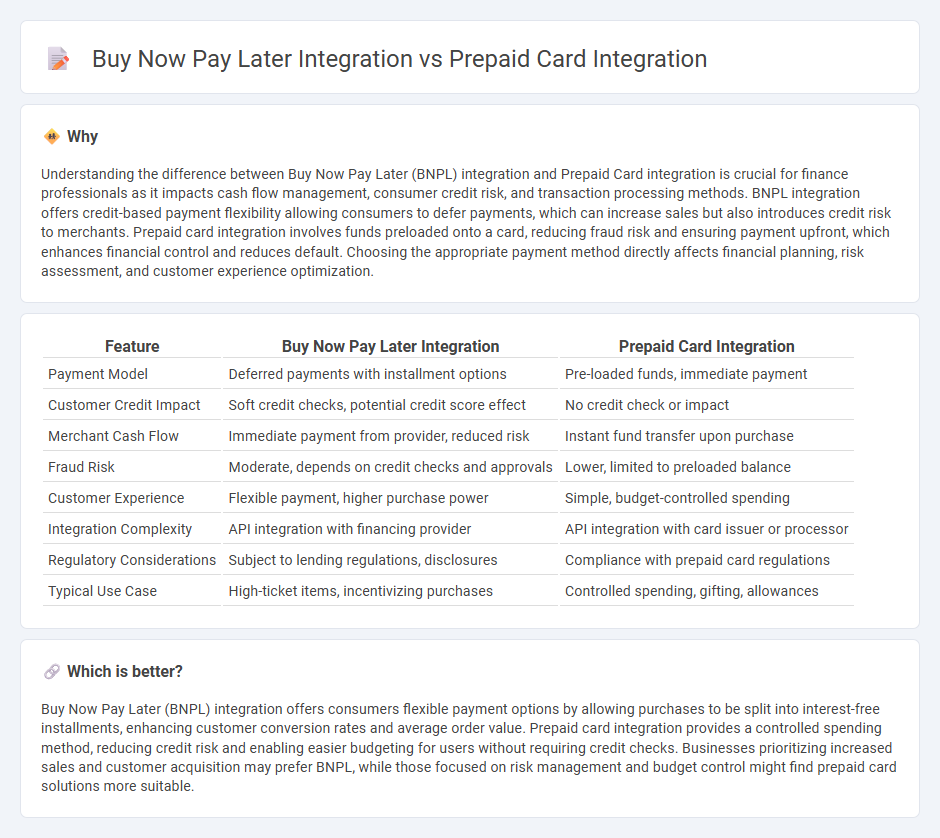

Understanding the difference between Buy Now Pay Later (BNPL) integration and Prepaid Card integration is crucial for finance professionals as it impacts cash flow management, consumer credit risk, and transaction processing methods. BNPL integration offers credit-based payment flexibility allowing consumers to defer payments, which can increase sales but also introduces credit risk to merchants. Prepaid card integration involves funds preloaded onto a card, reducing fraud risk and ensuring payment upfront, which enhances financial control and reduces default. Choosing the appropriate payment method directly affects financial planning, risk assessment, and customer experience optimization.

Comparison Table

| Feature | Buy Now Pay Later Integration | Prepaid Card Integration |

|---|---|---|

| Payment Model | Deferred payments with installment options | Pre-loaded funds, immediate payment |

| Customer Credit Impact | Soft credit checks, potential credit score effect | No credit check or impact |

| Merchant Cash Flow | Immediate payment from provider, reduced risk | Instant fund transfer upon purchase |

| Fraud Risk | Moderate, depends on credit checks and approvals | Lower, limited to preloaded balance |

| Customer Experience | Flexible payment, higher purchase power | Simple, budget-controlled spending |

| Integration Complexity | API integration with financing provider | API integration with card issuer or processor |

| Regulatory Considerations | Subject to lending regulations, disclosures | Compliance with prepaid card regulations |

| Typical Use Case | High-ticket items, incentivizing purchases | Controlled spending, gifting, allowances |

Which is better?

Buy Now Pay Later (BNPL) integration offers consumers flexible payment options by allowing purchases to be split into interest-free installments, enhancing customer conversion rates and average order value. Prepaid card integration provides a controlled spending method, reducing credit risk and enabling easier budgeting for users without requiring credit checks. Businesses prioritizing increased sales and customer acquisition may prefer BNPL, while those focused on risk management and budget control might find prepaid card solutions more suitable.

Connection

Buy Now Pay Later (BNPL) integration and prepaid card integration are connected through their ability to enhance consumer payment flexibility and financial inclusion. Both systems leverage digital payment platforms to provide seamless transaction experiences, with BNPL offering deferred payment options while prepaid cards allow for controlled spending using preloaded funds. Integrating these solutions enables merchants to cater to diverse customer preferences, improving conversion rates and managing credit risk more effectively.

Key Terms

Real-time Settlement

Real-time settlement in prepaid card integration offers instant fund availability, enabling seamless transaction processing and enhanced cash flow management for businesses. Buy Now Pay Later (BNPL) integration typically involves delayed settlements, impacting immediate liquidity but providing flexible payment options to consumers. Explore the nuances of real-time settlement in both systems to optimize your payment infrastructure.

Credit Risk Assessment

Prepaid card integration involves upfront payment, significantly reducing credit risk exposure by limiting transactions to available funds, while buy now pay later (BNPL) requires thorough credit risk assessment due to deferred payment and potential default. BNPL platforms utilize advanced credit scoring algorithms and real-time data analysis to evaluate consumer creditworthiness, balancing customer acquisition with minimizing financial losses. Explore detailed credit risk management strategies for both prepaid and BNPL integrations to optimize your payment solutions.

Transaction Authorization

Transaction authorization in prepaid card integration involves real-time validation of available funds to approve or decline payments instantly, ensuring controlled spending and minimizing fraud risk. Buy now pay later (BNPL) transaction authorization assesses creditworthiness and payment capacity dynamically, often integrating with alternative data sources for approval decisions, allowing deferred payments while managing risk. Explore detailed comparisons and implementation strategies to optimize transaction authorization in your payment solutions.

Source and External Links

How Prepaid Card can solve B2C flow challenges | J.P. Morgan - Offers businesses integrated prepaid card solutions that can be embedded within their own web and app environments, supporting multiple enrollment and funding methods for flexible, secure, and cost-effective disbursements.

Prepaid Card Issuance API Use Cases - Mastercard Developers - Details sample integration flows for issuing physical prepaid cards, including use cases for adding new cards for individual clients through APIs.

Visa, Mastercard, and UnionPay Prepaid Card APIs by Tutuka - Provides scalable APIs for issuing and managing virtual and physical prepaid cards across major card schemes, handling everything from card generation to transaction authorization and balance management.

dowidth.com

dowidth.com